Dillard's, Inc. (DDS): Price and Financial Metrics

DDS Price/Volume Stats

| Current price | $445.43 | 52-week high | $476.48 |

| Prev. close | $449.27 | 52-week low | $272.58 |

| Day low | $435.79 | Volume | 76,900 |

| Day high | $446.89 | Avg. volume | 93,286 |

| 50-day MA | $426.93 | Dividend yield | 0.24% |

| 200-day MA | $366.48 | Market Cap | 7.23B |

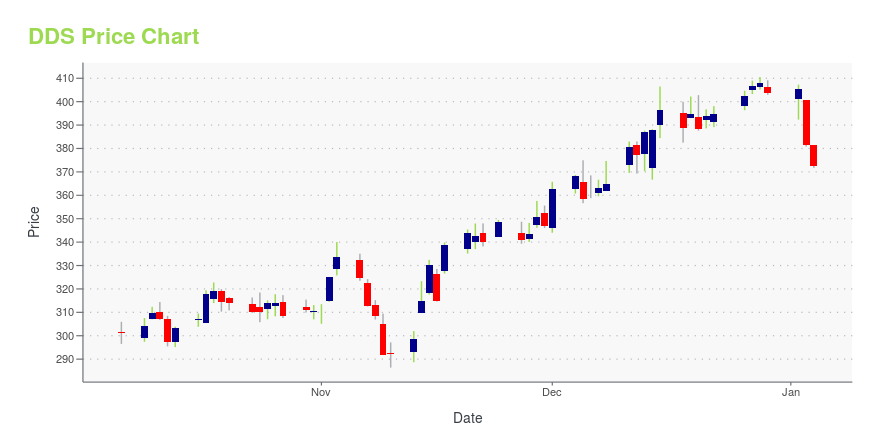

DDS Stock Price Chart Interactive Chart >

Dillard's, Inc. (DDS) Company Bio

Dillard's Inc. operates as a fashion apparel, cosmetics, and home furnishing retailer in the United States. The company was founded in 1938 and is based in Little Rock, Arkansas.

Latest DDS News From Around the Web

Below are the latest news stories about DILLARD'S INC that investors may wish to consider to help them evaluate DDS as an investment opportunity.

Are Investors Undervaluing Dillard's, Inc. (NYSE:DDS) By 47%?Key Insights Dillard's' estimated fair value is US$744 based on 2 Stage Free Cash Flow to Equity Current share price of... |

A Gold Mine on 34th Street?Buying Macy's because of its buyout offer could be rewarding. But there's a better buy out there. |

Dillard's, Inc. (NYSE:DDS) Passed Our Checks, And It's About To Pay A US$20.00 DividendIt looks like Dillard's, Inc. ( NYSE:DDS ) is about to go ex-dividend in the next four days. The ex-dividend date... |

5 Stocks in Focus on Their Recent Dividend HikeFive stocks to watch with recent dividend hikes are: DDS, CDW, TAC, TTE, CHDN. |

Dillard's, Inc.'s (NYSE:DDS) Stock's On An Uptrend: Are Strong Financials Guiding The Market?Most readers would already be aware that Dillard's' (NYSE:DDS) stock increased significantly by 16% over the past week... |

DDS Price Returns

| 1-mo | -2.76% |

| 3-mo | 10.51% |

| 6-mo | 52.41% |

| 1-year | 58.21% |

| 3-year | 408.53% |

| 5-year | 636.26% |

| YTD | 10.41% |

| 2023 | 32.05% |

| 2022 | 38.66% |

| 2021 | 290.27% |

| 2020 | -12.71% |

| 2019 | 22.76% |

DDS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DDS

Want to see what other sources are saying about Dillard'S Inc's financials and stock price? Try the links below:Dillard'S Inc (DDS) Stock Price | Nasdaq

Dillard'S Inc (DDS) Stock Quote, History and News - Yahoo Finance

Dillard'S Inc (DDS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...