Timberland Bancorp, Inc. (TSBK): Price and Financial Metrics

TSBK Price/Volume Stats

| Current price | $31.66 | 52-week high | $32.24 |

| Prev. close | $31.72 | 52-week low | $23.93 |

| Day low | $31.25 | Volume | 10,400 |

| Day high | $31.95 | Avg. volume | 13,265 |

| 50-day MA | $26.55 | Dividend yield | 3.15% |

| 200-day MA | $27.49 | Market Cap | 254.01M |

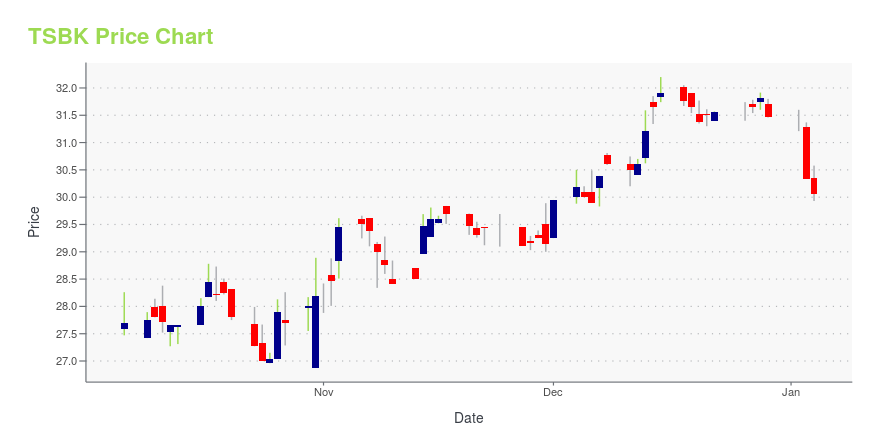

TSBK Stock Price Chart Interactive Chart >

Timberland Bancorp, Inc. (TSBK) Company Bio

Timberland Bancorp, Inc. operates as the bank holding company for Timberland Bank that provides various banking services in Washington. The company was founded in 1915 and is based in Hoquiam, Washington.

Latest TSBK News From Around the Web

Below are the latest news stories about TIMBERLAND BANCORP INC that investors may wish to consider to help them evaluate TSBK as an investment opportunity.

With 63% ownership, Timberland Bancorp, Inc. (NASDAQ:TSBK) boasts of strong institutional backingKey Insights Institutions' substantial holdings in Timberland Bancorp implies that they have significant influence over... |

Is It Smart To Buy Timberland Bancorp, Inc. (NASDAQ:TSBK) Before It Goes Ex-Dividend?Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Timberland... |

Timberland Bancorp Inc (TSBK) Reports 15% Rise in Fiscal 2023 Net Income to $27.12 MillionCompany also announces a 17% increase in Earnings Per Share (EPS) for the fiscal year |

Timberland Bancorp’s 2023 Fiscal Year Net Income Increases to $27.12 MillionFiscal Year EPS Increased 17% to $3.29Quarterly EPS Increased 5% to $0.81 from $0.77 for Preceding QuarterQuarterly Return on Average Assets of 1.45%Quarterly Return on Average Equity of 11.52%Quarterly Net Interest Margin of 3.85%Announces $0.23 Quarterly Cash Dividend HOQUIAM, Wash., Oct. 30, 2023 (GLOBE NEWSWIRE) -- Timberland Bancorp, Inc. (NASDAQ: TSBK) (“Timberland” or “the Company”), the holding company for Timberland Bank (the “Bank”), today reported that net income increased 15% to $27. |

If EPS Growth Is Important To You, Timberland Bancorp (NASDAQ:TSBK) Presents An OpportunityThe excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even... |

TSBK Price Returns

| 1-mo | 23.43% |

| 3-mo | 26.56% |

| 6-mo | 9.86% |

| 1-year | 5.48% |

| 3-year | 24.50% |

| 5-year | 38.59% |

| YTD | 2.50% |

| 2023 | -4.79% |

| 2022 | 27.55% |

| 2021 | 18.41% |

| 2020 | -15.08% |

| 2019 | 37.26% |

TSBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TSBK

Want to see what other sources are saying about Timberland Bancorp Inc's financials and stock price? Try the links below:Timberland Bancorp Inc (TSBK) Stock Price | Nasdaq

Timberland Bancorp Inc (TSBK) Stock Quote, History and News - Yahoo Finance

Timberland Bancorp Inc (TSBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...