Stag Industrial, Inc. (STAG): Price and Financial Metrics

STAG Price/Volume Stats

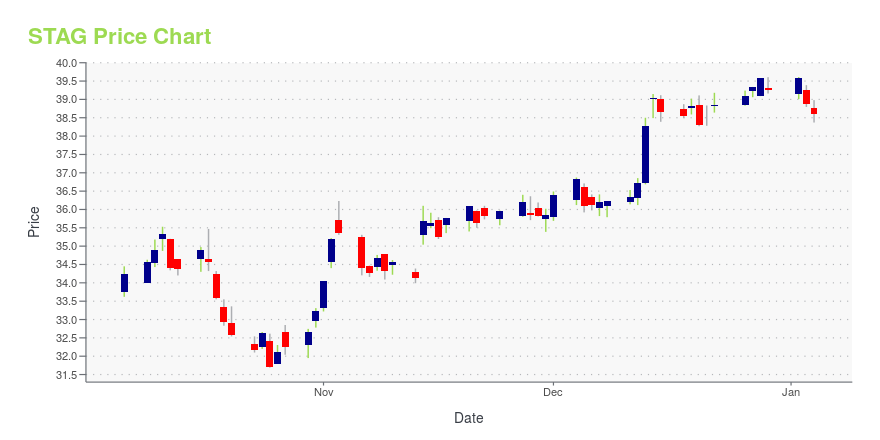

| Current price | $40.43 | 52-week high | $40.68 |

| Prev. close | $39.41 | 52-week low | $31.69 |

| Day low | $39.60 | Volume | 801,900 |

| Day high | $40.51 | Avg. volume | 1,133,802 |

| 50-day MA | $36.29 | Dividend yield | 3.67% |

| 200-day MA | $36.53 | Market Cap | 7.36B |

STAG Stock Price Chart Interactive Chart >

Stag Industrial, Inc. (STAG) Company Bio

STAG Industrial is focused on the acquisition and operation of single-tenant, industrial properties throughout the United States. The company was founded on July 21, 2010 and is based in Boston, Massachusetts.

Latest STAG News From Around the Web

Below are the latest news stories about STAG INDUSTRIAL INC that investors may wish to consider to help them evaluate STAG as an investment opportunity.

Here's Why 2024 Could be Great for REITs: 4 Stocks to Buy NowWith the Fed's accommodative approach and several asset categories displaying favorable market fundamentals, REITs like EQIX, O, EGP and STAG seem well-poised to excel in 2024. |

Holiday Sale: These 3 Dividend Stocks Are Bargain Buys This Holiday SeasonTheir high-yielding dividends will be the gift that keeps on giving. |

Is Stag Industrial Stock a Buy?Up around 20% in 2023 thus far, is this industrial REIT worth adding to your portfolio today? The answer isn't exactly an obvious yes or no. |

Stag Industrial Inc Chief Accounting Officer Sells Company SharesJaclyn Paul, Chief Accounting Officer of Stag Industrial Inc (NYSE:STAG), sold 12,900 shares of the company on December 21, 2023, according to a SEC Filing. |

CTO Realty (CTO) Sells Office Asset, Boosts Financial ResilienceCTO Realty's (CTO) latest disposition showcases the company's commitment to enhancing its financial position and focusing on core assets. |

STAG Price Returns

| 1-mo | 15.75% |

| 3-mo | 18.51% |

| 6-mo | 8.65% |

| 1-year | 13.43% |

| 3-year | 14.20% |

| 5-year | 65.69% |

| YTD | 5.11% |

| 2023 | 26.75% |

| 2022 | -29.65% |

| 2021 | 59.11% |

| 2020 | 4.18% |

| 2019 | 33.19% |

STAG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching STAG

Want to see what other sources are saying about STAG Industrial Inc's financials and stock price? Try the links below:STAG Industrial Inc (STAG) Stock Price | Nasdaq

STAG Industrial Inc (STAG) Stock Quote, History and News - Yahoo Finance

STAG Industrial Inc (STAG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...