RLJ Lodging Trust Common Shares of Beneficial Interest $0.01 par value (RLJ): Price and Financial Metrics

RLJ Price/Volume Stats

| Current price | $9.52 | 52-week high | $12.39 |

| Prev. close | $9.34 | 52-week low | $9.06 |

| Day low | $9.40 | Volume | 912,546 |

| Day high | $9.58 | Avg. volume | 1,307,781 |

| 50-day MA | $9.74 | Dividend yield | 4.14% |

| 200-day MA | $10.79 | Market Cap | 1.48B |

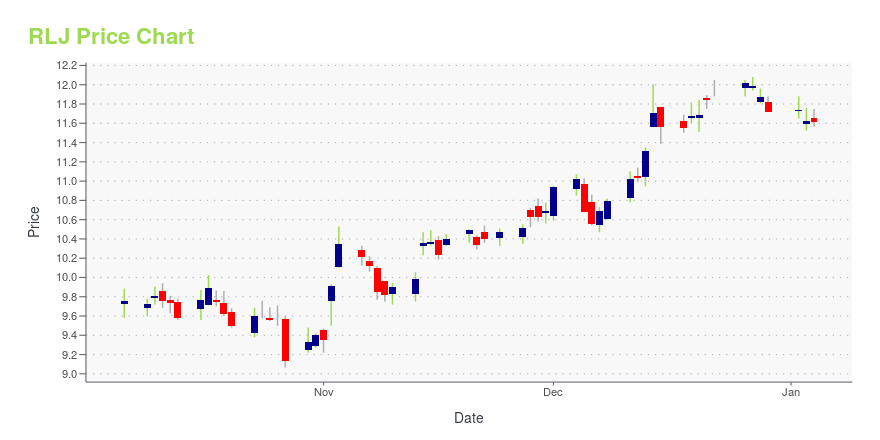

RLJ Stock Price Chart Interactive Chart >

RLJ Lodging Trust Common Shares of Beneficial Interest $0.01 par value (RLJ) Company Bio

RLJ Lodging Trust focuses on acquiring premium-branded, focused-service and compact full-service hotels. The company was founded in 2000 and is based in Bethesda, Maryland.

Latest RLJ News From Around the Web

Below are the latest news stories about RLJ LODGING TRUST that investors may wish to consider to help them evaluate RLJ as an investment opportunity.

RLJ Lodging Trust Announces Dividends for Fourth Quarter of 2023BETHESDA, M.D., December 15, 2023--RLJ Lodging Trust (the "Company") (NYSE: RLJ) today announced that its Board of Trustees has declared a quarterly cash dividend of $0.10 per common share of beneficial interest. The dividend is payable on January 16, 2024, to shareholders of record as of December 29, 2023. |

‘Bright Spots’ Could Lift These 2 Hotel REIT Stocks Higher, Says OppenheimerDespite a robust recovery in major U.S. stock indices since the beginning of the year, the same cannot be said for Real Estate Investment Trusts (REITs). The real estate sector has faced challenges, including disinflation and growing counterparty risk, which have hindered REIT performance. However, Oppenheimer analyst Tyler Batory, an expert in the REIT sector, sees a clear opportunity within REITs that concentrate on the hotel and leisure segment. He points out ‘bright spots’ that could potenti |

Real Estate Rut: 3 REITs With Major Growth PotentialGrowth REITs to buy is the name of the game, as real estate investments have underperformed U.S. stocks since the turn of the year. |

RLJ Lodging Trust Provides Update on its Embedded Value Creation InitiativesBETHESDA, Md., November 13, 2023--RLJ Lodging Trust (the "Company") (NYSE: RLJ) today provided an update to its embedded value creation initiatives. These initiatives include two new conversions in 2024, bringing the total completed and announced brand conversions and repositionings to eight hotels. |

RLJ Lodging Trust (NYSE:RLJ) Q3 2023 Earnings Call TranscriptRLJ Lodging Trust (NYSE:RLJ) Q3 2023 Earnings Call Transcript November 2, 2023 Operator: Welcome to the RLJ Lodging Trust Third Quarter 2023 Earnings Call. [Operator Instructions] I would now like to turn the call over to Nikhil Bhalla, RLJ’s Senior Vice President, Finance and Treasurer. Please go ahead. Nikhil Bhalla : Thank you, operator. Good […] |

RLJ Price Returns

| 1-mo | 1.70% |

| 3-mo | -13.40% |

| 6-mo | -17.83% |

| 1-year | 0.08% |

| 3-year | -29.39% |

| 5-year | -38.94% |

| YTD | -17.19% |

| 2023 | 14.59% |

| 2022 | -23.12% |

| 2021 | -1.29% |

| 2020 | -19.81% |

| 2019 | 16.53% |

RLJ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RLJ

Want to see what other sources are saying about RLJ Lodging Trust's financials and stock price? Try the links below:RLJ Lodging Trust (RLJ) Stock Price | Nasdaq

RLJ Lodging Trust (RLJ) Stock Quote, History and News - Yahoo Finance

RLJ Lodging Trust (RLJ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...