Taitron Components Incorporated - (TAIT): Price and Financial Metrics

TAIT Price/Volume Stats

| Current price | $2.85 | 52-week high | $4.16 |

| Prev. close | $2.80 | 52-week low | $2.57 |

| Day low | $2.85 | Volume | 10,563 |

| Day high | $2.91 | Avg. volume | 14,498 |

| 50-day MA | $2.83 | Dividend yield | 6.81% |

| 200-day MA | $3.19 | Market Cap | 17.16M |

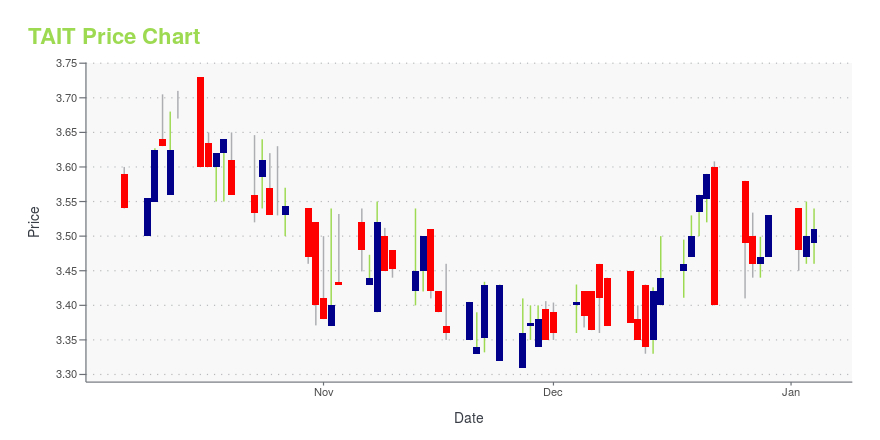

TAIT Stock Price Chart Interactive Chart >

Taitron Components Incorporated - (TAIT) Company Bio

Taitron Components Incorporated engages in the supply of original designed and manufactured (ODM) electronic components, and distribution of brand name electronic components. It distributes discrete semiconductors, commodity integrated circuits, optoelectronic devices, and passive components. The company also provides value-added engineering and turn-key solutions focusing on providing contract electronic manufacturers (CEMs) and original equipment manufacturers (OEMs) with ODM services for their turn-key projects. It serves other electronic distributors, CEMs, and OEMs in the United States, South Korea, China, Taiwan, and internationally. The company has strategic alliances with Teamforce Co. Ltd.; Grand Shine Management Limited; and Zowie Technology Corporation. Taitron Components Incorporated was founded in 1989 and is headquartered in Valencia, California.

Latest TAIT News From Around the Web

Below are the latest news stories about TAITRON COMPONENTS INC that investors may wish to consider to help them evaluate TAIT as an investment opportunity.

Estimating The Fair Value Of Taitron Components Incorporated (NASDAQ:TAIT)Key Insights The projected fair value for Taitron Components is US$3.15 based on Dividend Discount Model Current share... |

Taitron Components' (NASDAQ:TAIT) Dividend Will Be $0.05Taitron Components Incorporated ( NASDAQ:TAIT ) will pay a dividend of $0.05 on the 30th of November. This means the... |

Taitron Announces Quarterly Cash DividendLOS ANGELES, Oct. 27, 2023 (GLOBE NEWSWIRE) -- Taitron Components Incorporated (NASDAQ:TAIT) today announced that its Board of Directors has declared a quarterly cash dividend of $0.05 per share of common stock, payable on November 30, 2023 to stockholders of record as of the close of business on November 10, 2023. Under our current dividend policy, the Company will target a cash dividend to our stockholders in the amount of $0.20 per share per annum, payable in equal $0.05 per share quarterly i |

Taitron Components Incorporated (NASDAQ:TAIT) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?With its stock down 9.0% over the past three months, it is easy to disregard Taitron Components (NASDAQ:TAIT). But if... |

Taitron Components (NASDAQ:TAIT) Shareholders Will Want The ROCE Trajectory To ContinueDid you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to... |

TAIT Price Returns

| 1-mo | 7.15% |

| 3-mo | -8.67% |

| 6-mo | -8.13% |

| 1-year | -24.31% |

| 3-year | -25.47% |

| 5-year | 7.46% |

| YTD | -16.72% |

| 2023 | 6.92% |

| 2022 | -7.23% |

| 2021 | 28.75% |

| 2020 | 20.72% |

| 2019 | 71.46% |

TAIT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TAIT

Want to see what other sources are saying about Taitron Components Inc's financials and stock price? Try the links below:Taitron Components Inc (TAIT) Stock Price | Nasdaq

Taitron Components Inc (TAIT) Stock Quote, History and News - Yahoo Finance

Taitron Components Inc (TAIT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...