Virtu Financial, Inc. - (VIRT): Price and Financial Metrics

VIRT Price/Volume Stats

| Current price | $27.97 | 52-week high | $29.69 |

| Prev. close | $27.89 | 52-week low | $16.02 |

| Day low | $27.91 | Volume | 728,800 |

| Day high | $28.28 | Avg. volume | 1,309,564 |

| 50-day MA | $23.69 | Dividend yield | 3.38% |

| 200-day MA | $20.29 | Market Cap | 4.40B |

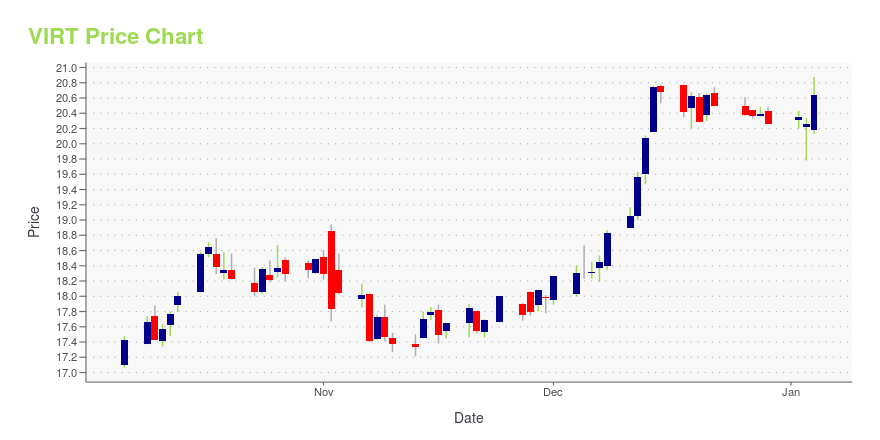

VIRT Stock Price Chart Interactive Chart >

Virtu Financial, Inc. - (VIRT) Company Bio

Virtu Financial, Inc. engages in the provision of market making and liquidity services. It operates through the following segments: Market Making, Execution Services and Corporate. The Market Making segment engages in buying and selling of securities and other financial instruments. The Execution Services segment agency offers trading venues that provide transparent trading in global equities, ETFs, and fixed income to institutions, banks and broker dealers. The Corporate segment consists of investments in strategic financial services-oriented opportunities and maintains corporate overhead expenses and all other income and expenses that are not attributable to the other segments. The company was founded by Vincent J. Viola and Douglas Cifu in 2008 and is headquartered in New York, NY.

Latest VIRT News From Around the Web

Below are the latest news stories about VIRTU FINANCIAL INC that investors may wish to consider to help them evaluate VIRT as an investment opportunity.

5 Investors Betting Big on Freight Technologies (FRGT) StockFRGT stock is registering unusual gains after the company announced that Amazon Mexico would continue to use its app. |

Strength Seen in Alerus (ALRS): Can Its 8.8% Jump Turn into More Strength?Alerus (ALRS) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Optimism for Virtu Financial (NASDAQ:VIRT) has grown this past week, despite five-year decline in earningsVirtu Financial, Inc. ( NASDAQ:VIRT ) shareholders should be happy to see the share price up 13% in the last month. But... |

Blue Owl Capital Corporation (OBDC) Up 4.3% Since Last Earnings Report: Can It Continue?Blue Owl Capital Corporation (OBDC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

5 Investors Betting Big on IceCure Medical (ICCM) StockInvestors in IceCure Medical and ICCM stock certainly have a big catalyst to price in today. |

VIRT Price Returns

| 1-mo | 21.29% |

| 3-mo | 28.36% |

| 6-mo | 66.33% |

| 1-year | 57.90% |

| 3-year | 24.41% |

| 5-year | 62.70% |

| YTD | 41.45% |

| 2023 | 4.62% |

| 2022 | -26.51% |

| 2021 | 18.58% |

| 2020 | 64.42% |

| 2019 | -34.86% |

VIRT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VIRT

Want to do more research on Virtu Financial Inc's stock and its price? Try the links below:Virtu Financial Inc (VIRT) Stock Price | Nasdaq

Virtu Financial Inc (VIRT) Stock Quote, History and News - Yahoo Finance

Virtu Financial Inc (VIRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...