Richmond Mutual Bancorporation, Inc. (RMBI): Price and Financial Metrics

RMBI Price/Volume Stats

| Current price | $12.28 | 52-week high | $13.00 |

| Prev. close | $12.30 | 52-week low | $9.44 |

| Day low | $12.25 | Volume | 4,156 |

| Day high | $12.51 | Avg. volume | 13,542 |

| 50-day MA | $11.70 | Dividend yield | 4.56% |

| 200-day MA | $11.30 | Market Cap | 135.88M |

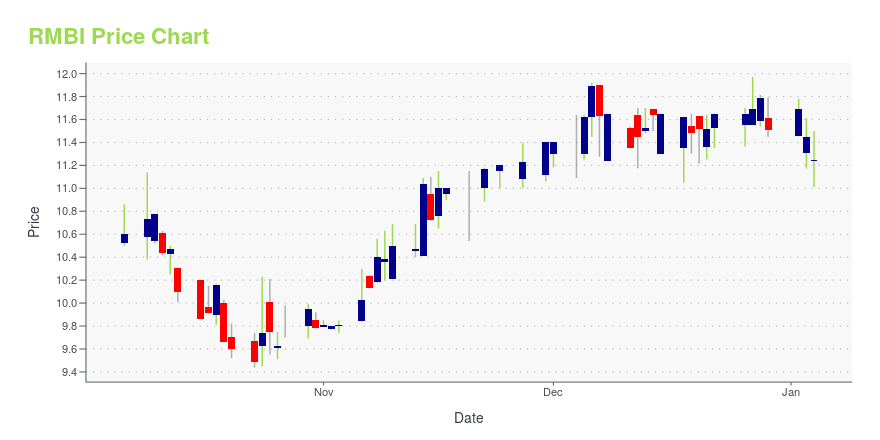

RMBI Stock Price Chart Interactive Chart >

Richmond Mutual Bancorporation, Inc. (RMBI) Company Bio

Richmond Mutual Bancorporation, Inc. operates as a bank holding company. The Company, through its subsidiaries, provides savings accounts, online and mobile banking, loans, home equity line of credit, mortgages, credit cards, cash management, investment, and custody services. Richmond Mutual Bancorporation serves customers in the United States.

Latest RMBI News From Around the Web

Below are the latest news stories about RICHMOND MUTUAL BANCORPORATION INC that investors may wish to consider to help them evaluate RMBI as an investment opportunity.

RICHMOND MUTUAL BANCORPORATION, INC. ANNOUNCES QUARTERLY DIVIDENDRichmond Mutual Bancorporation, Inc. (NASDAQ: RMBI) announced today that its Board of Directors has declared a cash dividend on Richmond Mutual Bancorporation common stock of $0.14 per share. The cash dividend will be payable on December 14, 2023 to stockholders of record as of the close of business on November 30, 2023. |

RICHMOND MUTUAL BANCORPORATION, INC. ANNOUNCES 2023 THIRD QUARTER FINANCIAL RESULTSRichmond Mutual Bancorporation, Inc., a Maryland corporation (the "Company") (NASDAQ: RMBI), parent company of First Bank Richmond (the "Bank"), today announced net income of $1.9 million, or $0.19 diluted earnings per share, for the third quarter of 2023, compared to net income of $2.7 million, or $0.26 diluted earnings per share, for the second quarter of 2023, and net income of $3.2 million, or $0.29 diluted earnings per share, for the third quarter of 2022. |

Richmond Mutual Bancorporation, Inc. (NASDAQ:RMBI) Passed Our Checks, And It's About To Pay A US$0.14 DividendIt looks like Richmond Mutual Bancorporation, Inc. ( NASDAQ:RMBI ) is about to go ex-dividend in the next four days... |

RICHMOND MUTUAL BANCORPORATION, INC. ANNOUNCES 2023 SECOND QUARTER FINANCIAL RESULTSRichmond Mutual Bancorporation, Inc., a Maryland corporation (the "Company") (NASDAQ: RMBI), parent company of First Bank Richmond (the "Bank"), today announced net income of $2.7 million, or $0.26 diluted earnings per share, for the second quarter of 2023, compared to net income of $2.9 million, or $0.27 diluted earnings per share, for the first quarter of 2023, and net income of $3.5 million, or $0.31 diluted earnings per share, for the second quarter of 2022. |

Richmond Mutual Bancorporation, Inc. Announces Increase and Extension of Stock Repurchase ProgramRichmond Mutual Bancorporation, Inc. (NASDAQ: RMBI) (the "Company"), the parent holding company of First Bank Richmond, today announced that its Board of Directors approved an amendment to the Company's existing stock repurchase program by authorizing the purchase of up to 321,386 shares of the Company's issued and outstanding common stock in addition to the remaining 827,554 shares available for repurchase under the existing program as of June 06, 2023, and extending the stock repurchase progra |

RMBI Price Returns

| 1-mo | 7.25% |

| 3-mo | 14.98% |

| 6-mo | 7.26% |

| 1-year | 11.15% |

| 3-year | -9.60% |

| 5-year | 11.55% |

| YTD | 9.31% |

| 2023 | -7.18% |

| 2022 | -16.70% |

| 2021 | 24.02% |

| 2020 | -13.31% |

| 2019 | N/A |

RMBI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...