Trustmark Corporation (TRMK): Price and Financial Metrics

TRMK Price/Volume Stats

| Current price | $35.42 | 52-week high | $35.42 |

| Prev. close | $34.30 | 52-week low | $18.96 |

| Day low | $34.72 | Volume | 408,004 |

| Day high | $35.42 | Avg. volume | 279,150 |

| 50-day MA | $30.22 | Dividend yield | 2.67% |

| 200-day MA | $26.97 | Market Cap | 2.17B |

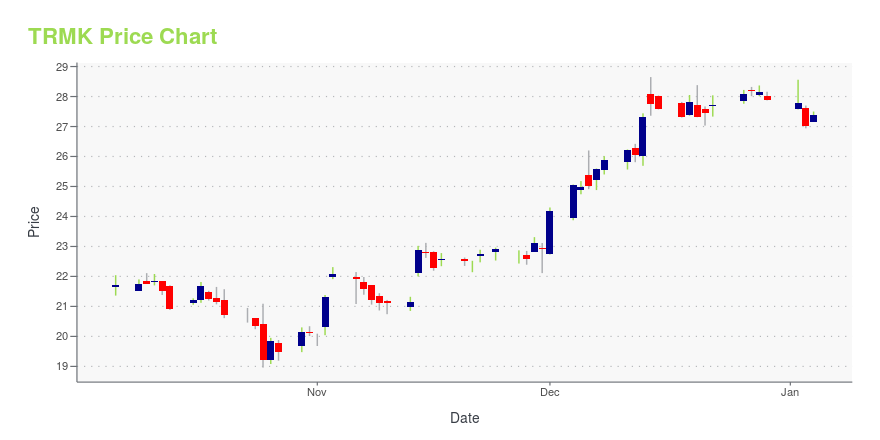

TRMK Stock Price Chart Interactive Chart >

Trustmark Corporation (TRMK) Company Bio

Trustmark Corporation provides banking and other financial solutions to individuals and corporate institutions in Alabama, Florida, Mississippi, Tennessee, and Texas. The company was founded in 1889 and is based in Jackson, Mississippi.

Latest TRMK News From Around the Web

Below are the latest news stories about TRUSTMARK CORP that investors may wish to consider to help them evaluate TRMK as an investment opportunity.

Trustmark Corporation to Announce Fourth Quarter Financial Results January 23 and Conduct Earnings Conference Call January 24JACKSON, Miss., December 28, 2023--Trustmark Corporation to Announce Fourth Quarter Financial Results January 23 and Conduct Earnings Conference Call January 24 |

Trustmark's (NASDAQ:TRMK) one-year decline in earnings translates into losses for shareholdersTrustmark Corporation ( NASDAQ:TRMK ) shareholders should be happy to see the share price up 24% in the last month. But... |

Trustmark (NASDAQ:TRMK) Has Affirmed Its Dividend Of $0.23Trustmark Corporation's ( NASDAQ:TRMK ) investors are due to receive a payment of $0.23 per share on 15th of December... |

Trustmark Corporation (NASDAQ:TRMK) Q3 2023 Earnings Call TranscriptTrustmark Corporation (NASDAQ:TRMK) Q3 2023 Earnings Call Transcript October 25, 2023 Operator: Good morning, ladies and gentlemen, and welcome to Trustmark Corporation’s Third Quarter Earnings Conference Call. [Operator Instructions] As a reminder, this call is being recorded. It is now my pleasure to introduce Mr. Joey Rein, Director of Corporate Strategy of Trustmark. Please go […] |

Q3 2023 Trustmark Corp Earnings CallQ3 2023 Trustmark Corp Earnings Call |

TRMK Price Returns

| 1-mo | 22.35% |

| 3-mo | 18.81% |

| 6-mo | 27.93% |

| 1-year | 41.63% |

| 3-year | 27.32% |

| 5-year | 16.99% |

| YTD | 29.17% |

| 2023 | -17.02% |

| 2022 | 10.67% |

| 2021 | 22.34% |

| 2020 | -17.98% |

| 2019 | 24.73% |

TRMK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TRMK

Want to do more research on Trustmark Corp's stock and its price? Try the links below:Trustmark Corp (TRMK) Stock Price | Nasdaq

Trustmark Corp (TRMK) Stock Quote, History and News - Yahoo Finance

Trustmark Corp (TRMK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...