VMware Inc. (VMW): Price and Financial Metrics

VMW Price/Volume Stats

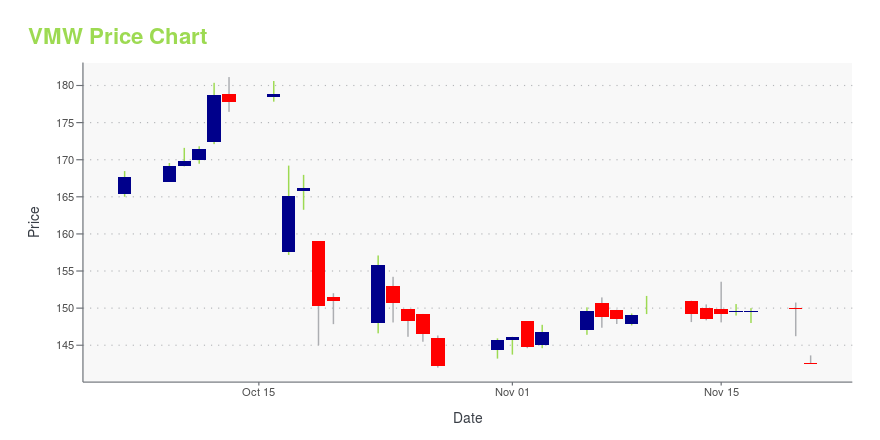

| Current price | $143.00 | 52-week high | $181.14 |

| Prev. close | $142.48 | 52-week low | $109.00 |

| Day low | $143.00 | Volume | 200 |

| Day high | $143.00 | Avg. volume | 1,569,096 |

| 50-day MA | $158.06 | Dividend yield | N/A |

| 200-day MA | $142.00 | Market Cap | 61.75B |

VMW Stock Price Chart Interactive Chart >

VMware Inc. (VMW) Company Bio

VMware, Inc. engages in the provision of cloud infrastructure and business mobility. Its products include Software-Defined Data Center, Hybrid Cloud Computing, and End-User Computing. It supports modernizing data centers, integrating public clouds, empowering digital workspaces and transforming security. The company was founded by Diane Greene, Mendel Rosenblum, Scott Devine, Edward Wang and Edouard Bugnion in 1998 and is headquartered in Palo Alto, CA.

Latest VMW News From Around the Web

Below are the latest news stories about VMWARE INC that investors may wish to consider to help them evaluate VMW as an investment opportunity.

Dual Delights: 3 Stocks Offering Robust Growth and Attractive DividendsDividend growth stocks offer high yields and significant stock appreciation. |

VMware Stockholders Hope Biden-Xi Meeting Brings Closure to Broadcom MergerShareholders are hoping that the meeting between President Biden and Chinese President Xi Jinping at the APEC summit in San Francisco this week may provide the spark to prompt China to approve Broadcom’s merger deal with VMware. There is a lot at stake from both a financial and strategic perspective, particularly for VMware investors. Broadcom’s merger with VMware (ticker: VMW), announced in May 2022, is one of the largest technology deals ever and the value of the transaction has surged with Broadcom stock (AVGO). |

VMware Investors in Limbo as Broadcom Merger Awaits Chinese ApprovalShareholders are hoping that the meeting between President Biden and Chinese President Xi Jinping at the APEC summit in San Francisco this week may provide the spark to prompt China to approve Broadcom’s merger deal with VMware. |

Broadcom Stock Set a Record HighShares of Broadcom logged a record high Friday. The stock rose some 5% to more than $957, rising for a tenth day in 11 sessions. It needed to close above $922.89, according to Dow Jones Market Data, to mark its first record close since August. |

Q4 2023 Cabot Corp Earnings CallQ4 2023 Cabot Corp Earnings Call |

VMW Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -9.57% |

| 3-year | -8.91% |

| 5-year | -19.80% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 5.94% |

| 2021 | -17.38% |

| 2020 | -7.60% |

| 2019 | 10.69% |

Continue Researching VMW

Want to see what other sources are saying about Vmware Inc's financials and stock price? Try the links below:Vmware Inc (VMW) Stock Price | Nasdaq

Vmware Inc (VMW) Stock Quote, History and News - Yahoo Finance

Vmware Inc (VMW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...