Unity Biotechnology, Inc. (UBX): Price and Financial Metrics

UBX Price/Volume Stats

| Current price | $1.52 | 52-week high | $3.82 |

| Prev. close | $1.48 | 52-week low | $1.46 |

| Day low | $1.47 | Volume | 37,373 |

| Day high | $1.52 | Avg. volume | 84,616 |

| 50-day MA | $1.61 | Dividend yield | N/A |

| 200-day MA | $2.00 | Market Cap | 25.48M |

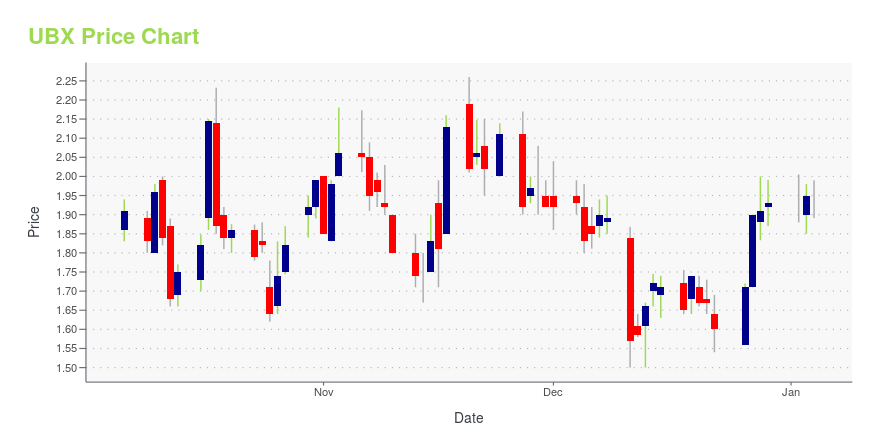

UBX Stock Price Chart Interactive Chart >

Unity Biotechnology, Inc. (UBX) Company Bio

Unity Biotechnology, Inc., a preclinical biotechnology company, engages in the research and development of therapeutics to extend human health span. The company’s lead drug candidates include UBX0101 for musculoskeletal disease with an initial focus on osteoarthritis; and UBX1967 for ophthalmologic diseases. It is also developing programs in pulmonary disorders. The company was formerly known as Forge, Inc. and changed its name to Unity Biotechnology, Inc. in January 2015. Unity Biotechnology, Inc. was founded in 2009 and is based in Brisbane, California.

Latest UBX News From Around the Web

Below are the latest news stories about UNITY BIOTECHNOLOGY INC that investors may wish to consider to help them evaluate UBX as an investment opportunity.

UNITY Biotechnology Doses First Patients in Phase 2 ASPIRE Study of UBX1325 in DMETopline 16-week data expected in the fourth quarter of 2024SOUTH SAN FRANCISCO, Calif., Dec. 12, 2023 (GLOBE NEWSWIRE) -- UNITY Biotechnology, Inc. (“UNITY”) [Nasdaq: UBX], a biotechnology company developing therapeutics to slow, halt, or reverse diseases of aging, today announced that the first patients have been dosed in the Phase 2 ASPIRE study of UBX1325 (foselutoclax), a Bcl-xL inhibitor being evaluated head-to-head against standard of care anti-VEGF in patients with diabetic macular edema |

Companies Like Unity Biotechnology (NASDAQ:UBX) Could Be Quite RiskyWe can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining... |

UNITY Biotechnology, Inc. Reports Third Quarter 2023 Financial Results and Business UpdatesSOUTH SAN FRANCISCO, Calif., Nov. 13, 2023 (GLOBE NEWSWIRE) -- UNITY Biotechnology, Inc. (UNITY) [NASDAQ:UBX], a biotechnology company developing therapeutics to slow, halt, or reverse diseases of aging, today reported financial results for the third quarter ended September 30, 2023. “Following positive efficacy and safety data at 48 weeks from a single injection of UBX1325 (foselutoclax) in patients with diabetic macular edema, we are working to quickly and efficiently advance UBX1325 (foseluto |

UNITY Biotechnology Announces Exercise of Warrants for $4.38 Million in Gross ProceedsSOUTH SAN FRANCISCO, Calif., Nov. 10, 2023 (GLOBE NEWSWIRE) -- UNITY Biotechnology, Inc. (“UNITY” or the “Company”) [Nasdaq: UBX], a biotechnology company developing therapeutics to slow, halt, or reverse diseases of aging, today announced the entry into a definitive agreement for the immediate exercise of certain outstanding warrants to purchase up to an aggregate of 2,143,000 shares of common stock, having an exercise price of $8.50 per share, issued by UNITY on August 22, 2022, at a reduced e |

Are Longevity Stocks the Next Trillion-Dollar Industry? 3 Anti-Aging PicksHere are the best longevity stocks to consider. |

UBX Price Returns

| 1-mo | -6.75% |

| 3-mo | -10.59% |

| 6-mo | -16.48% |

| 1-year | -26.57% |

| 3-year | -97.06% |

| 5-year | -98.20% |

| YTD | -21.24% |

| 2023 | -29.56% |

| 2022 | -81.23% |

| 2021 | -72.14% |

| 2020 | -27.32% |

| 2019 | -55.66% |

Loading social stream, please wait...