EQT Corporation (EQT): Price and Financial Metrics

EQT Price/Volume Stats

| Current price | $34.31 | 52-week high | $45.23 |

| Prev. close | $34.38 | 52-week low | $32.07 |

| Day low | $33.67 | Volume | 7,690,882 |

| Day high | $34.60 | Avg. volume | 7,141,376 |

| 50-day MA | $38.47 | Dividend yield | 1.8% |

| 200-day MA | $38.23 | Market Cap | 15.15B |

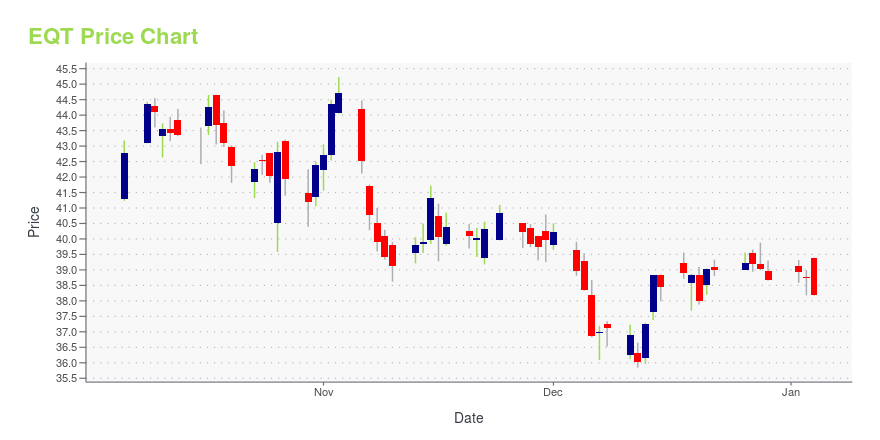

EQT Stock Price Chart Interactive Chart >

EQT Corporation (EQT) Company Bio

EQT Corporation explores for, as well as develops and produces natural gas, natural gas liquids, and crude oil. The company also provides natural gas gathering, transmission, and storage services for the companys produced gas, as well as for independent third parties. The company was founded in 1925 and is based in Pittsburgh, Pennsylvania.

Latest EQT News From Around the Web

Below are the latest news stories about EQT CORP that investors may wish to consider to help them evaluate EQT as an investment opportunity.

3 Energy Stocks You’ll Regret Not Buying SoonDiscover 2024's top energy stocks: Exxon Mobil, Chevron, EQT. |

EQT Corporation (NYSE:EQT) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?With its stock down 4.0% over the past month, it is easy to disregard EQT (NYSE:EQT). But if you pay close attention... |

Xometry and Lazydays Holdings have been highlighted as Zacks Bull and Bear of the DayXometry and Lazydays Holdings are part of the Zacks Bull and Bear of the Day article. |

EQT Corp (EQT) to Divest Minority Stake in Marcellus Gas WellsEQT Corp (EQT) intends to divest stakes in assets located throughout Northeast Pennsylvania, generating 700 million cubic feet per day in current production. |

Three Drivers of Negative Sentiment in Natural Gas Right NowForecasts for milder weather during the holiday season, record gas output, and fears of a global economic slowdown in 2024 keep natural gas prices suppressed. |

EQT Price Returns

| 1-mo | -9.14% |

| 3-mo | -15.19% |

| 6-mo | -3.57% |

| 1-year | -15.86% |

| 3-year | 75.95% |

| 5-year | 152.59% |

| YTD | -10.50% |

| 2023 | 16.20% |

| 2022 | 57.64% |

| 2021 | 71.60% |

| 2020 | 17.27% |

| 2019 | -41.82% |

EQT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EQT

Want to see what other sources are saying about EQT Corp's financials and stock price? Try the links below:EQT Corp (EQT) Stock Price | Nasdaq

EQT Corp (EQT) Stock Quote, History and News - Yahoo Finance

EQT Corp (EQT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...