Xerox Holdings Corp. (XRX): Price and Financial Metrics

XRX Price/Volume Stats

| Current price | $5.56 | 52-week high | $12.28 |

| Prev. close | $5.70 | 52-week low | $3.44 |

| Day low | $5.55 | Volume | 465,979 |

| Day high | $5.74 | Avg. volume | 3,937,298 |

| 50-day MA | $5.19 | Dividend yield | 1.75% |

| 200-day MA | $7.35 | Market Cap | 699.39M |

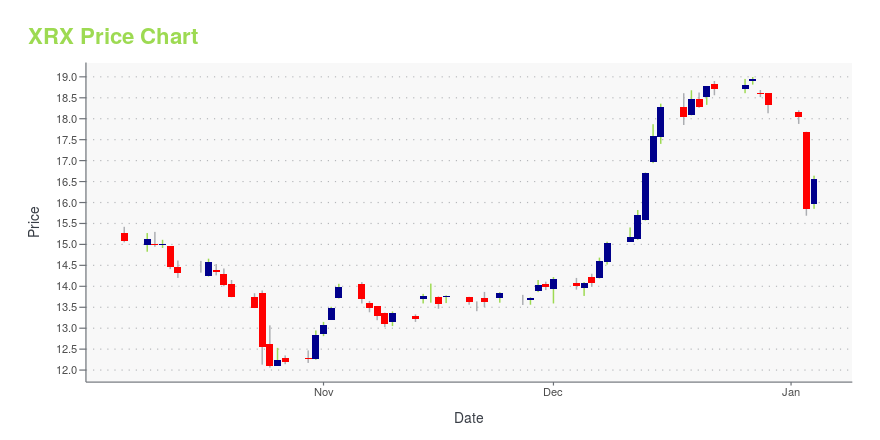

XRX Stock Price Chart Interactive Chart >

Xerox Holdings Corp. (XRX) Company Bio

Xerox Holdings Corp. provides printing equipment and supplies. The company is engaged in the designing, development, and sale of document management systems and solutions. It generates its revenue from the sale of equipment. Xerox has operations in 160 countries around the world and has filed over 18,000 patents for the company’s products and services. The company’s products and services include home and office printers and printer suppliers and business solutions that includes 3D printing and IT services. The company is headquartered in Norwalk, Connecticut and has over 24,000 employees around the world. John Vestin serves as Xerox’s Vice Chairman and Chief Executive Officer.

XRX Price Returns

| 1-mo | 8.90% |

| 3-mo | 53.47% |

| 6-mo | -35.81% |

| 1-year | -46.65% |

| 3-year | -52.05% |

| 5-year | -50.77% |

| YTD | -32.08% |

| 2024 | -49.82% |

| 2023 | 33.82% |

| 2022 | -31.32% |

| 2021 | 1.98% |

| 2020 | -33.61% |

XRX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching XRX

Here are a few links from around the web to help you further your research on Xerox Holdings Corp's stock as an investment opportunity:Xerox Holdings Corp (XRX) Stock Price | Nasdaq

Xerox Holdings Corp (XRX) Stock Quote, History and News - Yahoo Finance

Xerox Holdings Corp (XRX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...