United Microelectronics Corp. ADR (UMC): Price and Financial Metrics

UMC Price/Volume Stats

| Current price | $7.70 | 52-week high | $9.00 |

| Prev. close | $7.43 | 52-week low | $6.71 |

| Day low | $7.59 | Volume | 17,035,503 |

| Day high | $7.75 | Avg. volume | 8,599,191 |

| 50-day MA | $8.43 | Dividend yield | 4.59% |

| 200-day MA | $7.99 | Market Cap | 19.30B |

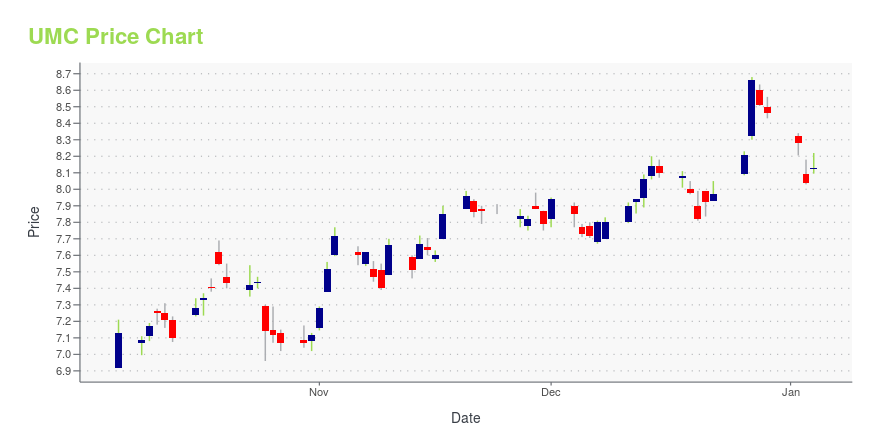

UMC Stock Price Chart Interactive Chart >

United Microelectronics Corp. ADR (UMC) Company Bio

United Microelectronics Corporation (UMC; Chinese: 聯華電子; pinyin: Liánhuá Diànzǐ) is a Taiwanese company based in Hsinchu, Taiwan. It was founded as Taiwan's first semiconductor company in 1980 as a spin-off of the government-sponsored Industrial Technology Research Institute (ITRI). (Source:Wikipedia)

Latest UMC News From Around the Web

Below are the latest news stories about UNITED MICROELECTRONICS CORP that investors may wish to consider to help them evaluate UMC as an investment opportunity.

7 Compelling Tech Stocks to Snag From the Discount BinYou don’t need to be a Wall Street expert to realize that innovators dominated the equities space in 2023. |

Chip Champions: 3 Semiconductor Stocks to Buy Before the Bull MarketExplore these semiconductor stocks offering unique investment opportunities amidst the semiconductor sector's resurgence. |

Got $1,000? 3 Ultra-High-Yield Dividend Stocks to Get Your Hands OnVerizon, UMC, and Altria are all good long-term income plays. |

Why These 3 Semiconductor Stocks Should Be on Your Radar in 2024The stock market has been performing well recently, with the S&P 500 rallying up over 4% in the last month. |

UMC Recognized for ESG Strength With DJSI World & Emerging Markets Index and MSCI-ESG AA RatingHSINCHU, Taiwan, December 11, 2023--United Microelectronics Corporation (NYSE: UMC; TWSE: 2303) ("UMC"), a leading global semiconductor wafer foundry, today announced its 16th consecutive year of being included in the Dow Jones Sustainability Indices (DJSI) and achieved the top ranking among its semiconductor foundry peers in the DJSI for multiple years, marking a significant benchmark for corporate sustainability performance. Meanwhile, UMC maintained its position as a constituent stock of the |

UMC Price Returns

| 1-mo | -8.49% |

| 3-mo | 3.03% |

| 6-mo | 2.37% |

| 1-year | 8.90% |

| 3-year | -8.22% |

| 5-year | 334.17% |

| YTD | -5.13% |

| 2023 | 36.75% |

| 2022 | -44.19% |

| 2021 | 42.07% |

| 2020 | 226.00% |

| 2019 | 54.08% |

UMC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UMC

Want to see what other sources are saying about United Microelectronics Corp's financials and stock price? Try the links below:United Microelectronics Corp (UMC) Stock Price | Nasdaq

United Microelectronics Corp (UMC) Stock Quote, History and News - Yahoo Finance

United Microelectronics Corp (UMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...