Rio Tinto PLC ADR (RIO): Price and Financial Metrics

RIO Price/Volume Stats

| Current price | $60.54 | 52-week high | $72.08 |

| Prev. close | $60.03 | 52-week low | $51.67 |

| Day low | $59.99 | Volume | 2,859,000 |

| Day high | $60.71 | Avg. volume | 3,357,280 |

| 50-day MA | $59.53 | Dividend yield | 7.43% |

| 200-day MA | $0.00 | Market Cap | 75.92B |

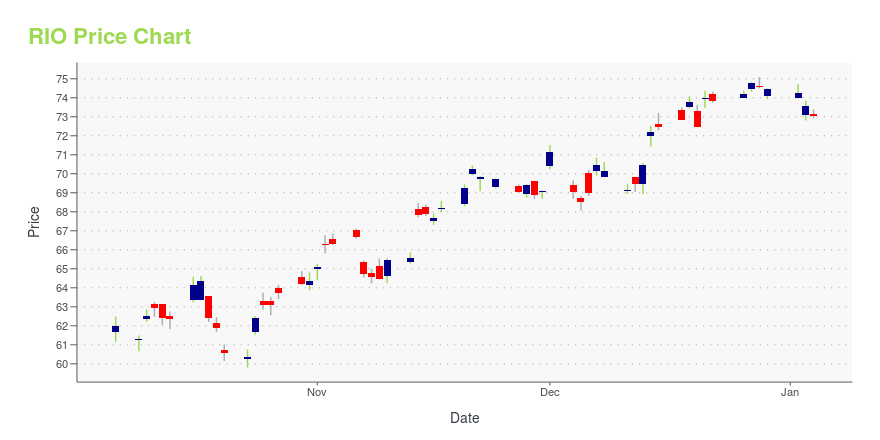

RIO Stock Price Chart Interactive Chart >

Rio Tinto PLC ADR (RIO) Company Bio

Rio Tinto Group is an Anglo-Australian multinational company that is the world's second-largest metals and mining corporation (behind BHP). The company was founded in 1873 when of a group of investors purchased a mine complex on the Rio Tinto, in Huelva, Spain, from the Spanish government. It has grown through a long series of mergers and acquisitions. Although primarily focused on extraction of minerals, Rio Tinto also has significant operations in refining, particularly the refining of bauxite and iron ore. Rio Tinto has joint head offices in London (global and "plc") and Melbourne ("Limited" – Australia). (Source:Wikipedia)

RIO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 1.20% |

| 3-year | 30.17% |

| 5-year | 46.01% |

| YTD | 6.66% |

| 2024 | -15.37% |

| 2023 | 11.04% |

| 2022 | 18.46% |

| 2021 | -0.40% |

| 2020 | 36.22% |

RIO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RIO

Want to see what other sources are saying about Rio Tinto Ltd's financials and stock price? Try the links below:Rio Tinto Ltd (RIO) Stock Price | Nasdaq

Rio Tinto Ltd (RIO) Stock Quote, History and News - Yahoo Finance

Rio Tinto Ltd (RIO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...