Provident Financial Holdings, Inc. (PROV): Price and Financial Metrics

PROV Price/Volume Stats

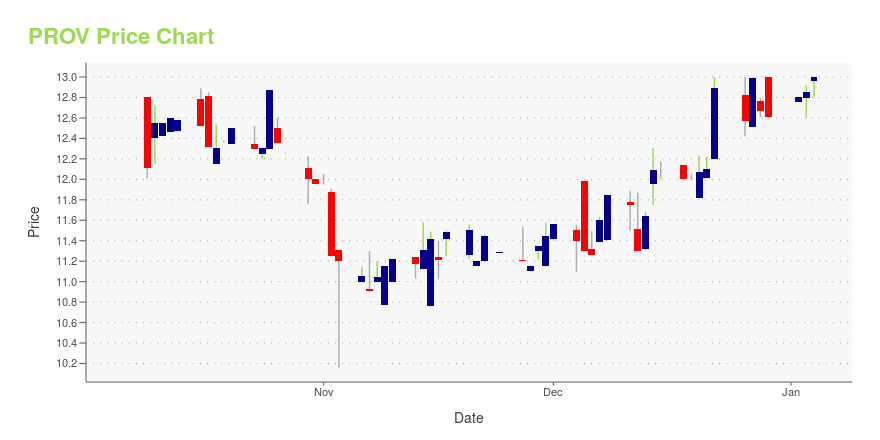

| Current price | $13.05 | 52-week high | $15.40 |

| Prev. close | $13.32 | 52-week low | $10.16 |

| Day low | $13.02 | Volume | 7,400 |

| Day high | $14.00 | Avg. volume | 5,395 |

| 50-day MA | $12.62 | Dividend yield | 4.12% |

| 200-day MA | $12.90 | Market Cap | 89.76M |

PROV Stock Price Chart Interactive Chart >

Provident Financial Holdings, Inc. (PROV) Company Bio

Provident Financial Holdings provides community and mortgage banking services to consumers and small to mid-sized businesses in the Inland Empire region of Southern California. The company was founded in 1956 and is based in Riverside, California.

Latest PROV News From Around the Web

Below are the latest news stories about PROVIDENT FINANCIAL HOLDINGS INC that investors may wish to consider to help them evaluate PROV as an investment opportunity.

Provident Financial Holdings Announces CFO SuccessionRIVERSIDE, Calif., Dec. 01, 2023 (GLOBE NEWSWIRE) -- Provident Financial Holdings, Inc. (“Company” or “Provident”), NASDAQ GS: PROV, the holding company for Provident Savings Bank, F.S.B. (“Bank” or “Provident”), today announced that Tam B. Nguyen has been appointed Senior Vice President, Chief Financial Officer, and Corporate Secretary of the Company and the Bank, effective January 2, 2024 succeeding Donavon P. Ternes who will become President and Chief Executive Officer on the same date. Ms. N |

ACRES Commercial (ACR) Expands Share Buyback Program by $10MACRES Commercial's (ACR) additional $10 million authorization for common and preferred stock under its existing share repurchase program will boost investor confidence. |

Provident Financial Holdings (NASDAQ:PROV) Could Be A Buy For Its Upcoming DividendReaders hoping to buy Provident Financial Holdings, Inc. ( NASDAQ:PROV ) for its dividend will need to make their move... |

Provident Financial Holdings (NASDAQ:PROV) Has Announced A Dividend Of $0.14Provident Financial Holdings, Inc.'s ( NASDAQ:PROV ) investors are due to receive a payment of $0.14 per share on 7th... |

Provident Financial Holdings, Inc. (NASDAQ:PROV) Q1 2024 Earnings Call TranscriptProvident Financial Holdings, Inc. (NASDAQ:PROV) Q1 2024 Earnings Call Transcript October 26, 2023 Operator: Ladies and gentlemen, thank you for standing by, and welcome to the Provident Financial Holdings First Quarter Earnings Call. At this time, all participants are in a listen-only mode. Later, we will conduct a question-and-answer session, instructions will be given at […] |

PROV Price Returns

| 1-mo | 4.07% |

| 3-mo | 2.31% |

| 6-mo | -11.75% |

| 1-year | -4.74% |

| 3-year | -15.96% |

| 5-year | -23.26% |

| YTD | 5.68% |

| 2023 | -4.32% |

| 2022 | -13.54% |

| 2021 | 8.80% |

| 2020 | -25.43% |

| 2019 | 45.18% |

PROV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PROV

Want to do more research on Provident Financial Holdings Inc's stock and its price? Try the links below:Provident Financial Holdings Inc (PROV) Stock Price | Nasdaq

Provident Financial Holdings Inc (PROV) Stock Quote, History and News - Yahoo Finance

Provident Financial Holdings Inc (PROV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...