Penns Woods Bancorp, Inc. (PWOD): Price and Financial Metrics

PWOD Price/Volume Stats

| Current price | $23.14 | 52-week high | $27.48 |

| Prev. close | $23.32 | 52-week low | $17.01 |

| Day low | $23.14 | Volume | 12,924 |

| Day high | $23.68 | Avg. volume | 31,983 |

| 50-day MA | $20.62 | Dividend yield | 5.53% |

| 200-day MA | $20.29 | Market Cap | 174.24M |

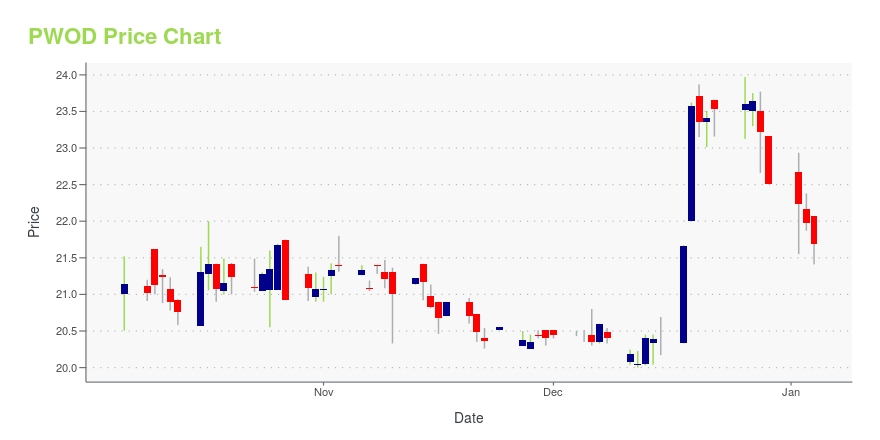

PWOD Stock Price Chart Interactive Chart >

Penns Woods Bancorp, Inc. (PWOD) Company Bio

Penns Woods Bancorp, Inc. provides banking and financial services to individuals, partnerships, non-profit organizations, and corporations in Pennsylvania. The company was founded in 1934 and is based in Williamsport, Pennsylvania.

Latest PWOD News From Around the Web

Below are the latest news stories about PENNS WOODS BANCORP INC that investors may wish to consider to help them evaluate PWOD as an investment opportunity.

Penns Woods Bancorp (NASDAQ:PWOD) Is Due To Pay A Dividend Of $0.32The board of Penns Woods Bancorp, Inc. ( NASDAQ:PWOD ) has announced that it will pay a dividend on the 22nd of... |

Penns Woods Bancorp, Inc. Announces Quarterly DividendWILLIAMSPORT, Pa., Nov. 28, 2023 (GLOBE NEWSWIRE) -- Richard A. Grafmyre CFP®, Chief Executive Officer of Penns Woods Bancorp, Inc., (NASDAQ:PWOD) has announced that the Company’s Board of Directors declared a fourth quarter 2023 cash dividend of $0.32 per share. The dividend is payable December 22, 2023 to shareholders of record December 12, 2023. About Penns Woods Bancorp, Inc. Penns Woods Bancorp, Inc. is the bank holding company for Jersey Shore State Bank and Luzerne Bank. The banks serve c |

Investors in Penns Woods Bancorp (NASDAQ:PWOD) have unfortunately lost 7.1% over the last five yearsIn order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market... |

Penns Woods Bancorp Inc (PWOD) Reports Q3 2023 EarningsNet income of $11.1 million for the nine months ended September 30, 2023 |

Penns Woods Bancorp, Inc. Reports Third Quarter 2023 EarningsWILLIAMSPORT, Pa., Oct. 25, 2023 (GLOBE NEWSWIRE) -- Penns Woods Bancorp, Inc. (NASDAQ: PWOD) Penns Woods Bancorp, Inc. achieved net income of $11.1 million for the nine months ended September 30, 2023, resulting in basic and diluted earnings per share of $1.56 and $1.53. Highlights Net income, as reported under GAAP, for the three and nine months ended September 30, 2023 was $2.2 million and $11.1 million, compared to $5.3 million and $12.9 million for the same periods of 2022. Results for the |

PWOD Price Returns

| 1-mo | 9.77% |

| 3-mo | 34.25% |

| 6-mo | 9.70% |

| 1-year | -6.26% |

| 3-year | 15.04% |

| 5-year | -0.60% |

| YTD | 6.19% |

| 2023 | -10.75% |

| 2022 | 18.68% |

| 2021 | -4.35% |

| 2020 | -23.13% |

| 2019 | 37.90% |

PWOD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PWOD

Want to do more research on Penns Woods Bancorp Inc's stock and its price? Try the links below:Penns Woods Bancorp Inc (PWOD) Stock Price | Nasdaq

Penns Woods Bancorp Inc (PWOD) Stock Quote, History and News - Yahoo Finance

Penns Woods Bancorp Inc (PWOD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...