SmartFinancial, Inc. (SMBK): Price and Financial Metrics

SMBK Price/Volume Stats

| Current price | $28.29 | 52-week high | $28.65 |

| Prev. close | $27.84 | 52-week low | $19.00 |

| Day low | $27.90 | Volume | 45,400 |

| Day high | $28.33 | Avg. volume | 41,551 |

| 50-day MA | $23.75 | Dividend yield | 1.14% |

| 200-day MA | $22.34 | Market Cap | 482.71M |

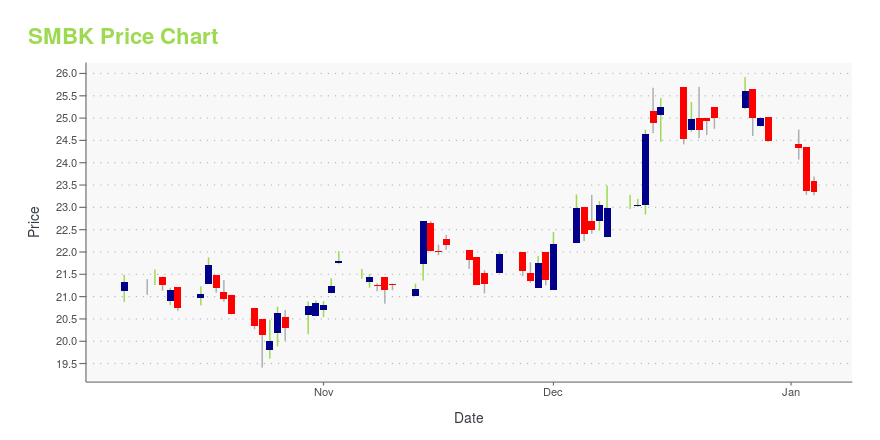

SMBK Stock Price Chart Interactive Chart >

SmartFinancial, Inc. (SMBK) Company Bio

SmartFinancial, Inc. provides various banking services to individuals and corporate customers in East Tennessee and the Florida Panhandle. The company is based in Knoxville, Tennessee.

Latest SMBK News From Around the Web

Below are the latest news stories about SMARTFINANCIAL INC that investors may wish to consider to help them evaluate SMBK as an investment opportunity.

Shareholders in SmartFinancial (NASDAQ:SMBK) are in the red if they invested a year agoPassive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active... |

SmartFinancial Announces Transfer Of Listing Of Common Stock To The New York Stock ExchangeKNOXVILLE, Tenn., Nov. 28, 2023 (GLOBE NEWSWIRE) -- SmartFinancial, Inc. (“SmartFinancial”) (Nasdaq: SMBK), the parent company for SmartBank, announced today that it is transferring the listing of its common stock to the New York Stock Exchange (“NYSE”) from The Nasdaq Stock Market LLC (“Nasdaq”). SmartFinancial’s common stock is expected to begin trading on the NYSE on Monday, December 11, 2023, under the ticker symbol of “SMBK”. SmartFinancial expects its common stock to continue to trade on N |

SmartFinancial's (NASDAQ:SMBK) Dividend Will Be $0.08The board of SmartFinancial, Inc. ( NASDAQ:SMBK ) has announced that it will pay a dividend of $0.08 per share on the... |

SmartFinancial Approves Regular Quarterly Cash DividendKNOXVILLE, Tenn., Oct. 30, 2023 (GLOBE NEWSWIRE) -- SmartFinancial, Inc. (“SmartFinancial”) (Nasdaq: SMBK), the parent company for SmartBank, announced that on October 27, 2023, the board of directors of SmartFinancial declared a quarterly cash dividend of $0.08 per share of SmartFinancial common stock payable on November 27, 2023, to shareholders of record as of the close of business on November 13, 2023. About SmartFinancial, Inc. SmartFinancial, Inc., based in Knoxville, Tennessee, is the pub |

SmartFinancial, Inc. (NASDAQ:SMBK) Q3 2023 Earnings Call TranscriptSmartFinancial, Inc. (NASDAQ:SMBK) Q3 2023 Earnings Call Transcript October 24, 2023 Operator: Hello, everyone and welcome to the SmartFinancial Third Quarter 2023 Earnings Release and Conference Call. My name is Seb and I will be the operator for your call today. [Operator Instructions] I will now hand the floor over to Nate Strall to begin. […] |

SMBK Price Returns

| 1-mo | 26.58% |

| 3-mo | 37.42% |

| 6-mo | 17.19% |

| 1-year | 17.54% |

| 3-year | 20.23% |

| 5-year | 37.40% |

| YTD | 16.33% |

| 2023 | -9.70% |

| 2022 | 1.59% |

| 2021 | 52.36% |

| 2020 | -22.31% |

| 2019 | 29.74% |

SMBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SMBK

Here are a few links from around the web to help you further your research on Smartfinancial Inc's stock as an investment opportunity:Smartfinancial Inc (SMBK) Stock Price | Nasdaq

Smartfinancial Inc (SMBK) Stock Quote, History and News - Yahoo Finance

Smartfinancial Inc (SMBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...