China Petroleum & Chemical Corp. ADR (SNP): Price and Financial Metrics

SNP Price/Volume Stats

| Current price | $45.66 | 52-week high | $55.03 |

| Prev. close | $45.79 | 52-week low | $40.60 |

| Day low | $45.35 | Volume | 137,000 |

| Day high | $46.01 | Avg. volume | 219,445 |

| 50-day MA | $45.84 | Dividend yield | 9.21% |

| 200-day MA | $48.34 | Market Cap | 55.28B |

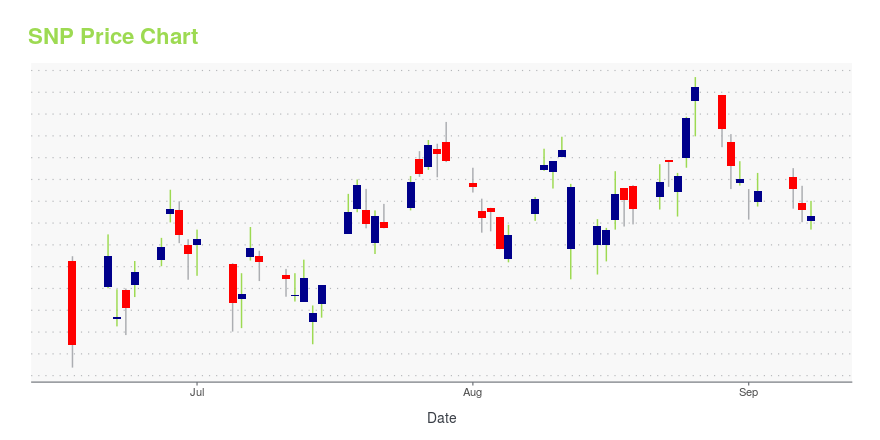

SNP Stock Price Chart Interactive Chart >

China Petroleum & Chemical Corp. ADR (SNP) Company Bio

China Petroleum & Chemical Corp. engages in the exploration, development and production of crude oil and natural gas. It operates through the following segments: Exploration and Production; Refining; Marketing and Distribution; Chemicals; and Corporate and Others. The Exploration and Production segment consists of activities related to exploring for and developing, producing, and selling crude oil and natural gas. The Refining segment purchases crude oil from its exploration and production segment and from third parties, processing of crude oil into refined oil products, and selling refined oil products principally to its marketing and distribution segment. The Marketing and Distribution segment includes refined oil products from its refining segment and third parties, and marketing, selling and distributing refined oil products by wholesale to large customers and independent distributors, and retail through its retail network. The Chemicals segment focuses on chemical feedstock principally from the refining segment and producing, marketing, selling, and distributing chemical product. The Corporate and Others segment comprises of trading activities of the import and export subsidiaries, and its research and development activities. The company was founded on February 25, 2000 and is headquartered in Beijing, China.

Latest SNP News From Around the Web

Below are the latest news stories about CHINA PETROLEUM & CHEMICAL CORP that investors may wish to consider to help them evaluate SNP as an investment opportunity.

Sinopec Releases 2021 CSR Report, Underlines Clean Energy, Sustainability and Sharing Fruits of Development with SocietyChina Petroleum & Chemical Corporation's (HKG: 0386, "Sinopec") has released its 2021 Corporate Responsibility Report lately, highlighting its clean energy development with 104 of its subsidiaries recognized as Green Enterprise and an annual carbon emission reduction of 2.38 million tons. |

Sinopec (SNP) Records Profit in 1H22 on Higher ProductionHigher oil and natural gas production, and commodity prices aid Sinopec's (SNP) 1H earnings. |

RETRANSMISSION: Sinopec 2022 Interim Profit Reached Record High Level H-Shares Annualized Dividend Yield Exceeding 10% Coupled with Shares Repurchase PlanChina Petroleum & Chemical Corporation ("Sinopec Corp." or the "Company") (HKEX: 386; SSE: 600028; NYSE:SNP) today announced its interim results for the six months ended 30 June 2022. |

China's Sinopec starts first carbon capture, storage facility, plans another two by 2025China's Sinopec Corp said on Monday it has put into operation the country's largest carbon capture, utilisation and storage (CCUS) facility in east China, and plans to build two more plants of similar size by 2025. The state oil giant is one of the leading companies building pilot CCUS projects in China, part of the country's goal to reach peak carbon emissions by 2030. The new CCUS project, which started construction just over a year ago, involves capturing carbon dioxide produced from Sinopec's Qilu refinery in eastern Shandong province during a hydrogen-making process, and then injecting it into 73 oil wells in the nearby Shengli oilfield. |

Sinopec 2022 Interim Profit Reached Record High Level H-Shares Annualized Dividend Yield Exceeding 10% Coupled with Shares Repurchase PlanChina Petroleum & Chemical Corporation ("Sinopec Corp." or the "Company") (HKEX: 386; SSE: 600028; NYSE:SNP) today announced its interim results for the six months ended 30 June 2022. |

SNP Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 18.22% |

| 5-year | -1.02% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 12.73% |

| 2020 | -18.35% |

| 2019 | -6.09% |

SNP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SNP

Want to do more research on China Petroleum & Chemical Corp's stock and its price? Try the links below:China Petroleum & Chemical Corp (SNP) Stock Price | Nasdaq

China Petroleum & Chemical Corp (SNP) Stock Quote, History and News - Yahoo Finance

China Petroleum & Chemical Corp (SNP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...