Venator Materials PLC Ordinary Shares (VNTR): Price and Financial Metrics

VNTR Price/Volume Stats

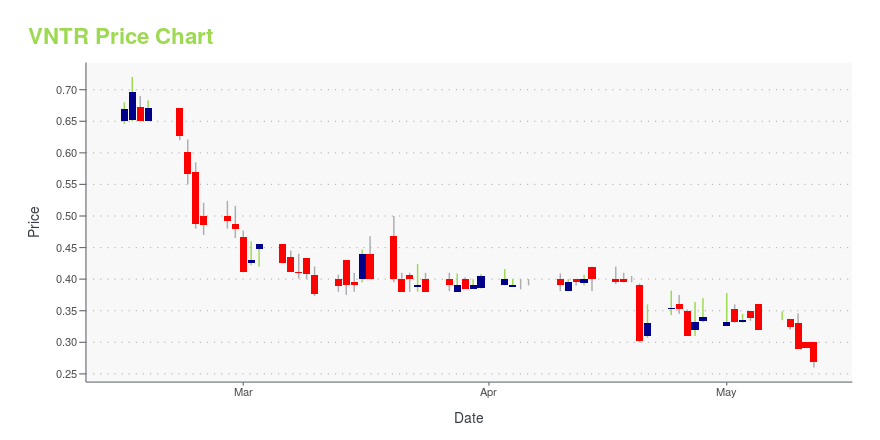

| Current price | $0.27 | 52-week high | $2.78 |

| Prev. close | $0.29 | 52-week low | $0.26 |

| Day low | $0.26 | Volume | 504,300 |

| Day high | $0.30 | Avg. volume | 280,884 |

| 50-day MA | $0.37 | Dividend yield | N/A |

| 200-day MA | $0.81 | Market Cap | 28.75M |

VNTR Stock Price Chart Interactive Chart >

Venator Materials PLC Ordinary Shares (VNTR) Company Bio

Venator Materials LLC manufactures and markets chemical products worldwide. It operates through two segments, Titanium Dioxide and Performance Additives. The company offers titanium dioxide for use in coatings, plastics, paper, printing inks, fibers, and food and personal care products, as well as catalysts and pharmaceuticals. It also provides functional additives, including zinc and barium functional additives used in coatings, plastics, and pharmaceuticals; color pigments, such as iron oxide color pigments, natural and synthetic inorganic pigments, and metal carboxylate driers for construction, coating, plastics, and specialty markets; wood protection chemicals for use in residential and commercial applications; and water treatment chemicals, which are used to enhance water purity in industrial, commercial, and municipal applications, as well as in paper industry. Venator Materials LLC was formerly known as Venator Materials Corporation. The company was founded in 2016 and is based in The Woodlands, Texas. Venator Materials LLC operates as a subsidiary of Huntsman International LLC.

Latest VNTR News From Around the Web

Below are the latest news stories about VENATOR MATERIALS PLC that investors may wish to consider to help them evaluate VNTR as an investment opportunity.

Venator Completes Divestiture of Iron Oxide BusinessVenator Materials PLC ("Venator") (NYSE: VNTR) announced today that it has completed the sale of its Iron Oxide business to Cathay Industries. The enterprise value of the transaction was $140 million and Venator expects to receive cash proceeds of approximately $130 million net of working capital adjustments, taxes, fees and other closing cash adjustments. Venator expects an approximate $50 million reduction of its ABL facility resulting in a net liquidity improvement of approximately $80 millio |

Venator Files Annual Report on Form 20-FVenator Materials PLC ("Venator") (NYSE: VNTR) has filed its annual report on Form 20-F for the year ended December 31, 2022, with the U.S. Securities and Exchange Commission. The 2022 Form 20-F is available on Venator's website at https://www.venatorcorp.com/investor-relations and on the website of the U.S. Securities and Exchange Commission at www.sec.gov. |

Venator Announces Fourth Quarter and Full-Year 2022 Results, Strategic Review Underway Against Challenging Macroeconomic BackdropFourth Quarter 2022 and Other Highlights |

Venator to Discuss Fourth Quarter and Full Year 2022 Results on February 21, 2023Venator Materials PLC (NYSE: VNTR) ("Venator") will hold a conference call to discuss its fourth quarter and full year 2022 financial results on Tuesday, February 21, 2023, at 08:00 a.m. ET. Results will be released to the public before the market opens that day via PR Newswire. |

Venator Strategic Review Update, Appointment of Advisors, Two New Independent Directors and Chairman, Engagement with StakeholdersVenator Materials PLC ("Venator") (NYSE: VNTR) today provides a fourth quarter business update and announces the appointment of Moelis & Company and Kirkland & Ellis, in addition to business and operational advisor Alvarez & Marsal to assist with strategic review and engagement with stakeholders. Venator additionally announces the appointment of new independent directors, Stefan M. Selig and Jame Donath, who bring extensive experience to the role including in finance, investment and regulatory a |

VNTR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -91.74% |

| 5-year | -93.41% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -78.74% |

| 2021 | -23.26% |

| 2020 | -13.58% |

| 2019 | -8.59% |

Continue Researching VNTR

Want to do more research on Venator Materials PLC's stock and its price? Try the links below:Venator Materials PLC (VNTR) Stock Price | Nasdaq

Venator Materials PLC (VNTR) Stock Quote, History and News - Yahoo Finance

Venator Materials PLC (VNTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...