Summit Midstream Partners, LP Common Limited Partner Interests (SMLP): Price and Financial Metrics

SMLP Price/Volume Stats

| Current price | $36.93 | 52-week high | $37.59 |

| Prev. close | $36.89 | 52-week low | $13.00 |

| Day low | $36.53 | Volume | 19,900 |

| Day high | $37.10 | Avg. volume | 41,915 |

| 50-day MA | $34.25 | Dividend yield | N/A |

| 200-day MA | $24.36 | Market Cap | 384.66M |

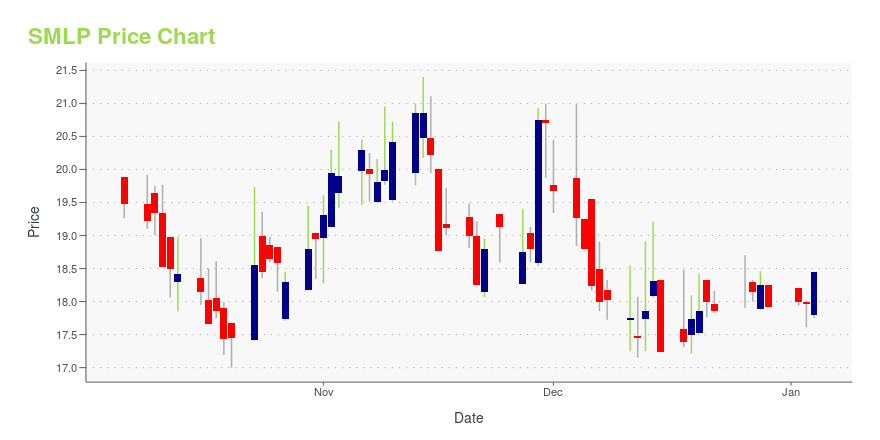

SMLP Stock Price Chart Interactive Chart >

Summit Midstream Partners, LP Common Limited Partner Interests (SMLP) Company Bio

Summit Midstream Partners LP focuses on owning, developing, and operating midstream energy infrastructure assets primarily shale formations, in North America. The company provides natural gas gathering, treating, and processing services. The company was founded in 2009 and is based in The Woodlands, Texas.

Latest SMLP News From Around the Web

Below are the latest news stories about SUMMIT MIDSTREAM PARTNERS LP that investors may wish to consider to help them evaluate SMLP as an investment opportunity.

Summit Midstream Partners, LP Announces Opportunistic Refinancing of its 2025 Unsecured Notes and Amendment to ABL FacilityAs part of its previously announced strategic alternatives review, Summit Midstream Partners, LP (NYSE: SMLP) ("Summit," "SMLP" or the "Partnership") announces the execution of an opportunistic refinancing of its senior notes due 2025 (the "2025 Unsecured Notes") and amendment to its asset-based lending credit facility ("ABL Facility"). |

Summit Midstream Partners, LP (NYSE:SMLP) Q3 2023 Earnings Call TranscriptSummit Midstream Partners, LP (NYSE:SMLP) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good day, and thank you for standing by. Welcome to the Summit Midstream Partners Third Quarter 2023 Earnings Conference Call. At this time all participants are in a listen-only mode. After the speaker’s presentation there will be a question-and-answer session. [Operator […] |

Q3 2023 Summit Midstream Partners LP Earnings CallQ3 2023 Summit Midstream Partners LP Earnings Call |

Summit Midstream Partners LP (SMLP) Reports Q3 2023 Financial Results: Net Income of $3. ...Strong quarter-over-quarter growth with a 24% increase in Adjusted EBITDA |

Summit Midstream Partners, LP Reports Third Quarter 2023 Financial and Operating ResultsSummit Midstream Partners, LP (NYSE: SMLP) ("Summit", "SMLP" or the "Partnership") announced today its financial and operating results for the three months ended September 30, 2023. |

SMLP Price Returns

| 1-mo | 3.01% |

| 3-mo | 27.39% |

| 6-mo | 122.20% |

| 1-year | 135.37% |

| 3-year | -2.48% |

| 5-year | -63.41% |

| YTD | 106.20% |

| 2023 | 7.37% |

| 2022 | -24.86% |

| 2021 | 77.74% |

| 2020 | -73.85% |

| 2019 | -60.90% |

Continue Researching SMLP

Want to do more research on Summit Midstream Partners LP's stock and its price? Try the links below:Summit Midstream Partners LP (SMLP) Stock Price | Nasdaq

Summit Midstream Partners LP (SMLP) Stock Quote, History and News - Yahoo Finance

Summit Midstream Partners LP (SMLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...