BlackRock TCP Capital Corp. (TCPC): Price and Financial Metrics

TCPC Price/Volume Stats

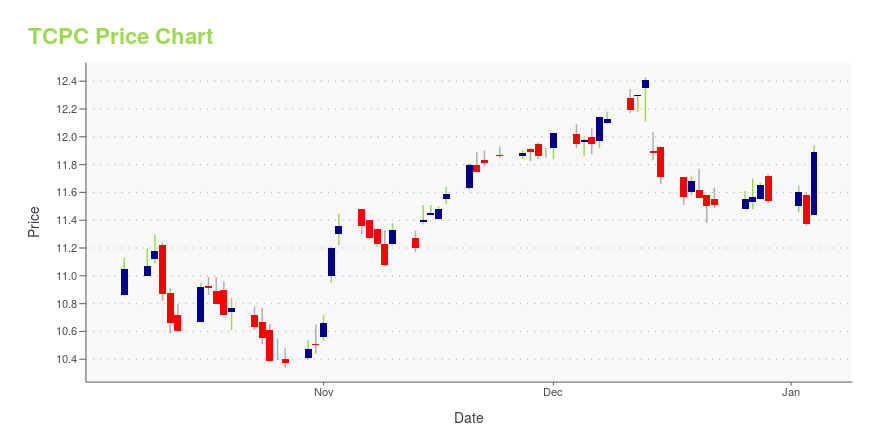

| Current price | $10.81 | 52-week high | $13.00 |

| Prev. close | $10.79 | 52-week low | $9.90 |

| Day low | $10.73 | Volume | 173,548 |

| Day high | $10.83 | Avg. volume | 428,901 |

| 50-day MA | $10.92 | Dividend yield | 12.65% |

| 200-day MA | $10.98 | Market Cap | 925.24M |

TCPC Stock Price Chart Interactive Chart >

BlackRock TCP Capital Corp. (TCPC) Company Bio

TCP Capital Corp. is an externally-managed specialty finance company. The Company, which operates as a business development company, focuses on lending to middle-market U.S. companies to achieve high total returns through current income and capital appreciation. The company was founded in 1999 and is based in Santa Monica, California.

Latest TCPC News From Around the Web

Below are the latest news stories about BLACKROCK TCP CAPITAL CORP that investors may wish to consider to help them evaluate TCPC as an investment opportunity.

Q3 2023 BlackRock Capital Investment Corp Earnings CallQ3 2023 BlackRock Capital Investment Corp Earnings Call |

BlackRock TCP Capital Corp. (NASDAQ:TCPC) Q3 2023 Earnings Call TranscriptBlackRock TCP Capital Corp. (NASDAQ:TCPC) Q3 2023 Earnings Call Transcript November 2, 2023 BlackRock TCP Capital Corp. beats earnings expectations. Reported EPS is $0.49, expectations were $0.47. Operator: Ladies and gentlemen, good afternoon. Welcome everyone to BlackRock TCP Capital Corp.’s Third Quarter 2023 Earnings Conference Call. Today’s conference call is being recorded for replay purposes. […] |

BlackRock TCP Capital Corp (TCPC) Announces Q3 2023 Financial ResultsNet Investment Income of $0.49 Per Share, Declares Q4 Dividend of $0.34 Per Share and a Special Dividend of $0.25 Per Share |

BlackRock TCP Capital Corp. Announces Third Quarter 2023 Financial Results Including Net Investment Income of $0.49 Per Share; Declares Fourth Quarter Dividend of $0.34 Per Share and a Special Dividend of $0.25 Per ShareSANTA MONICA, Calif., November 02, 2023--BlackRock TCP Capital Corp. ("we," "us," "our," "TCPC" or the "Company"), a business development company (NASDAQ: TCPC), today announced its financial results for the third quarter ended September 30, 2023 and filed its Form 10-Q with the U.S. Securities and Exchange Commission. |

BlackRock TCP Capital Corp. to Report Third Quarter 2023 Financial Results on November 2, 2023SANTA MONICA, Calif., September 22, 2023--BlackRock TCP Capital Corp. (NASDAQ: TCPC) announced today that it will report its financial results for the third quarter ended September 30, 2023 on Thursday, November 2, 2023, prior to the opening of the financial markets. |

TCPC Price Returns

| 1-mo | 2.17% |

| 3-mo | 10.49% |

| 6-mo | -1.86% |

| 1-year | 5.46% |

| 3-year | 8.30% |

| 5-year | 35.66% |

| YTD | -0.24% |

| 2023 | 3.23% |

| 2022 | 5.61% |

| 2021 | 30.76% |

| 2020 | -9.17% |

| 2019 | 19.31% |

TCPC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TCPC

Want to do more research on BlackRock TCP Capital Corp's stock and its price? Try the links below:BlackRock TCP Capital Corp (TCPC) Stock Price | Nasdaq

BlackRock TCP Capital Corp (TCPC) Stock Quote, History and News - Yahoo Finance

BlackRock TCP Capital Corp (TCPC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...