Sun Life Financial Inc. (SLF): Price and Financial Metrics

SLF Price/Volume Stats

| Current price | $49.90 | 52-week high | $55.46 |

| Prev. close | $49.55 | 52-week low | $44.57 |

| Day low | $49.71 | Volume | 216,116 |

| Day high | $50.16 | Avg. volume | 703,850 |

| 50-day MA | $49.57 | Dividend yield | 4.73% |

| 200-day MA | $50.91 | Market Cap | 28.93B |

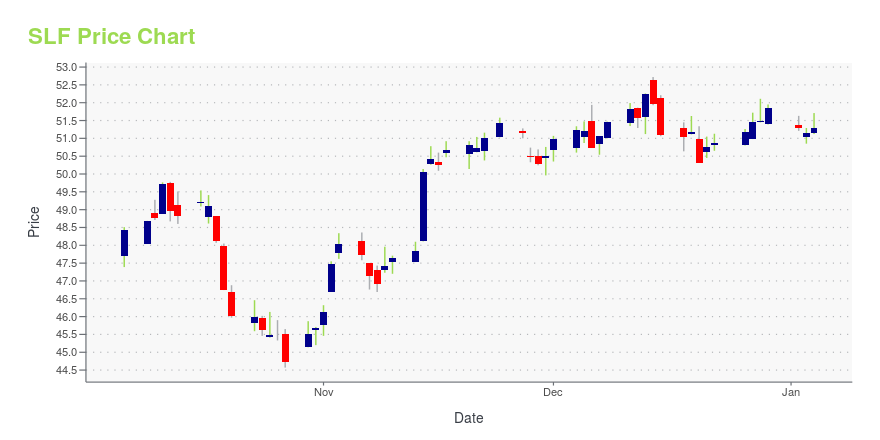

SLF Stock Price Chart Interactive Chart >

Sun Life Financial Inc. (SLF) Company Bio

Sun Life Financial Inc. is a Canadian financial services company. It is primarily known as a life insurance company. (Source:Wikipedia)

Latest SLF News From Around the Web

Below are the latest news stories about SUN LIFE FINANCIAL INC that investors may wish to consider to help them evaluate SLF as an investment opportunity.

12 High Growth Dividend Paying Stocks To BuyIn this article, we discuss 12 high growth dividend stocks to buy. You can skip our detailed analysis of dividend stocks and their performance over the years, and go directly to read 5 High Growth Dividend Paying Stocks To Buy. Among some investors, there’s a perception or concern that allocating funds toward dividend payouts might […] |

Wells Fargo Joins $5.5M Settlement With Oregon Over Inflated Tax BreakWells Fargo and two other firms settled claims that they drove up the cost of dental clinics in exchange for larger tax benefits. |

12 Most Profitable Canadian StocksIn this piece, we will take a look at the 12 most profitable Canadian stocks. If you want to skip our overview of the Canadian economy, then you can take a look at the 5 Most Profitable Canadian Stocks. Canada is one of the most prosperous nations in the world. The Canadian economy is worth […] |

Why Is Sun Life (SLF) Up 3% Since Last Earnings Report?Sun Life (SLF) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

15 Best Travel Insurance Companies Heading into 2024In this article, we will discuss the 15 best travel insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Travel Insurance Companies Heading into 2024. Travel Insurance Industry: A Market Analysis According to a report by Grand View Research, the global tourism insurance […] |

SLF Price Returns

| 1-mo | 2.67% |

| 3-mo | -2.29% |

| 6-mo | -0.70% |

| 1-year | -0.54% |

| 3-year | 11.88% |

| 5-year | 43.75% |

| YTD | -1.60% |

| 2023 | 16.88% |

| 2022 | -12.88% |

| 2021 | 27.54% |

| 2020 | 1.53% |

| 2019 | 42.71% |

SLF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SLF

Want to do more research on Sun Life Financial Inc's stock and its price? Try the links below:Sun Life Financial Inc (SLF) Stock Price | Nasdaq

Sun Life Financial Inc (SLF) Stock Quote, History and News - Yahoo Finance

Sun Life Financial Inc (SLF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...