United Bankshares, Inc. (UBSI): Price and Financial Metrics

UBSI Price/Volume Stats

| Current price | $39.32 | 52-week high | $39.86 |

| Prev. close | $38.33 | 52-week low | $25.35 |

| Day low | $38.70 | Volume | 735,538 |

| Day high | $39.86 | Avg. volume | 528,580 |

| 50-day MA | $33.35 | Dividend yield | 3.92% |

| 200-day MA | $33.71 | Market Cap | 5.32B |

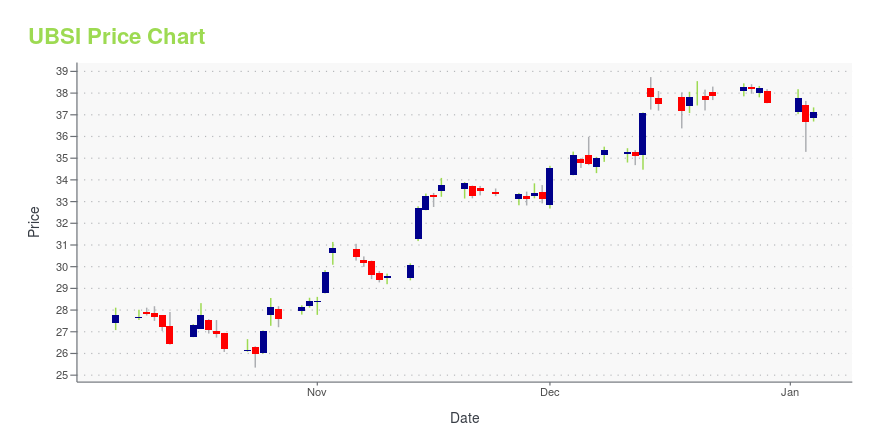

UBSI Stock Price Chart Interactive Chart >

United Bankshares, Inc. (UBSI) Company Bio

United Bankshares operates as the bank holding company for United Bank (WV) and United Bank (VA) that provides commercial and retail banking services and products in the United States. The company has branches across West Virginia, Maryland, Washington, D.C., Pennsylvania, and Ohio. The company was founded in 1982 and is based in Charleston, West Virginia.

Latest UBSI News From Around the Web

Below are the latest news stories about UNITED BANKSHARES INC that investors may wish to consider to help them evaluate UBSI as an investment opportunity.

The Zacks Analyst Blog Highlights United Bankshares, Wintrust Financial, First BanCorp, TowneBank and WSFS FinancialUnited Bankshares, Wintrust Financial, First BanCorp, TowneBank and WSFS Financial are included in this Analyst Blog. |

5 Top-Ranked Banks That Outperformed S&P 500 in NovemberBank stocks are on a roll in November on investor optimism about no further rate hikes, with United Bankshares (UBSI), Wintrust Financial (WTFC), First BanCorp. (FBP), TowneBank (TOWN) and WSFS Financial (WSFS) outperforming the S&P 500 index. |

Why You Might Be Interested In United Bankshares, Inc. (NASDAQ:UBSI) For Its Upcoming DividendUnited Bankshares, Inc. ( NASDAQ:UBSI ) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one... |

United Bankshares (NASDAQ:UBSI) Is Increasing Its Dividend To $0.37United Bankshares, Inc.'s ( NASDAQ:UBSI ) periodic dividend will be increasing on the 2nd of January to $0.37, with... |

Dividend Kings In Focus: United BanksharesUnited Bankshares recently increased its dividend for the 50th consecutive year, joining the list of Dividend Kings. |

UBSI Price Returns

| 1-mo | 24.55% |

| 3-mo | 19.30% |

| 6-mo | 9.33% |

| 1-year | 23.96% |

| 3-year | 28.21% |

| 5-year | 28.47% |

| YTD | 7.09% |

| 2023 | -3.17% |

| 2022 | 16.06% |

| 2021 | 16.34% |

| 2020 | -11.68% |

| 2019 | 28.84% |

UBSI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UBSI

Here are a few links from around the web to help you further your research on United Bankshares Inc's stock as an investment opportunity:United Bankshares Inc (UBSI) Stock Price | Nasdaq

United Bankshares Inc (UBSI) Stock Quote, History and News - Yahoo Finance

United Bankshares Inc (UBSI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...