Vericel Corporation (VCEL): Price and Financial Metrics

VCEL Price/Volume Stats

| Current price | $52.32 | 52-week high | $54.08 |

| Prev. close | $51.70 | 52-week low | $30.18 |

| Day low | $51.39 | Volume | 252,400 |

| Day high | $52.90 | Avg. volume | 465,599 |

| 50-day MA | $47.38 | Dividend yield | N/A |

| 200-day MA | $42.85 | Market Cap | 2.54B |

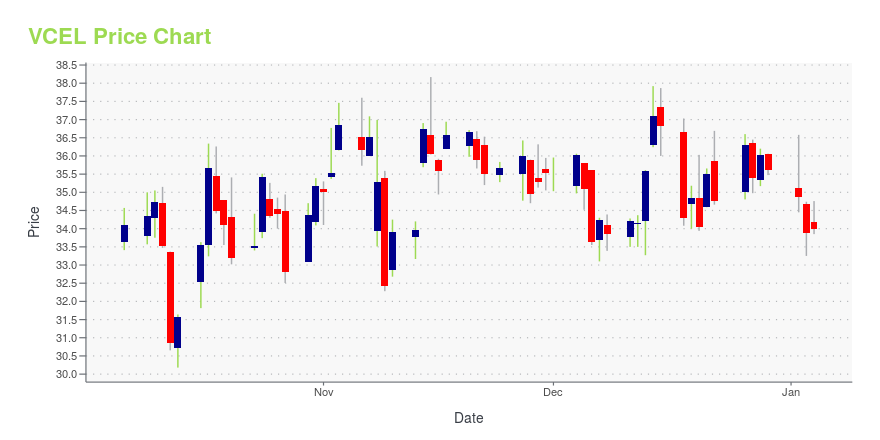

VCEL Stock Price Chart Interactive Chart >

Vericel Corporation (VCEL) Company Bio

Vericel Corporation focuses on developing patient-specific expanded cellular therapies for use in the treatment of patients with severe diseases and conditions. The company was founded in 1989 and is based in Cambridge, Massachusetts.

Latest VCEL News From Around the Web

Below are the latest news stories about VERICEL CORP that investors may wish to consider to help them evaluate VCEL as an investment opportunity.

The five-year returns have been solid for Vericel (NASDAQ:VCEL) shareholders despite underlying losses increasingThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company... |

Insider Sell: Director Paul Wotton Offloads 5,000 Shares of Vericel Corp (VCEL)Vericel Corp (NASDAQ:VCEL), a leader in the field of regenerative medicine, has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. |

Insider Sell: President and CEO Dominick Colangelo Sells 24,397 Shares of Vericel Corp (VCEL)Vericel Corp (NASDAQ:VCEL), a leader in the field of regenerative medicine, has recently witnessed a significant insider sell by its President and CEO, Dominick Colangelo. |

Insider Sell: COO Michael Halpin Sells 17,447 Shares of Vericel Corp (VCEL)Vericel Corp (NASDAQ:VCEL), a leader in the field of regenerative medicine, has recently witnessed a significant insider transaction. |

Insider Sell: Chief Medical Officer Jonathan Hopper Sells 5,000 Shares of Vericel Corp (VCEL)Vericel Corp (NASDAQ:VCEL), a leader in the field of regenerative medicine, has recently seen a significant insider transaction. |

VCEL Price Returns

| 1-mo | 14.34% |

| 3-mo | 13.62% |

| 6-mo | 22.82% |

| 1-year | 39.45% |

| 3-year | -1.86% |

| 5-year | 171.51% |

| YTD | 46.93% |

| 2023 | 35.19% |

| 2022 | -32.98% |

| 2021 | 27.27% |

| 2020 | 77.47% |

| 2019 | 0.00% |

Continue Researching VCEL

Here are a few links from around the web to help you further your research on Vericel Corp's stock as an investment opportunity:Vericel Corp (VCEL) Stock Price | Nasdaq

Vericel Corp (VCEL) Stock Quote, History and News - Yahoo Finance

Vericel Corp (VCEL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...