Sysco Corp. (SYY): Price and Financial Metrics

SYY Price/Volume Stats

| Current price | $78.41 | 52-week high | $82.23 |

| Prev. close | $77.91 | 52-week low | $67.12 |

| Day low | $77.97 | Volume | 2,333,100 |

| Day high | $78.81 | Avg. volume | 3,332,279 |

| 50-day MA | $74.39 | Dividend yield | 2.77% |

| 200-day MA | $0.00 | Market Cap | 38.01B |

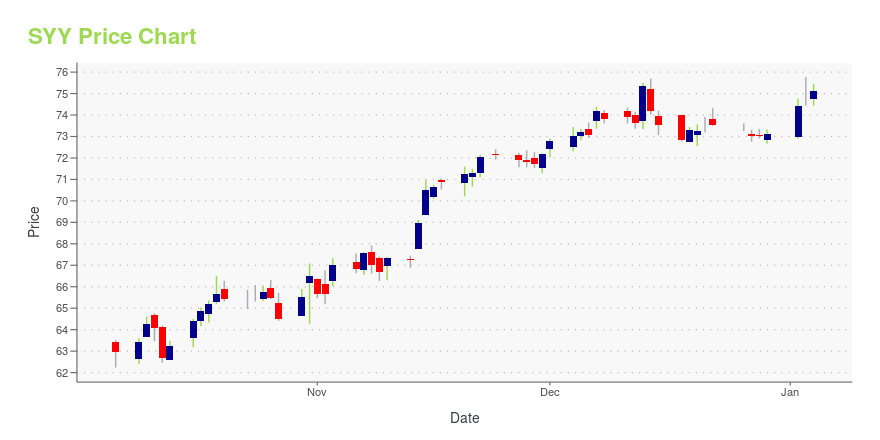

SYY Stock Price Chart Interactive Chart >

Sysco Corp. (SYY) Company Bio

Sysco Corp. is headquartered in Houston, Texas and is in the business of food distribution. Its primary business involves the distribution of food and related products to the foodservice or food-away-from-home industry. The company has operations in 90 countries around the world in four business groups: Broadline, Specialty Companies, International, and Sygma. Sysco employs over 57,000 individuals across the globe and operates 326 distribution facilities that serve more than 625,000 customer locations. For the fiscal year ending June 27, 2020, the company generated more than 52 billion US dollars in sales. Kevin Hourican serves as Sysco’s President and Chief Executive Officer.

SYY Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 9.45% |

| 3-year | -3.61% |

| 5-year | 68.27% |

| YTD | 4.68% |

| 2024 | 7.41% |

| 2023 | -1.70% |

| 2022 | -0.33% |

| 2021 | 8.29% |

| 2020 | -10.40% |

SYY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SYY

Want to do more research on Sysco Corp's stock and its price? Try the links below:Sysco Corp (SYY) Stock Price | Nasdaq

Sysco Corp (SYY) Stock Quote, History and News - Yahoo Finance

Sysco Corp (SYY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...