Royal Gold, Inc. (RGLD): Price and Financial Metrics

RGLD Price/Volume Stats

| Current price | $135.09 | 52-week high | $140.95 |

| Prev. close | $135.34 | 52-week low | $100.55 |

| Day low | $134.94 | Volume | 250,100 |

| Day high | $137.50 | Avg. volume | 395,995 |

| 50-day MA | $129.73 | Dividend yield | 1.16% |

| 200-day MA | $119.03 | Market Cap | 8.88B |

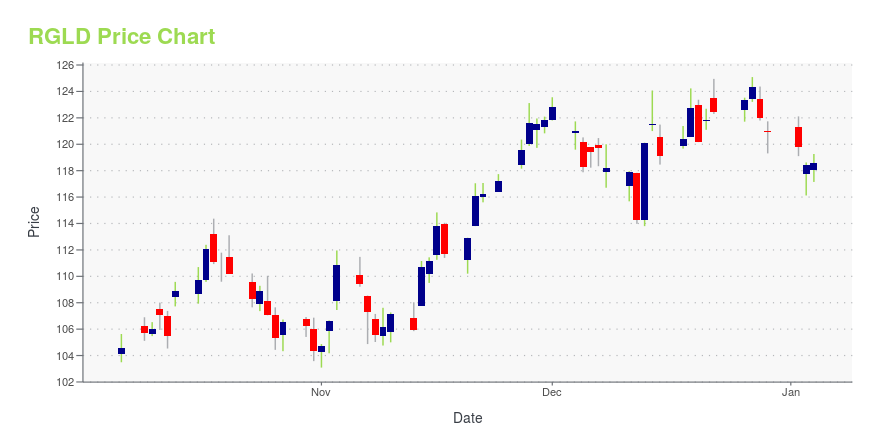

RGLD Stock Price Chart Interactive Chart >

Royal Gold, Inc. (RGLD) Company Bio

Royal Gold, Inc. acquires and manages precious metals royalties, metal streams, and similar interests in the United States, Canada, Chile, and Mexico. The company also holds royalty and stream interests in mines and projects in other countries, including Argentina, Australia, Bolivia, Brazil, Burkina Faso, the Dominican Republic, Finland, Ghana, Guatemala, Honduras, Macedonia, Nicaragua, Peru, Russia, Spain, and Tunisia. The company was founded in 1981 and is based in Denver, Colorado.

Latest RGLD News From Around the Web

Below are the latest news stories about ROYAL GOLD INC that investors may wish to consider to help them evaluate RGLD as an investment opportunity.

Is This Unique Gold Investment the Perfect Inflation Hedge?Investors often see hard assets as a way to hedge against inflation. These precious metals stocks could be a nearly perfect option. |

13 Most Promising Gold Stocks According to AnalystsIn this article, we discuss the 13 most promising gold stocks according to analysts. To skip the detailed analysis of the industry, go directly to the 5 Most Promising Gold Stocks According to Analysts. Gold has started to make noise in the stock and commodity markets again as it recently jumped to a record high. […] |

Royal Gold (NASDAQ:RGLD) Is Increasing Its Dividend To $0.40Royal Gold, Inc. ( NASDAQ:RGLD ) will increase its dividend from last year's comparable payment on the 19th of January... |

Royal Gold to Participate in the Renmark Financial Communications Virtual Non-Deal Roadshow Series on Wednesday, December 13DENVER, December 11, 2023--Royal Gold to Participate in the Renmark Financial Communications Virtual Non-Deal Roadshow Series on Wednesday, December 13 |

Why Is Kinross Gold (KGC) Up 8% Since Last Earnings Report?Kinross Gold (KGC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

RGLD Price Returns

| 1-mo | 7.82% |

| 3-mo | 8.77% |

| 6-mo | 16.77% |

| 1-year | 15.47% |

| 3-year | 18.27% |

| 5-year | 20.18% |

| YTD | 12.77% |

| 2023 | 8.70% |

| 2022 | 8.51% |

| 2021 | 0.04% |

| 2020 | -12.13% |

| 2019 | 44.27% |

RGLD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RGLD

Want to see what other sources are saying about Royal Gold Inc's financials and stock price? Try the links below:Royal Gold Inc (RGLD) Stock Price | Nasdaq

Royal Gold Inc (RGLD) Stock Quote, History and News - Yahoo Finance

Royal Gold Inc (RGLD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...