ReTo Eco-Solutions, Inc. (RETO): Price and Financial Metrics

RETO Price/Volume Stats

| Current price | $0.96 | 52-week high | $73.60 |

| Prev. close | $0.95 | 52-week low | $0.86 |

| Day low | $0.92 | Volume | 47,500 |

| Day high | $0.99 | Avg. volume | 105,883 |

| 50-day MA | $1.98 | Dividend yield | N/A |

| 200-day MA | $8.66 | Market Cap | 418.38K |

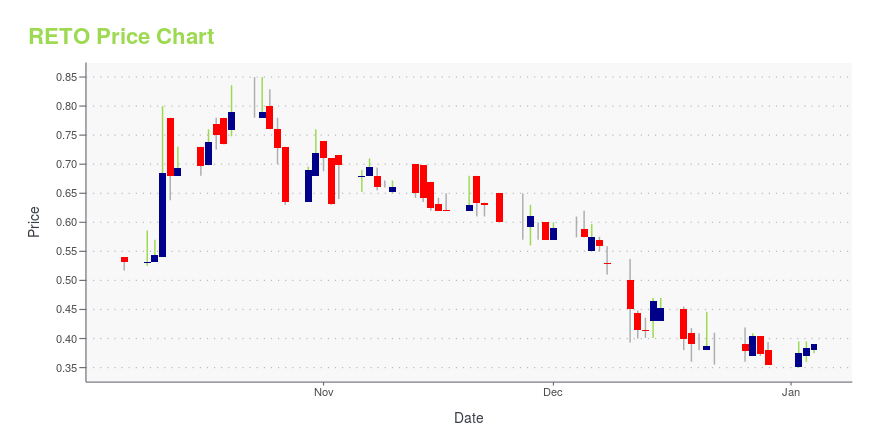

RETO Stock Price Chart Interactive Chart >

ReTo Eco-Solutions, Inc. (RETO) Company Bio

ReTo Eco-Solutions, Inc. manufactures building materials. The Company produces abrasives, asbestos, nonmetallic mineral products, concretes, bricks, pavers, and tiles. ReTo Eco-Solutions markets its products throughout China.

Latest RETO News From Around the Web

Below are the latest news stories about RETO ECO-SOLUTIONS INC that investors may wish to consider to help them evaluate RETO as an investment opportunity.

ReTo Eco-Solutions, Inc. Announces First Half 2023 Financial ResultsReTo Eco-Solutions, Inc. (Nasdaq: RETO) (the "Company"), a provider of technology solutions and operation services for intelligent ecological environments and internet of things technology development services in China and other countries, today announced its financial results for the six months ended June 30, 2023. |

ReTo Eco-Solutions Resumed Its Participation in the BIG 5 Global ExhibitionReTo Eco-Solutions, Inc. (Nasdaq: RETO) ("ReTo" or the "Company") today announced the participation of its subsidiary, Beijing REIT Technology Development Co., Ltd., in the BIG 5 Global exhibition, a global construction sector exhibition held at the Dubai World Trade Center from December 4 to 7, 2023. At the exhibition, ReTo will showcase a series of products and technologies, which are designed to meet the changing needs of the construction industry. ReTo welcomes investors to visit Booth No. S |

ReTo Receives Nasdaq Notification Regarding Minimum Bid Price DeficiencyReTo Eco-Solutions, Inc. (Nasdaq: RETO) ("ReTo" or the "Company"), a provider of technology solutions and operation services for intelligent ecological environments and internet of things technology development services in China and other countries, today announced that the Company received a written notification (the "Notification Letter") from the Nasdaq Stock Market LLC ("Nasdaq") on October 13, 2023, notifying the Company that it is not in compliance with the minimum bid price requirement se |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're starting off Friday with a breakdown of the biggest pre-market stock movers traders will want to keep an eye on this morning! |

ReTo Eco-Solutions, Inc. Announces $15 Million Registered Direct Offering and $10 Million Concurrent Private PlacementReTo Eco-Solutions, Inc. (Nasdaq: RETO) ("ReTo" or the "Company"), a provider of technology solutions and operation services for intelligent ecological environments and internet of things technology development services in China and other countries, today announced that it has entered into a securities purchase agreement, dated as of September 29, 2023, with certain purchasers, for the sale of an aggregate of 15,000,000 common shares, par value US$0.01 per share, of the Company (the "Shares"), a |

RETO Price Returns

| 1-mo | -12.73% |

| 3-mo | -75.06% |

| 6-mo | -84.88% |

| 1-year | -96.26% |

| 3-year | -99.14% |

| 5-year | -99.51% |

| YTD | -72.97% |

| 2023 | -91.34% |

| 2022 | -75.88% |

| 2021 | 155.83% |

| 2020 | -24.31% |

| 2019 | -32.47% |

Continue Researching RETO

Here are a few links from around the web to help you further your research on ReTo Eco-Solutions Inc's stock as an investment opportunity:ReTo Eco-Solutions Inc (RETO) Stock Price | Nasdaq

ReTo Eco-Solutions Inc (RETO) Stock Quote, History and News - Yahoo Finance

ReTo Eco-Solutions Inc (RETO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...