Turkcell Iletisim Hizmetleri A.S. ADR (TKC): Price and Financial Metrics

TKC Price/Volume Stats

| Current price | $7.94 | 52-week high | $8.47 |

| Prev. close | $7.83 | 52-week low | $4.07 |

| Day low | $7.90 | Volume | 1,253,363 |

| Day high | $8.00 | Avg. volume | 444,803 |

| 50-day MA | $7.55 | Dividend yield | 0.86% |

| 200-day MA | $5.76 | Market Cap | 6.99B |

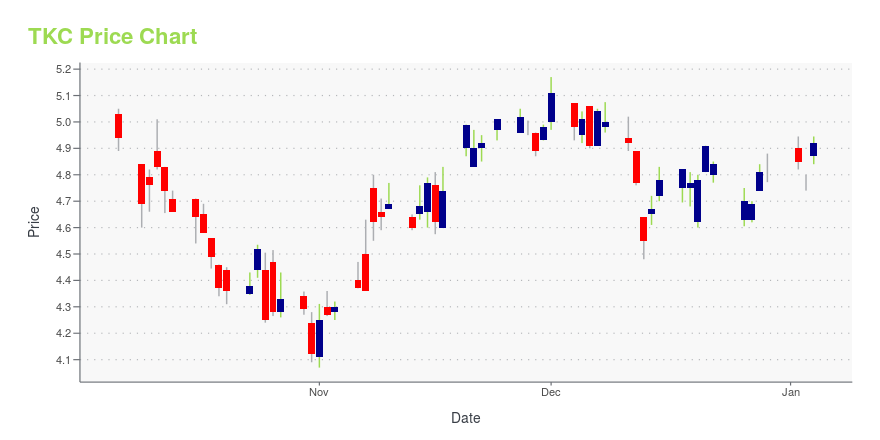

TKC Stock Price Chart Interactive Chart >

Turkcell Iletisim Hizmetleri A.S. ADR (TKC) Company Bio

Turkcell Iletisim Hizmetleri AS establishes and operates a Global System for Mobile Communications (GSM) network in Turkey and regional states. The company was founded in 1993 and is based in Istanbul, Turkey.

Latest TKC News From Around the Web

Below are the latest news stories about TURKCELL ILETISIM HIZMETLERI A S that investors may wish to consider to help them evaluate TKC as an investment opportunity.

16 Most Profitable Penny Stocks NowIn this article, we will take a look at the 16 most profitable penny stocks now. To see more such companies, go directly to 5 Most Profitable Penny Stocks Now. Earlier this month investors cheered the latest inflation data report which showed the Fed’s battle against inflation might finally be working. Throughout 2023, investors and […] |

Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) Q3 2023 Earnings Call TranscriptTurkcell Iletisim Hizmetleri A.S. (NYSE:TKC) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Ladies and gentlemen, thank you for standing by. I am [Gaeli], your Chorus Call operator. Welcome, and thank you for joining the Turkcell’s conference call and live webcast to present and discuss the Turkcell Third Quarter 2023 Financial Results Conference Call […] |

Turkcell Iletisim Hizmetleri: Third Quarter 2023 ResultsISTANBUL, November 07, 2023--Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) (BIST:TCELL): |

Unveiling Turkcell Iletisim Hizmetleri AS (TKC)'s Value: Is It Really Priced Right? A ...Delving into the Intrinsic Value of Turkcell Iletisim Hizmetleri AS (TKC) |

Turkcell Iletisim Hizmetleri AS (TKC): A Detailed Examination of Its OvervaluationIs the current market price reflective of its intrinsic value? Let's find out. |

TKC Price Returns

| 1-mo | 9.22% |

| 3-mo | 32.78% |

| 6-mo | 41.28% |

| 1-year | 83.10% |

| 3-year | 88.62% |

| 5-year | 56.83% |

| YTD | 65.07% |

| 2023 | 1.89% |

| 2022 | 36.55% |

| 2021 | -29.95% |

| 2020 | -5.58% |

| 2019 | 6.63% |

TKC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TKC

Here are a few links from around the web to help you further your research on Turkcell Iletisim Hizmetleri A S's stock as an investment opportunity:Turkcell Iletisim Hizmetleri A S (TKC) Stock Price | Nasdaq

Turkcell Iletisim Hizmetleri A S (TKC) Stock Quote, History and News - Yahoo Finance

Turkcell Iletisim Hizmetleri A S (TKC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...