Rogers Communications Inc. Cl B (RCI): Price and Financial Metrics

RCI Price/Volume Stats

| Current price | $37.82 | 52-week high | $48.19 |

| Prev. close | $36.90 | 52-week low | $35.55 |

| Day low | $37.09 | Volume | 578,535 |

| Day high | $37.89 | Avg. volume | 714,913 |

| 50-day MA | $38.15 | Dividend yield | 3.9% |

| 200-day MA | $41.55 | Market Cap | 20.05B |

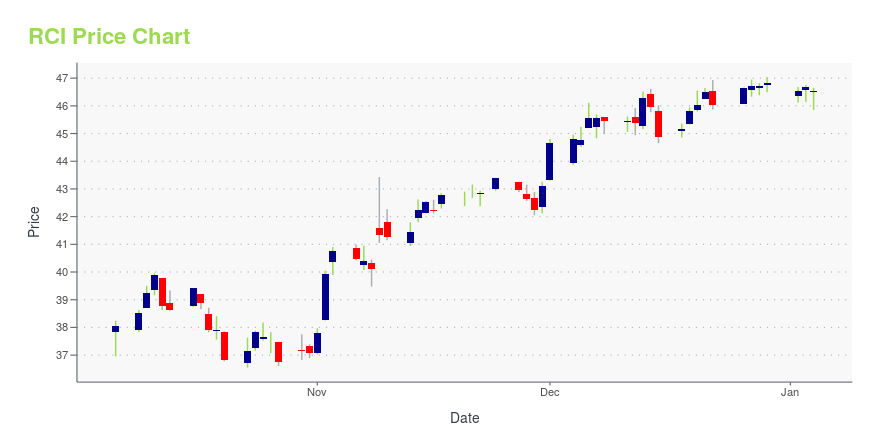

RCI Stock Price Chart Interactive Chart >

Rogers Communications Inc. Cl B (RCI) Company Bio

Rogers Communications Inc. is a Canadian communications and media company operating primarily in the fields of wireless communications, cable television, telephony and Internet, with significant additional telecommunications and mass media assets. Rogers has its headquarters in Toronto, Ontario.The company traces its origins to 1925 when Edward S. Rogers Sr. founded Rogers Vacuum Tube Company to sell battery-less radios, although this present enterprise dates to 1960, when Ted Rogers and a partner acquired the CHFI-FM radio station; they then became part-owners of a group that established the CFTO television station. (Source:Wikipedia)

Latest RCI News From Around the Web

Below are the latest news stories about ROGERS COMMUNICATIONS INC that investors may wish to consider to help them evaluate RCI as an investment opportunity.

Rogers Communications 4Q23 Investment Community Teleconference February 1, 2024 at 8:00 a.m. ETTORONTO, Dec. 20, 2023 (GLOBE NEWSWIRE) -- Rogers Communications Inc. (TSX: RCI.A and RCI.B) (NYSE: RCI) plans to release its fourth quarter 2023 financial results on Thursday, February 1, 2024, before North American financial markets open. The results will be distributed by newswire and posted at investors.rogers.com. Rogers’ management will host its quarterly teleconference with the investment community to discuss the results and outlook at 8:00 a.m. ET. A live webcast of the teleconference wi |

Rogers Communication (RCI) to Deploy Satellite Tech in 2024Rogers Communication (RCI) plans to introduce satellite-to-mobile phone technology in 2024, aiming to establish connectivity in remote areas. |

Rogers to launch satellite-to-mobile phone technology in 2024 to connect remote areasLaunch will start with SMS texting, and will expand to include voice and data |

Top headlines: Canada’s biggest banks at bottom of low-carbon finance rankingThe latest business news as it happens |

Rogers and Lynk Complete Historic Satellite-to-Mobile Phone Call in CanadaGlobal technology will improve public safety and connect Canadians in the most remote areas of the country Premier Andrew Furey completes first call with Search and Rescue volunteer HEART’S CONTENT, Newfoundland and Labrador, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Rogers and Lynk Global, Inc. today announced they completed Canada’s first successful satellite-to-mobile phone call using Samsung S22 smartphones. The call took place in historic Heart’s Content, where the world’s first transatlantic teleg |

RCI Price Returns

| 1-mo | 2.13% |

| 3-mo | 0.57% |

| 6-mo | -19.52% |

| 1-year | -10.57% |

| 3-year | -18.93% |

| 5-year | -17.57% |

| YTD | -18.44% |

| 2023 | 3.38% |

| 2022 | 1.61% |

| 2021 | 3.93% |

| 2020 | -3.02% |

| 2019 | -0.19% |

RCI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RCI

Here are a few links from around the web to help you further your research on Rogers Communications Inc's stock as an investment opportunity:Rogers Communications Inc (RCI) Stock Price | Nasdaq

Rogers Communications Inc (RCI) Stock Quote, History and News - Yahoo Finance

Rogers Communications Inc (RCI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...