United Community Banks, Inc. (UCBI): Price and Financial Metrics

UCBI Price/Volume Stats

| Current price | $31.51 | 52-week high | $31.96 |

| Prev. close | $31.18 | 52-week low | $21.63 |

| Day low | $31.30 | Volume | 663,500 |

| Day high | $31.96 | Avg. volume | 592,276 |

| 50-day MA | $26.27 | Dividend yield | 3.07% |

| 200-day MA | $26.19 | Market Cap | 3.75B |

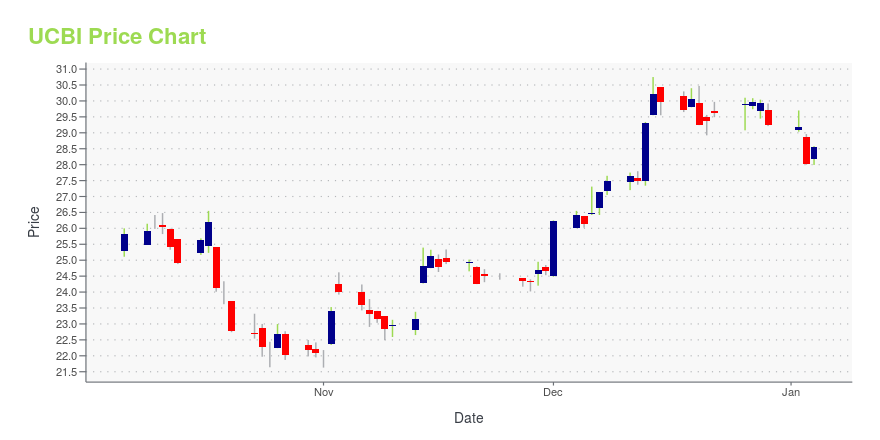

UCBI Stock Price Chart Interactive Chart >

United Community Banks, Inc. (UCBI) Company Bio

United Community Banks operates as the bank holding company for United Community Bank that provides retail and corporate banking services to individuals and businesses. The company has branches across Georgia, North Carolina, South Carolina, and Tennessee. The company was founded in 1950 and is based in Blairsville, Georgia.

Latest UCBI News From Around the Web

Below are the latest news stories about UNITED COMMUNITY BANKS INC that investors may wish to consider to help them evaluate UCBI as an investment opportunity.

United Community Banks, Inc. (NASDAQ:UCBI) Passed Our Checks, And It's About To Pay A US$0.23 DividendIt looks like United Community Banks, Inc. ( NASDAQ:UCBI ) is about to go ex-dividend in the next 4 days. The... |

United Community Banks, Inc. Names John James to Board of DirectorsUnited Community Banks, Inc. is pleased to announce the addition of industry veteran John James to its Board of Directors. James is an accomplished financial executive with more than 35 years of experience driving growth, increasing shareholder value, and optimizing organizational policy. |

United Community Banks, Inc. Announces Quarterly Cash Dividends on Common and Preferred StockGREENVILLE, S.C., Nov. 27, 2023 (GLOBE NEWSWIRE) -- United Community Banks, Inc. (NASDAQ: UCBI) (“United”), reported that its Board of Directors approved a quarterly cash dividend of $0.23 per share on the Company’s common stock. The dividend is payable January 5, 2024 to shareholders of record as of December 15, 2023. The Board of Directors also approved a quarterly cash dividend of $429.6875 per share (equivalent to $0.4296875 per depositary share or 1/1000th interest per share) on the Company |

United Community Earns 7th Consecutive Recognition as one of the Best Banks to Work ForUnited Community has once again been named one of the Best Banks to Work For in 2023 by American Banker and Best Companies Group. This recognition is based on employee satisfaction and signifies the bank's commitment to employee development and the fostering of a strong culture. This is the seventh consecutive year the bank has been selected for this list, which can be seen here. United is one of only three banks on the list with over $25 billion in assets. |

United Community Banks, Inc. (NASDAQ:UCBI) institutional owners may be pleased with recent gains after 35% loss over the past yearKey Insights Institutions' substantial holdings in United Community Banks implies that they have significant influence... |

UCBI Price Returns

| 1-mo | 26.70% |

| 3-mo | 22.42% |

| 6-mo | 12.29% |

| 1-year | 13.97% |

| 3-year | 19.51% |

| 5-year | 25.59% |

| YTD | 9.68% |

| 2023 | -10.44% |

| 2022 | -3.48% |

| 2021 | 29.42% |

| 2020 | -4.44% |

| 2019 | 47.41% |

UCBI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UCBI

Want to do more research on United Community Banks Inc's stock and its price? Try the links below:United Community Banks Inc (UCBI) Stock Price | Nasdaq

United Community Banks Inc (UCBI) Stock Quote, History and News - Yahoo Finance

United Community Banks Inc (UCBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...