Suncor Energy Inc. (SU): Price and Financial Metrics

SU Price/Volume Stats

| Current price | $38.50 | 52-week high | $41.50 |

| Prev. close | $38.48 | 52-week low | $29.45 |

| Day low | $38.05 | Volume | 1,543,700 |

| Day high | $38.67 | Avg. volume | 4,493,135 |

| 50-day MA | $38.51 | Dividend yield | 4.2% |

| 200-day MA | $35.38 | Market Cap | 49.34B |

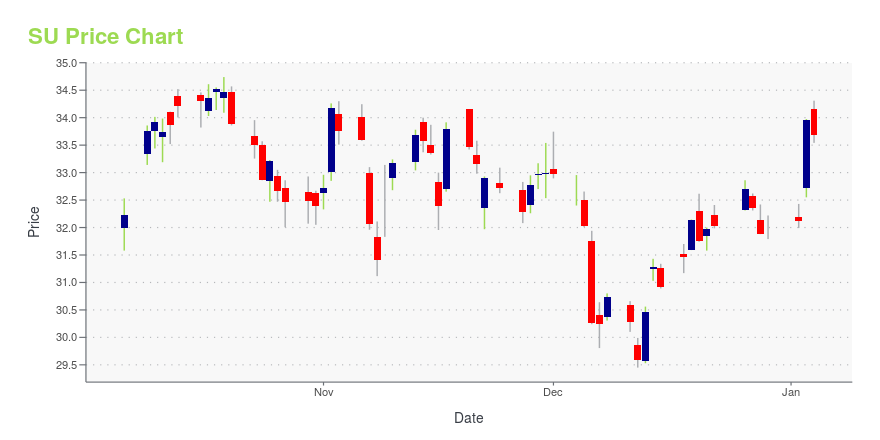

SU Stock Price Chart Interactive Chart >

Suncor Energy Inc. (SU) Company Bio

Suncor Energy (French: Suncor Énergie) is a Canadian integrated energy company based in Calgary, Alberta. It specializes in production of synthetic crude from oil sands. In the 2020 Forbes Global 2000, Suncor Energy was ranked as the 48th-largest public company in the world. (Source:Wikipedia)

Latest SU News From Around the Web

Below are the latest news stories about SUNCOR ENERGY INC that investors may wish to consider to help them evaluate SU as an investment opportunity.

Here's Why Suncor Energy (TSE:SU) Has Caught The Eye Of InvestorsFor beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

Suncor Energy (SU) Stock Moves -1.15%: What You Should KnowSuncor Energy (SU) closed the most recent trading day at $31.76, moving -1.15% from the previous trading session. |

13 Most Promising Energy Stocks According to AnalystsIn this article, we discuss the 13 most promising energy stocks according to analysts. To skip the overview of the energy sector, go directly to the 5 Most Promising Energy Stocks According to Analysts. Despite the global push toward clean energy, fossil fuels have shown their impact on the economy in recent years. While renewable […] |

Billionaire Paul Singer’s Recent Activist Targets and Top Stock PicksIn this article, we discuss billionaire Paul Singer’s recent activist targets and top stock picks. If you want to see more stocks in this selection, you can check out Billionaire Paul Singer’s Recent Activist Targets and 5 Top Stock Picks. Paul Singer is regarded as one of the most successful hedge fund managers, having perfected […] |

Canada Targets Oil & Gas Emissions, Introduces FrameworkCompanies like Suncor Energy (SU), Canadian Natural Resources (CNQ) and Imperial Oil Limited (IMO) could be impacted by Canada's ambitious emissions cap plan for the oil and gas sector. |

SU Price Returns

| 1-mo | 3.22% |

| 3-mo | -1.29% |

| 6-mo | 20.22% |

| 1-year | 34.06% |

| 3-year | 116.64% |

| 5-year | 58.38% |

| YTD | 22.85% |

| 2023 | 5.96% |

| 2022 | 32.31% |

| 2021 | 52.63% |

| 2020 | -46.68% |

| 2019 | 22.11% |

SU Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SU

Want to see what other sources are saying about Suncor Energy Inc's financials and stock price? Try the links below:Suncor Energy Inc (SU) Stock Price | Nasdaq

Suncor Energy Inc (SU) Stock Quote, History and News - Yahoo Finance

Suncor Energy Inc (SU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...