Shopify Inc. Cl A (SHOP): Price and Financial Metrics

SHOP Price/Volume Stats

| Current price | $59.94 | 52-week high | $91.57 |

| Prev. close | $59.44 | 52-week low | $45.50 |

| Day low | $59.81 | Volume | 5,256,400 |

| Day high | $61.52 | Avg. volume | 10,005,154 |

| 50-day MA | $62.76 | Dividend yield | N/A |

| 200-day MA | $69.64 | Market Cap | 77.24B |

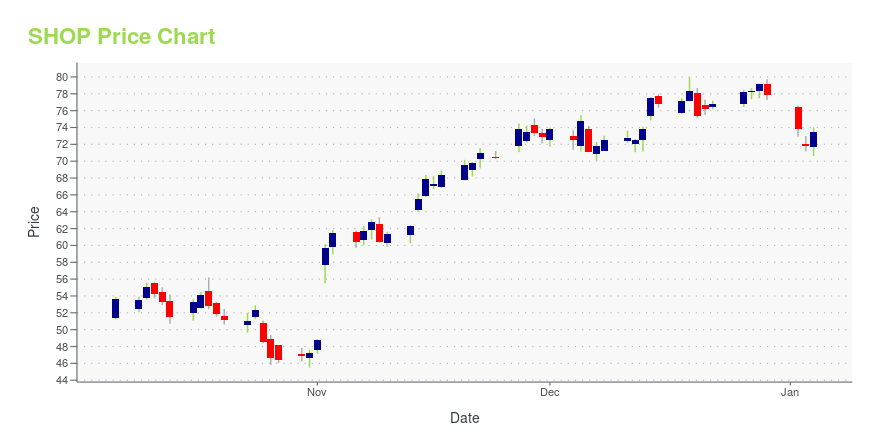

SHOP Stock Price Chart Interactive Chart >

Shopify Inc. Cl A (SHOP) Company Bio

Shopify Inc. allows Merchants to use its software to design, set up and manage their stores across multiple sales channels, including web, mobile, social media, brick-and-mortar locations, and pop-up shops. The company was founded in 2004 and is based in Ottawa, Canada.

Latest SHOP News From Around the Web

Below are the latest news stories about SHOPIFY INC that investors may wish to consider to help them evaluate SHOP as an investment opportunity.

3 Growth Stocks Set to Outperform the Nasdaq in 2024As we transition into a new year, investors cannot ignore these three growth stocks to outperform the Nasdaq in 2024! |

Canadian Tech Stocks Powered by Shopify Zoom Past Nasdaq 100(Bloomberg) -- The US technology sector was hot in 2023, Canada’s was hotter. Most Read from BloombergThe Late-Night Email to Tim Cook That Set the Apple Watch Saga in MotionChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerBridgewater CEO’s Past Office Romance Led to Favoritism ClaimsL’Oreal Heir Francoise Bettencourt Meyers Becomes First Woman With $100 Billion FortuneXiaomi Unveils Its First EV, With Ambition to Be China’s Porsche or TeslaAn investor frenzy for artificial intel |

5 Stocks to Hold for the Next 20 YearsBuying and holding for the long term is a lot easier when you own great companies. |

Investors Heavily Search Shopify Inc. (SHOP): Here is What You Need to KnowShopify (SHOP) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock. |

Etsy Is Slashing Costs Like Shopify Did. Time to Buy the Stock?Management is pivoting toward efficiency as sales growth slows. |

SHOP Price Returns

| 1-mo | -8.42% |

| 3-mo | -15.97% |

| 6-mo | -26.50% |

| 1-year | -6.29% |

| 3-year | -61.46% |

| 5-year | 78.11% |

| YTD | -23.06% |

| 2023 | 124.43% |

| 2022 | -74.80% |

| 2021 | 21.68% |

| 2020 | 184.71% |

| 2019 | 187.17% |

Continue Researching SHOP

Here are a few links from around the web to help you further your research on Shopify Inc's stock as an investment opportunity:Shopify Inc (SHOP) Stock Price | Nasdaq

Shopify Inc (SHOP) Stock Quote, History and News - Yahoo Finance

Shopify Inc (SHOP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...