WPP PLC ADR (WPP): Price and Financial Metrics

WPP Price/Volume Stats

| Current price | $48.17 | 52-week high | $55.55 |

| Prev. close | $47.39 | 52-week low | $41.13 |

| Day low | $47.76 | Volume | 114,400 |

| Day high | $48.31 | Avg. volume | 167,190 |

| 50-day MA | $49.09 | Dividend yield | 6.38% |

| 200-day MA | $47.33 | Market Cap | 10.39B |

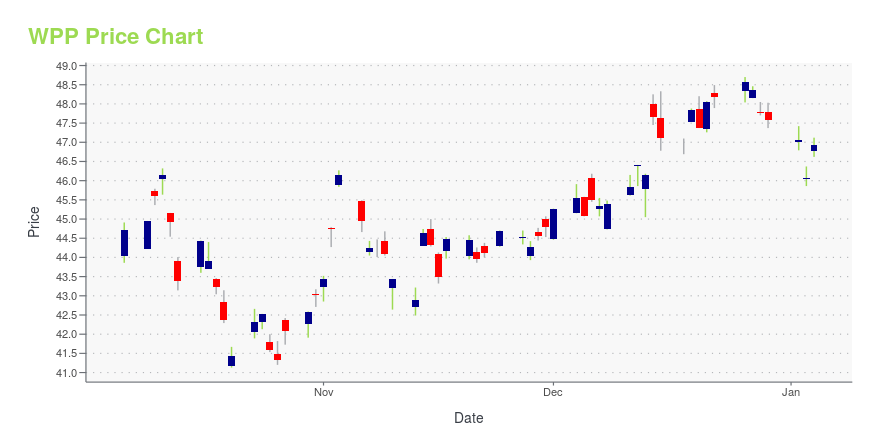

WPP Stock Price Chart Interactive Chart >

WPP PLC ADR (WPP) Company Bio

WPP plc is a British multinational communications, advertising, public relations, technology, and commerce holding company headquartered in London, England. It was the world's largest advertising company, as of 2019. WPP plc owns many companies, which includes advertising, public relations, media, and market research networks such as AKQA, BCW, CMI Media Group, Essence Global, Finsbury, Grey, Hill+Knowlton Strategies, Mindshare, Ogilvy, Wavemaker, Wunderman Thompson, and VMLY&R. It is one of the "Big Four" agency companies, alongside Publicis, Interpublic Group of Companies, and Omnicom.[5] WPP has a primary listing on the London Stock Exchange, and is a constituent of the FTSE 100 Index. (Source:Wikipedia)

Latest WPP News From Around the Web

Below are the latest news stories about WPP PLC that investors may wish to consider to help them evaluate WPP as an investment opportunity.

WPP plc (LON:WPP) is favoured by institutional owners who hold 61% of the companyKey Insights Significantly high institutional ownership implies WPP's stock price is sensitive to their trading actions... |

Global Advertising Growth Is Expected to Slow in 2024, Excluding Elections SpendingWorldwide ad spending excluding U.S. political campaigns will reach $936 billion next year, GroupM said in a new forecast. |

Is WPP plc (LON:WPP) A High Quality Stock To Own?Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is... |

Jon Iwata, 35-Year IBM Veteran and Founding Executive Director of Yale School of Management's Data & Trust Alliance, to be Awarded the Harold Burson Award at PRSA-NY 2023 Big Apple AwardsThe New York Chapter of the Public Relations Society of America (PRSA-NY) has announced that Jon Iwata, IBM marketing and communications veteran and founding executive director of the Yale School of Management Data & Trust Alliance, is the 2023 recipient of the Harold Burson Award, sponsored by BCW. Iwata will receive the honor at the 2023 Big Apple Awards gala at Tao Downtown in New York City on November 15. |

17 Largest Media Companies in the World in 2023In this article, we will be taking a look at the 17 largest media companies in the world in 2023. If you are not interested in reading the details on global media landscape, head straight to the 5 Largest Media Companies In The World In 2023. In 2023, the global media landscape continues to evolve […] |

WPP Price Returns

| 1-mo | 2.93% |

| 3-mo | -2.50% |

| 6-mo | -0.57% |

| 1-year | -7.05% |

| 3-year | -15.24% |

| 5-year | 3.15% |

| YTD | 4.41% |

| 2023 | 1.58% |

| 2022 | -32.09% |

| 2021 | 43.48% |

| 2020 | -17.25% |

| 2019 | 36.33% |

WPP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WPP

Want to do more research on WPP plc's stock and its price? Try the links below:WPP plc (WPP) Stock Price | Nasdaq

WPP plc (WPP) Stock Quote, History and News - Yahoo Finance

WPP plc (WPP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...