Shore Bancshares Inc (SHBI): Price and Financial Metrics

SHBI Price/Volume Stats

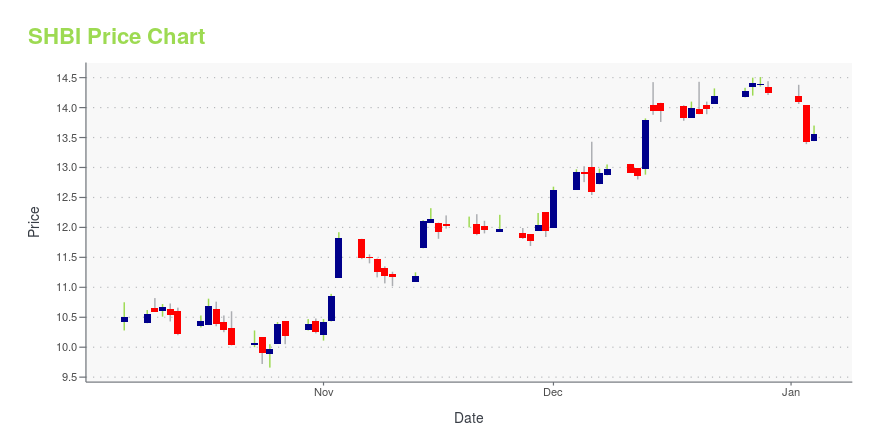

| Current price | $14.64 | 52-week high | $14.99 |

| Prev. close | $14.44 | 52-week low | $9.66 |

| Day low | $14.53 | Volume | 144,234 |

| Day high | $14.99 | Avg. volume | 85,639 |

| 50-day MA | $11.62 | Dividend yield | 3.46% |

| 200-day MA | $11.69 | Market Cap | 486.40M |

SHBI Stock Price Chart Interactive Chart >

Shore Bancshares Inc (SHBI) Company Bio

Shore Bancshares, Inc. provides various commercial banking products and services to individuals, businesses, and other organizations in Maryland and Delaware. The company was founded in 1876 and is based in Easton, Maryland.

Latest SHBI News From Around the Web

Below are the latest news stories about SHORE BANCSHARES INC that investors may wish to consider to help them evaluate SHBI as an investment opportunity.

Shore Bancshares Third Quarter 2023 Earnings: Misses ExpectationsShore Bancshares ( NASDAQ:SHBI ) Third Quarter 2023 Results Key Financial Results Revenue: US$23.6m (down 26% from 3Q... |

Shore Bancshares (SHBI) Soars 7.3%: Is Further Upside Left in the Stock?Shore Bancshares (SHBI) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Independent Director of Shore Bancshares Dawn Willey Buys 36% More SharesEven if it's not a huge purchase, we think it was good to see that Dawn Willey, the Independent Director of Shore... |

Dividend Investors: Don't Be Too Quick To Buy Shore Bancshares, Inc. (NASDAQ:SHBI) For Its Upcoming DividendIt looks like Shore Bancshares, Inc. ( NASDAQ:SHBI ) is about to go ex-dividend in the next three days. The ex-dividend... |

Shore Bancshares, Inc. Reports Quarterly Dividend of $0.12 Per ShareShore Bancshares, Inc. (NASDAQ - SHBI) announced that the Board of Directors has declared a quarterly common stock dividend in the amount of $0.12 per share, payable November 30, 2023 to stockholders of record on November 18, 2023. |

SHBI Price Returns

| 1-mo | 35.81% |

| 3-mo | 40.55% |

| 6-mo | 8.74% |

| 1-year | 17.10% |

| 3-year | -5.57% |

| 5-year | 6.63% |

| YTD | 5.00% |

| 2023 | -15.07% |

| 2022 | -14.36% |

| 2021 | 46.88% |

| 2020 | -12.26% |

| 2019 | 22.62% |

SHBI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SHBI

Want to see what other sources are saying about Shore Bancshares Inc's financials and stock price? Try the links below:Shore Bancshares Inc (SHBI) Stock Price | Nasdaq

Shore Bancshares Inc (SHBI) Stock Quote, History and News - Yahoo Finance

Shore Bancshares Inc (SHBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...