Royalty Pharma PLC (RPRX): Price and Financial Metrics

RPRX Price/Volume Stats

| Current price | $28.00 | 52-week high | $35.76 |

| Prev. close | $28.11 | 52-week low | $25.92 |

| Day low | $27.81 | Volume | 1,748,200 |

| Day high | $28.27 | Avg. volume | 2,670,691 |

| 50-day MA | $29.61 | Dividend yield | 3.02% |

| 200-day MA | $28.79 | Market Cap | 16.73B |

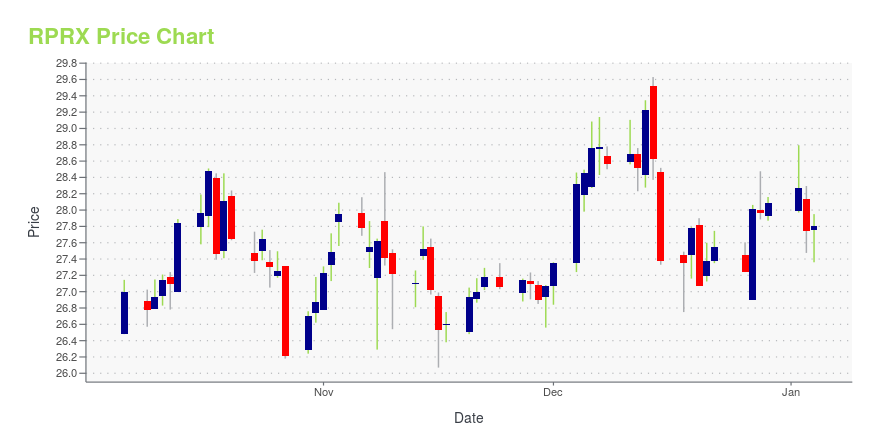

RPRX Stock Price Chart Interactive Chart >

Royalty Pharma PLC (RPRX) Company Bio

Royalty Pharma ist ein US-amerikanisches Finanzunternehmen mit Sitz in New York City. Es besitzt Rechte an verschiedenen Medikamenten, welche von diversen Pharmariesen wie Sanofi, Merck & Co. oder Novartis vermarktet werden und kassiert dafür Anteile am Vertriebsumsatz (Royalty Interest). (Source:Wikipedia)

Latest RPRX News From Around the Web

Below are the latest news stories about ROYALTY PHARMA PLC that investors may wish to consider to help them evaluate RPRX as an investment opportunity.

Royalty Pharma to Present at the Evercore ISI 6th Annual HealthCONx ConferenceNEW YORK, Nov. 27, 2023 (GLOBE NEWSWIRE) -- Royalty Pharma plc (Nasdaq: RPRX) today announced that it is scheduled to participate in a fireside chat at the Evercore ISI 6th Annual HealthCONx Conference on November 28, 2023 at 3:00 p.m. ET. The webcast will be accessible from Royalty Pharma’s “Events” page at https://www.royaltypharma.com/investors/news-and-events/events. The webcast will also be archived for a minimum of thirty days. About Royalty Pharma Founded in 1996, Royalty Pharma is the la |

Royalty Pharma plc (NASDAQ:RPRX) is a favorite amongst institutional investors who own 69%Key Insights Given the large stake in the stock by institutions, Royalty Pharma's stock price might be vulnerable to... |

Royalty Pharma and Teva Collaborate to Further Accelerate Olanzapine Lai ProgramRoyalty Pharma to provide R&D funding support of up to $125 million for the development of olanzapine LAI (TEV-‘749), a long-acting subcutaneous injectable olanzapine for schizophreniaPhase 3 data expected in the second half of 2024 NEW YORK and TEL AVIV, Israel, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Royalty Pharma plc (Nasdaq: RPRX) and Teva Pharmaceuticals International GmbH, a subsidiary of Teva Pharmaceutical Industries Ltd. (NYSE and TASE: TEVA) announced today a collaboration to further accele |

Teva and Royalty Pharma Collaborate to Further Accelerate Olanzapine LAI ProgramTEL AVIV, Israel & NEW YORK, November 13, 2023--Teva Pharmaceuticals International GmbH, a subsidiary of Teva Pharmaceutical Industries Ltd. (NYSE and TASE: TEVA) and Royalty Pharma plc (Nasdaq: RPRX), announced today a collaboration to further accelerate the clinical research program for Teva’s olanzapine LAI (TEV-‘749) by entering into a funding agreement of up to $125 million to offset program costs. Olanzapine LAI (TEV-‘749) is a once-monthly subcutaneous long-acting injection of the atypica |

The Royalty Pharma PLC (RPRX) Company: A Short SWOT AnalysisDecoding Royalty Pharma PLC (RPRX): A Strategic SWOT Insight |

RPRX Price Returns

| 1-mo | -8.05% |

| 3-mo | -3.12% |

| 6-mo | 8.40% |

| 1-year | -18.56% |

| 3-year | -33.22% |

| 5-year | N/A |

| YTD | 0.40% |

| 2023 | -27.08% |

| 2022 | 0.99% |

| 2021 | -19.09% |

| 2020 | N/A |

| 2019 | N/A |

RPRX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...