Western Midstream Partners L.P. (WES): Price and Financial Metrics

WES Price/Volume Stats

| Current price | $39.81 | 52-week high | $42.80 |

| Prev. close | $39.96 | 52-week low | $25.69 |

| Day low | $39.44 | Volume | 1,292,946 |

| Day high | $40.58 | Avg. volume | 1,184,806 |

| 50-day MA | $39.30 | Dividend yield | 8.32% |

| 200-day MA | $32.97 | Market Cap | 15.15B |

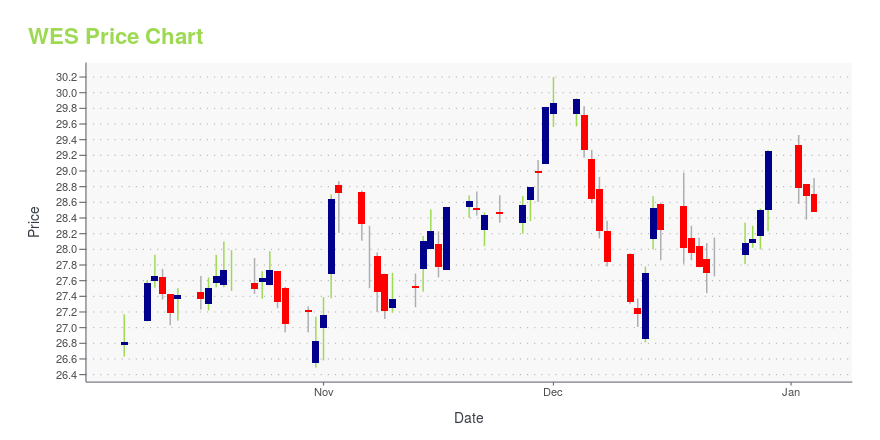

WES Stock Price Chart Interactive Chart >

Western Midstream Partners L.P. (WES) Company Bio

Western Midstream Partners LP owns, operates, acquires and develops midstream energy assets. It engages in the business of gathering, processing, compressing, treating, and transporting natural gas, condensate, natural gas liquids, and crude oil for Anadarko, as well as third-party producers and customers. The company was founded in 2007 and is headquartered in The Woodlands, TX.

Latest WES News From Around the Web

Below are the latest news stories about WESTERN MIDSTREAM PARTNERS LP that investors may wish to consider to help them evaluate WES as an investment opportunity.

Western Midstream (WES) Upgraded to Strong Buy: What Does It Mean for the Stock?Western Midstream (WES) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy). |

Best Income Stocks to Buy for December 14thWES made it to the Zacks Rank #1 (Strong Buy) income stocks list on December 144, 2023. |

Power Surge: 3 Dividend Energy Stocks Fueling Up for a Bullish RunEnergy stocks often offer dividends, are popular in retirement portfolios, and offer an excellent hedge against a downturn. |

Western Midstream Announces Third-Quarter Post-Earnings Interview With Chief Financial Officer, Kristen Shults and VP, Corporate Development, Jon Greenberg and Participation in Upcoming Investor ConferencesHOUSTON, November 06, 2023--Today Western Midstream Partners, LP (NYSE: WES) ("WES" or the "Partnership") announced that tomorrow before the market open it will make available on its website at www.westernmidstream.com a post-earnings interview with Kristen Shults, Senior Vice President and Chief Financial Officer, and Jon Greenberg, Vice President, Corporate Development, to provide additional insights related to third quarter 2023 results. |

Western Midstream Announces Third-Quarter 2023 ResultsHOUSTON, November 01, 2023--Today Western Midstream Partners, LP (NYSE: WES) ("WES" or the "Partnership") announced third-quarter 2023 financial and operating results. Net income (loss) attributable to limited partners for the third quarter of 2023 totaled $270.8 million, or $0.70 per common unit (diluted), with third-quarter 2023 Adjusted EBITDA(1) totaling $510.9 million. Third-quarter 2023 Cash flows provided by operating activities totaled $394.8 million, and third-quarter 2023 Free cash flo |

WES Price Returns

| 1-mo | 1.04% |

| 3-mo | 13.75% |

| 6-mo | 41.50% |

| 1-year | 54.34% |

| 3-year | 154.43% |

| 5-year | 108.39% |

| YTD | 42.18% |

| 2023 | 19.46% |

| 2022 | 29.29% |

| 2021 | 72.31% |

| 2020 | -19.13% |

| 2019 | -22.65% |

WES Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WES

Here are a few links from around the web to help you further your research on Western Midstream Partners LP's stock as an investment opportunity:Western Midstream Partners LP (WES) Stock Price | Nasdaq

Western Midstream Partners LP (WES) Stock Quote, History and News - Yahoo Finance

Western Midstream Partners LP (WES) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...