Weis Markets, Inc. (WMK): Price and Financial Metrics

WMK Price/Volume Stats

| Current price | $74.92 | 52-week high | $75.26 |

| Prev. close | $74.36 | 52-week low | $58.87 |

| Day low | $73.92 | Volume | 73,652 |

| Day high | $75.26 | Avg. volume | 95,191 |

| 50-day MA | $65.60 | Dividend yield | 1.88% |

| 200-day MA | $63.74 | Market Cap | 2.02B |

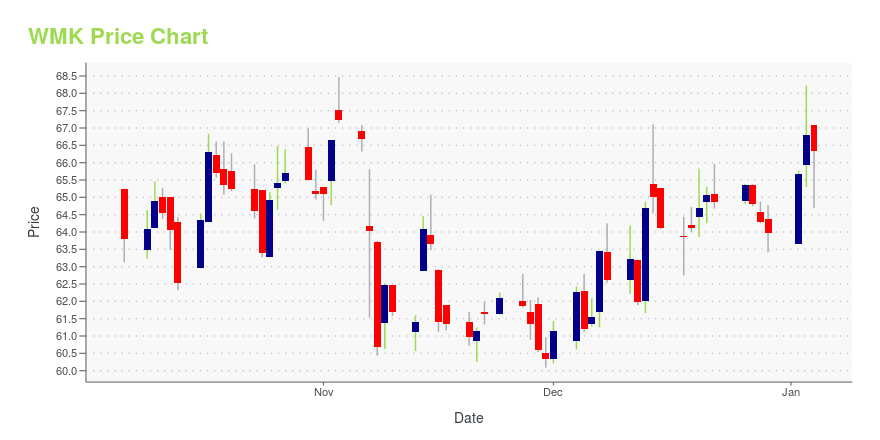

WMK Stock Price Chart Interactive Chart >

Weis Markets, Inc. (WMK) Company Bio

Weis Markets operates grocery stores in the northeast and mid-atlantic region of the U.S. The company was founded in 1912 and is based in Sunbury, Pennsylvania.

Latest WMK News From Around the Web

Below are the latest news stories about WEIS MARKETS INC that investors may wish to consider to help them evaluate WMK as an investment opportunity.

Weis Markets, Inc. (NYSE:WMK) has caught the attention of institutional investors who hold a sizeable 40% stakeKey Insights Institutions' substantial holdings in Weis Markets implies that they have significant influence over the... |

Pardon the Disruption: Can Amazon be a grocer and a 3P delivery provider?The tech giant has signed some key grocery chains to its digital marketplace recently, helping it reach more households even as it retools its Amazon Fresh stores and online platform. |

Lead Investigation of Fruit Pouches Expands to Cinnamon ShipmentsThe Food and Drug Administration said it is screening cinnamon shipments from several countries as part of its investigation of illnesses potentially linked to pouches of cinnamon-flavored applesauce. The federal agency said this week it believes the cinnamon used in these products could be the source of lead contamination. There have been 34 reports of lead-related illnesses potentially tied to the recalled products. |

Amazon links with Weis Markets for its first loyalty program integrationThe e-commerce giant also expanded same-day delivery availability with the regional grocer. |

Returns On Capital At Weis Markets (NYSE:WMK) Have StalledIf we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'd... |

WMK Price Returns

| 1-mo | 19.72% |

| 3-mo | 18.30% |

| 6-mo | 23.20% |

| 1-year | 16.02% |

| 3-year | 50.03% |

| 5-year | 126.75% |

| YTD | 18.40% |

| 2023 | -20.81% |

| 2022 | 27.10% |

| 2021 | 40.93% |

| 2020 | 21.27% |

| 2019 | -12.73% |

WMK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WMK

Here are a few links from around the web to help you further your research on Weis Markets Inc's stock as an investment opportunity:Weis Markets Inc (WMK) Stock Price | Nasdaq

Weis Markets Inc (WMK) Stock Quote, History and News - Yahoo Finance

Weis Markets Inc (WMK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...