Solar Capital Ltd. (SLRC): Price and Financial Metrics

SLRC Price/Volume Stats

| Current price | $15.91 | 52-week high | $16.77 |

| Prev. close | $15.89 | 52-week low | $13.93 |

| Day low | $15.85 | Volume | 167,300 |

| Day high | $15.95 | Avg. volume | 161,686 |

| 50-day MA | $16.17 | Dividend yield | 10.26% |

| 200-day MA | $15.37 | Market Cap | 867.97M |

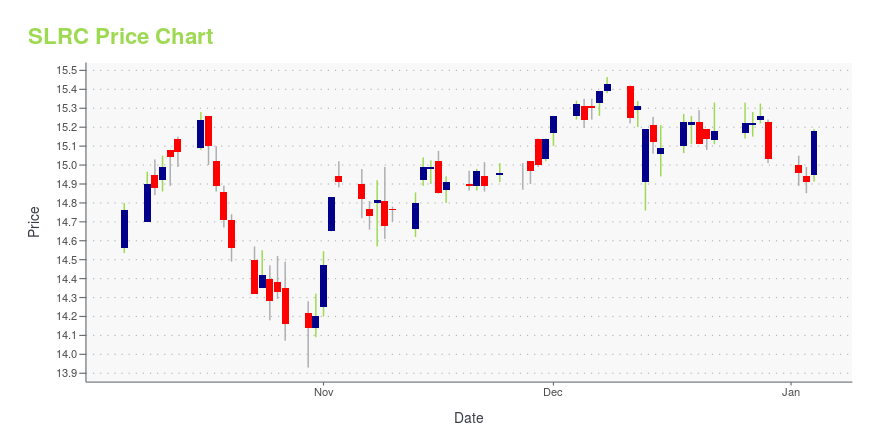

SLRC Stock Price Chart Interactive Chart >

Solar Capital Ltd. (SLRC) Company Bio

Solar Capital Ltd. invests primarily in leveraged middle markets companies in the form of senior secured loans, mezzanine loans and equity securities. The company was founded in 2007 and is based in New York, New York.

Latest SLRC News From Around the Web

Below are the latest news stories about SLR INVESTMENT CORP that investors may wish to consider to help them evaluate SLRC as an investment opportunity.

SLR Investment Corp. Announces Quarter Ended September 30, 2023 Financial ResultsNet Investment Income of $0.43 Per Share for Q3 2023; Declared Quarterly Distribution of $0.41 Per Share; Stable NAV and Strong Portfolio Credit Quality NEW YORK, Nov. 07, 2023 (GLOBE NEWSWIRE) -- SLR Investment Corp. (NASDAQ: SLRC) (the “Company”, “SLRC”, “we”, “us”, or “our”) today reported net investment income of $23.4 million, or $0.43 per share, for the third quarter of 2023. At September 30, 2023, net asset value (NAV) was $18.06 per share, compared to $17.98 at June 30, 2023. Beginning w |

7 Great Growth Stocks That Pay a Monthly DividendThe only thing better than growth stocks are finding growth stocks that pay a monthly dividend. |

SLR Investment Corp. Schedules the Release of its Financial Results for the Quarter Ended September 30, 2023NEW YORK, Sept. 29, 2023 (GLOBE NEWSWIRE) -- SLR Investment Corp. (the “Company”) (NASDAQ: SLRC) today announced that it will release its financial results for the quarter ended September 30, 2023 on Tuesday, November 7, 2023 after the close of the financial markets. The Company will host an earnings conference call and audio webcast at 10:00 a.m. (Eastern Time) on Wednesday, November 8, 2023. All interested parties may participate in the conference call by dialing (800) 267-6316 approximately 5 |

SLR Welcomes Chris York as a PartnerSLR Capital Partners, LLC ("SLR"), a private credit platform specializing in direct lending to U.S. middle market companies, announces that Chris York has joined the firm as a Partner. York will focus on product and business development, leveraging his 17 years of experience in the credit and alternatives investment industry. |

SLR Appoints Brad Coleman as an Operating PartnerSLR Capital Partners, LLC ("SLR"), a private credit platform specializing in direct lending to U.S. middle market companies, announces that Brad Coleman has joined the firm as an Operating Partner. Coleman will focus on strategic growth initiatives for the firm, leveraging his 35 years of experience in the financial services industry. |

SLRC Price Returns

| 1-mo | -0.75% |

| 3-mo | 5.09% |

| 6-mo | 8.68% |

| 1-year | 16.71% |

| 3-year | 14.32% |

| 5-year | 25.38% |

| YTD | 11.43% |

| 2023 | 20.59% |

| 2022 | -16.09% |

| 2021 | 14.73% |

| 2020 | -5.63% |

| 2019 | 16.18% |

SLRC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SLRC

Want to do more research on Solar Capital Ltd's stock and its price? Try the links below:Solar Capital Ltd (SLRC) Stock Price | Nasdaq

Solar Capital Ltd (SLRC) Stock Quote, History and News - Yahoo Finance

Solar Capital Ltd (SLRC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...