Whirlpool Corp. (WHR): Price and Financial Metrics

WHR Price/Volume Stats

| Current price | $99.53 | 52-week high | $148.50 |

| Prev. close | $101.57 | 52-week low | $84.18 |

| Day low | $99.14 | Volume | 1,072,848 |

| Day high | $102.71 | Avg. volume | 1,388,512 |

| 50-day MA | $96.10 | Dividend yield | 6.91% |

| 200-day MA | $107.49 | Market Cap | 5.44B |

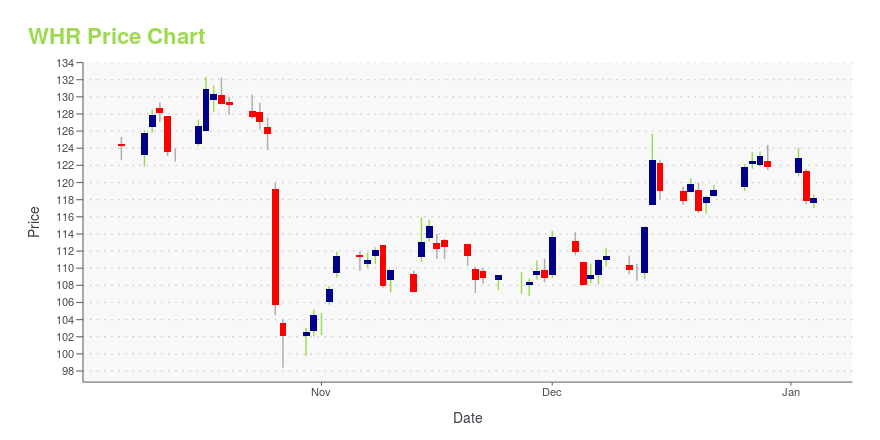

WHR Stock Price Chart Interactive Chart >

Whirlpool Corp. (WHR) Company Bio

The Whirlpool Corporation is an American multinational manufacturer and marketer of home appliances, headquartered in Benton Charter Township, Michigan, United States.[2] The Fortune 500 company has annual revenue of approximately $21 billion, 78,000 employees, and more than 70 manufacturing and technology research centers around the world. (Source:Wikipedia)

Latest WHR News From Around the Web

Below are the latest news stories about WHIRLPOOL CORP that investors may wish to consider to help them evaluate WHR as an investment opportunity.

3 No-Brainer Dividend Stocks to Buy in 2024Start the new year right with these balanced buys. |

Jim Cramer Says Recession Is Not Coming and Recommends These 11 StocksIn this article, we will take a detailed look at the Jim Cramer Says Recession Is Not Coming and Recommends These 11 Stocks. For a quick overview of such stocks, read our article Jim Cramer Says Recession Is Not Coming and Recommends These 5 Stocks. On December 14, an enthusiastic Jim Cramer announced on his program on CNBC that the […] |

Whirlpool (WHR) Gains from Effective Cost-Reduction EffortsWhirlpool's (WHR) strategic cost reductions and supply-chain improvements in Q3 led to significant market share gains and a $300-million cost benefit, positioning it strongly for growth. |

Celebrating the Brilliant Minds Behind Innovation at Whirlpool CorporationNORTHAMPTON, MA / ACCESSWIRE / December 14, 2023 / At our Patent Awards, we proudly honor 362 inventors from across the globe who have brought a total of 403 patents and 6 trade secrets to life in the past year. Their creativity, dedication, and ingenuity ... |

Whirlpool Corporation Named to 2023 Dow Jones Sustainability World Index for Second Consecutive YearWhirlpool Corporation (NYSE: WHR) announced today that it has been named to the 2023 Dow Jones Sustainability World Index (DJSI) in recognition of the company's dedication to responsible and ethical business practices. This marks the second consecutive year Whirlpool Corp. has been named to the World Index. The company is also on the North America Index for the 17th year. |

WHR Price Returns

| 1-mo | -2.34% |

| 3-mo | 7.19% |

| 6-mo | -11.11% |

| 1-year | -25.21% |

| 3-year | -47.64% |

| 5-year | -17.87% |

| YTD | -15.35% |

| 2023 | -9.09% |

| 2022 | -37.16% |

| 2021 | 33.26% |

| 2020 | 26.52% |

| 2019 | 42.83% |

WHR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WHR

Want to do more research on Whirlpool Corp's stock and its price? Try the links below:Whirlpool Corp (WHR) Stock Price | Nasdaq

Whirlpool Corp (WHR) Stock Quote, History and News - Yahoo Finance

Whirlpool Corp (WHR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...