Sasol Ltd. ADR (SSL): Price and Financial Metrics

SSL Price/Volume Stats

| Current price | $4.99 | 52-week high | $8.40 |

| Prev. close | $4.95 | 52-week low | $2.78 |

| Day low | $4.97 | Volume | 783,200 |

| Day high | $5.06 | Avg. volume | 1,193,767 |

| 50-day MA | $4.64 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 3.24B |

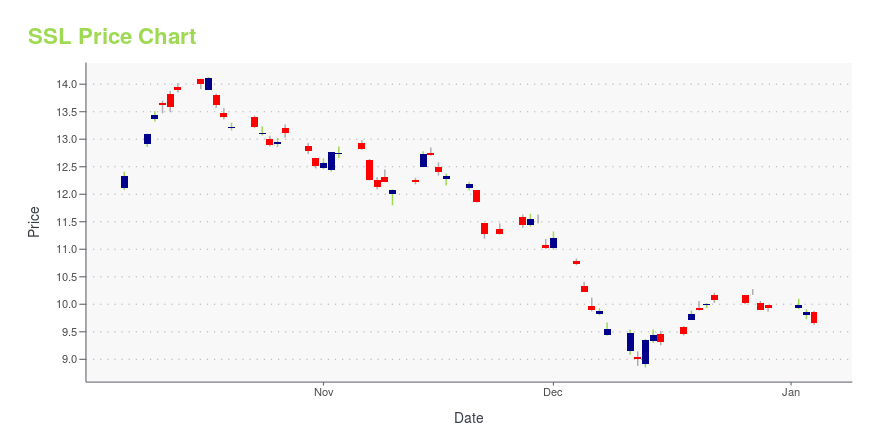

SSL Stock Price Chart Interactive Chart >

Sasol Ltd. ADR (SSL) Company Bio

Sasol Ltd. operates as an integrated energy and petrochemicals company worldwide. The Company develops and commercializes technologies, builds and operates facilities to produce a range of product streams, including liquid fuels, high-value chemicals and low-carbon electricity. The company was founded in 1950 and is based in Johannesburg, South Africa.

SSL Price Returns

| 1-mo | -4.59% |

| 3-mo | 36.71% |

| 6-mo | 0.60% |

| 1-year | -31.74% |

| 3-year | -72.71% |

| 5-year | -35.64% |

| YTD | 9.43% |

| 2024 | -53.62% |

| 2023 | -33.13% |

| 2022 | -0.57% |

| 2021 | 85.10% |

| 2020 | -59.00% |

Continue Researching SSL

Want to see what other sources are saying about Sasol Ltd's financials and stock price? Try the links below:Sasol Ltd (SSL) Stock Price | Nasdaq

Sasol Ltd (SSL) Stock Quote, History and News - Yahoo Finance

Sasol Ltd (SSL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...