TrustCo Bank Corp NY (TRST): Price and Financial Metrics

TRST Price/Volume Stats

| Current price | $35.40 | 52-week high | $35.74 |

| Prev. close | $35.02 | 52-week low | $23.78 |

| Day low | $34.31 | Volume | 75,400 |

| Day high | $35.74 | Avg. volume | 78,929 |

| 50-day MA | $29.04 | Dividend yield | 4.15% |

| 200-day MA | $28.24 | Market Cap | 673.45M |

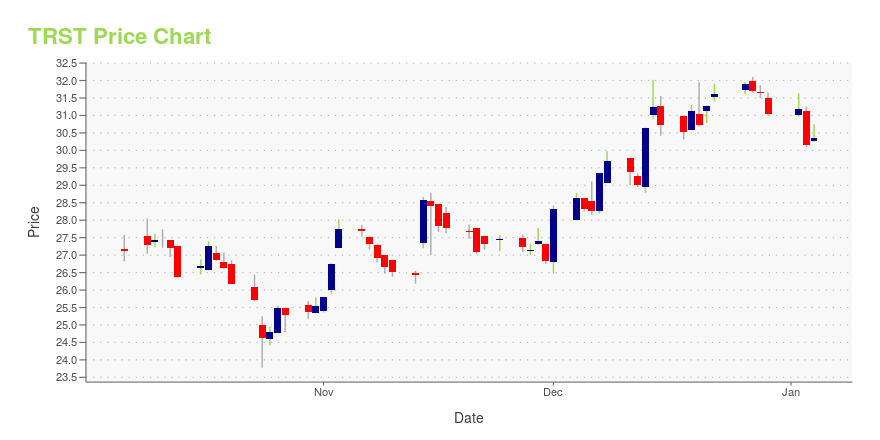

TRST Stock Price Chart Interactive Chart >

TrustCo Bank Corp NY (TRST) Company Bio

TrustCo Bank provides personal and business banking services to individuals, partnerships, and corporations in New York, Florida, Massachusetts, New Jersey, and Vermont. The company was founded in 1902 and is based in Glenville, New York.

Latest TRST News From Around the Web

Below are the latest news stories about TRUSTCO BANK CORP N Y that investors may wish to consider to help them evaluate TRST as an investment opportunity.

TrustCo Bank Corp NY Insiders Added US$1.30m Of Stock To Their HoldingsIt is usually uneventful when a single insider buys stock. However, When quite a few insiders buy shares, as it... |

Why You Might Be Interested In TrustCo Bank Corp NY (NASDAQ:TRST) For Its Upcoming DividendTrustCo Bank Corp NY ( NASDAQ:TRST ) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one... |

TrustCo Bank Corp NY (NASDAQ:TRST) Has Announced A Dividend Of $0.36TrustCo Bank Corp NY's ( NASDAQ:TRST ) investors are due to receive a payment of $0.36 per share on 2nd of January... |

Strong Capital Supports TrustCo’s Consistent Dividend; Annualized Payout of $1.44 per shareGLENVILLE, N.Y., Nov. 21, 2023 (GLOBE NEWSWIRE) -- The Board of Directors of TrustCo Bank Corp NY (TrustCo, Nasdaq: TRST) on November 21, 2023, declared a quarterly cash dividend of $0.36 per share, or $1.44 per share on an annualized basis. The dividend will be payable on January 2, 2024 to shareholders of record at the close of business on December 1, 2023. Chairman, President, and Chief Executive Officer Robert J. McCormick said: “We are pleased that our strategic preservation of capital enab |

TrustCo Bank Corp NY (NASDAQ:TRST) Q3 2023 Earnings Call TranscriptTrustCo Bank Corp NY (NASDAQ:TRST) Q3 2023 Earnings Call Transcript October 24, 2023 Operator: Good day, and welcome to the TrustCo Bank Corp Earnings Call and Webcast. All participants will be in a listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. [Operator Instructions] Before proceeding, we would like […] |

TRST Price Returns

| 1-mo | 28.49% |

| 3-mo | 32.44% |

| 6-mo | 21.56% |

| 1-year | 22.70% |

| 3-year | 21.64% |

| 5-year | 8.96% |

| YTD | 17.05% |

| 2023 | -13.27% |

| 2022 | 17.58% |

| 2021 | 3.97% |

| 2020 | -19.75% |

| 2019 | 30.75% |

TRST Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TRST

Want to see what other sources are saying about Trustco Bank Corp N Y's financials and stock price? Try the links below:Trustco Bank Corp N Y (TRST) Stock Price | Nasdaq

Trustco Bank Corp N Y (TRST) Stock Quote, History and News - Yahoo Finance

Trustco Bank Corp N Y (TRST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...