Grupo Simec, S.A.B. de C.V. American Depositary Shares (SIM): Price and Financial Metrics

SIM Price/Volume Stats

| Current price | $28.20 | 52-week high | $37.00 |

| Prev. close | $29.21 | 52-week low | $28.15 |

| Day low | $28.20 | Volume | 2,000 |

| Day high | $29.90 | Avg. volume | 1,012 |

| 50-day MA | $31.15 | Dividend yield | N/A |

| 200-day MA | $32.04 | Market Cap | 4.34B |

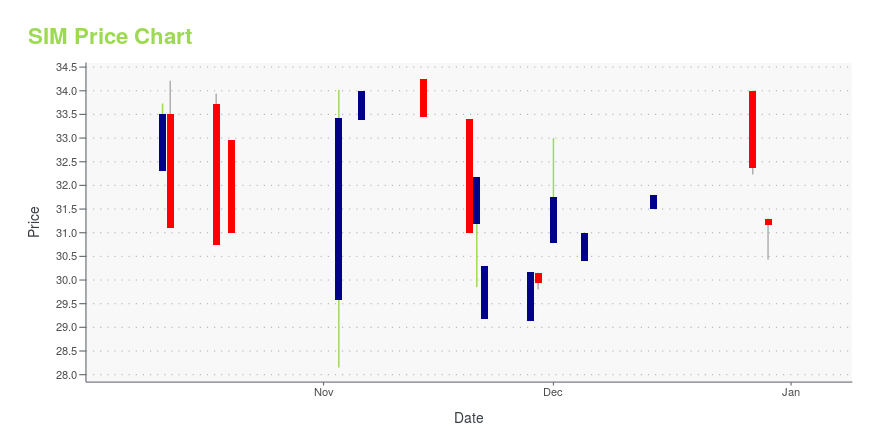

SIM Stock Price Chart Interactive Chart >

Grupo Simec, S.A.B. de C.V. American Depositary Shares (SIM) Company Bio

Grupo Simec, S.A.B. de C.V., together with its subsidiaries, manufactures, processes, and distributes special bar quality (SBQ) steel and structural steel products in Mexico, the United States, Canada, Latin America, Europe, and Asia. The company was founded in 1969 and is based in Guadalajara, Mexico.

Latest SIM News From Around the Web

Below are the latest news stories about GRUPO SIMEC SAB DE CV that investors may wish to consider to help them evaluate SIM as an investment opportunity.

21 Countries with Most Spanish Speakers Heading into 2024In this article, we will discuss the 21 countries with most Spanish speakers heading into 2024. If you want to skip our discussion on global language trends, you can go directly to the 5 Countries with Most Spanish Speakers Heading into 2024. Spanish is one of the most popular languages in the world. It is […] |

GRUPO SIMEC ANNOUNCES RESULTS OF OPERATIONS FOR THE FIRST NINE MONTHS OF 2023Grupo Simec, S.A.B. de C.V. (NYSE: SIM) ("Simec") announced today its results of operations for the nine-month period ended September 30, 2023. |

Unveiling Grupo Simec SAB de CV (SIM)'s Value: Is It Really Priced Right? A Comprehensive GuideAn in-depth look at the intrinsic value, financial strength, profitability, and growth of Grupo Simec SAB de CV (SIM) |

Grupo Simec SAB de CV (SIM): A Comprehensive Analysis of Its Market ValueUncovering the True Worth of Grupo Simec SAB de CV (SIM) |

Grupo Simec to Idle Steelmaking Operations Indefinitely at Its Republic Steel Mills in Canton, Ohio and Lackawanna, N.Y.Grupo Simec (AMEX:SIM), a leading international producer of special bar quality (SBQ) steel, steel wire, rebar, and commercial and structural steel long products, today announces it will indefinitely idle steelmaking operations at its Republic Steel mills in Canton, Ohio, and Lackawanna, N.Y. |

SIM Price Returns

| 1-mo | -5.53% |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -17.25% |

| 3-year | 17.94% |

| 5-year | 288.09% |

| YTD | -9.53% |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 110.94% |

| 2020 | 43.21% |

| 2019 | 5.83% |

Continue Researching SIM

Want to see what other sources are saying about Group Simec Sa De Cv's financials and stock price? Try the links below:Group Simec Sa De Cv (SIM) Stock Price | Nasdaq

Group Simec Sa De Cv (SIM) Stock Quote, History and News - Yahoo Finance

Group Simec Sa De Cv (SIM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...