United Insurance Holdings Corp. (UIHC): Price and Financial Metrics

UIHC Price/Volume Stats

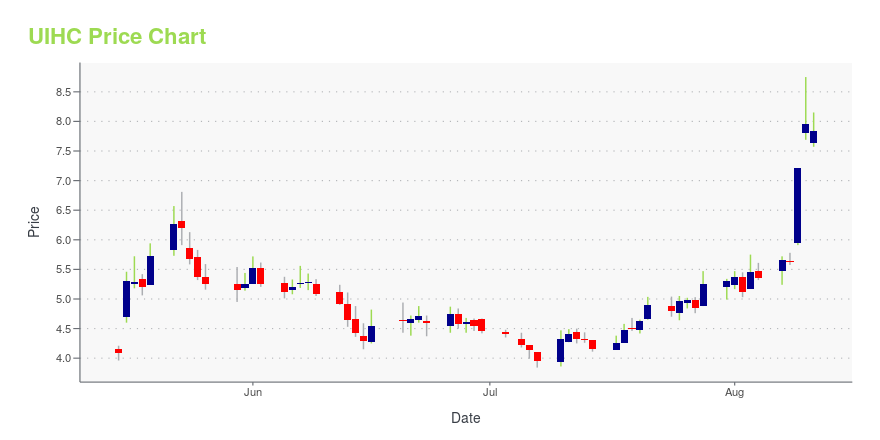

| Current price | $7.93 | 52-week high | $8.75 |

| Prev. close | $7.83 | 52-week low | $0.29 |

| Day low | $7.86 | Volume | 740,000 |

| Day high | $8.71 | Avg. volume | 494,462 |

| 50-day MA | $5.00 | Dividend yield | N/A |

| 200-day MA | $2.84 | Market Cap | 343.27M |

UIHC Stock Price Chart Interactive Chart >

United Insurance Holdings Corp. (UIHC) Company Bio

United Insurance Holdings Corporation writes and services residential property and casualty insurance policies using a network of independent agents and a group of wholly owned insurance subsidiaries. The company was founded in 1999 and is based in St. Petersburg, FL.

Latest UIHC News From Around the Web

Below are the latest news stories about AMERICAN COASTAL INSURANCE CORP that investors may wish to consider to help them evaluate UIHC as an investment opportunity.

United Insurance Holdings Corp. (NASDAQ:UIHC) Q2 2023 Earnings Call TranscriptUnited Insurance Holdings Corp. (NASDAQ:UIHC) Q2 2023 Earnings Call Transcript August 10, 2023 Operator: Hello, and welcome to the American Coastal Insurance Corporation Second Quarter 2023 Financial Results Conference Call and Webcast. [Operator Instructions]. As a reminder, this conference is being recorded. It’s now my pleasure to turn the call over to Karin Daly, Vice […] |

American Coastal Insurance Corporation Reports Financial Results for Its Second Quarter Ended June 30, 2023ST. PETERSBURG, Fla., August 10, 2023--American Coastal Insurance Corporation (Nasdaq: UIHC) ("ACIC" or "the Company"), a property and casualty insurance holding company, today reported its financial results for the second quarter ended June 30, 2023. On February 27, 2023, the Florida Department of Financial Services was appointed as receiver of the Company's former subsidiary, United Property & Casualty Insurance Company ("UPC"). As such, prior year financial results have been recast to reflect |

United Insurance Holdings Corp. (UIHC) Announces Name and Ticker Change to American Coastal Insurance Corporation (ACIC)ST. PETERSBURG, Fla., July 27, 2023--United Insurance Holdings Corp. (Nasdaq: UIHC), the insurance holding company of American Coastal Insurance Company ("AmCoastal"), announced today that it has changed its corporate name to ‘American Coastal Insurance Corporation’ ("the Company" "American Coastal" or "ACIC"). The Company will begin trading on NASDAQ under the ticker symbol ‘ACIC’, prior to market open on August 15, 2023. |

15 Best Places to Retire in Florida Without HurricanesIn this article, we will take a look at the 15 best places to retire in Florida without hurricanes. If you want to skip our detailed analysis of Florida’s insurance market and the best places without hurricanes, go to the 5 Best Places to Retire in Florida Without Hurricanes. Florida’s Insurance Market The insurance industry […] |

12 Best Multibagger Penny Stocks To BuyIn this article, we will take a look at the 12 best mulitbagger penny stocks to buy. To see more such companies, go directly to 5 Best Multibagger Penny Stocks To Buy. Apple Inc. (NASDAQ:AAPL). Amazon.com, Inc. (NASDAQ:AMZN). Microsoft Corporation (NASDAQ:MSFT). Alphabet Inc. (NASDAQ:GOOG). Meta Platforms, Inc. (NASDAQ:META). These are the stocks almost everybody talks […] |

UIHC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 63.84% |

| 3-year | 99.46% |

| 5-year | -22.33% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -75.13% |

| 2021 | -20.43% |

| 2020 | -53.07% |

| 2019 | -22.77% |

Continue Researching UIHC

Want to do more research on United Insurance Holdings Corp's stock and its price? Try the links below:United Insurance Holdings Corp (UIHC) Stock Price | Nasdaq

United Insurance Holdings Corp (UIHC) Stock Quote, History and News - Yahoo Finance

United Insurance Holdings Corp (UIHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...