One of the most popular options strategies is the covered call, or buy-write, in which one owns underlying stock and sells a call. It’s a bullish position which generates income through a premium collection. Many investors and money managers consider it a very conservative approach and employ it in their retirement accounts.

But suggest selling a put, and those same people will respond, “that’s too risky, I’d never sell a naked put!”

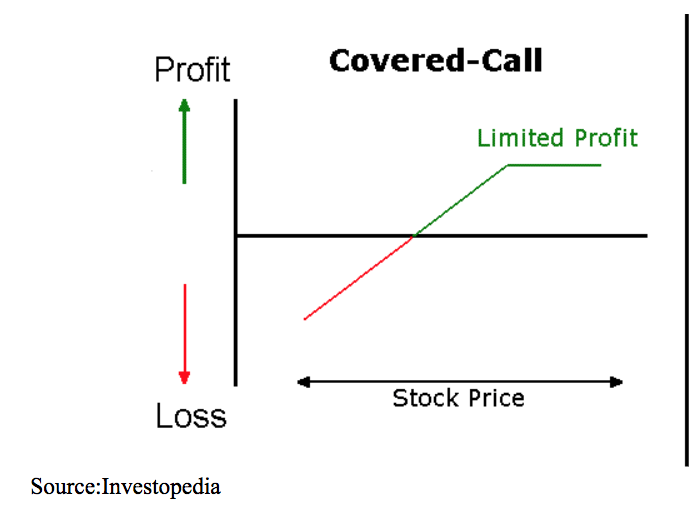

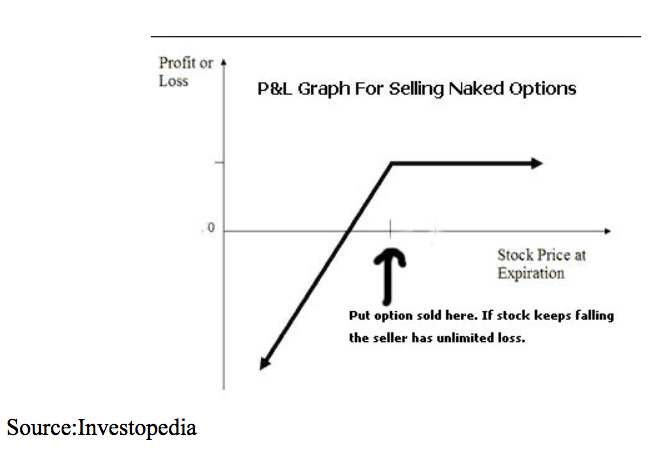

Here’s the thing: The risk/reward profile of a covered call and selling a put (one that is cash secured) are exactly the same. A profit that is capped and a loss could be large should shares decline sharply. Here’s the risk graph for each.

Knowing the risk/reward, similarities and differences, between options strategies is crucial to success. It not only helps you pick the strategy that best aligns with your thesis and risk threshold, but can also provide flexibility in how you approach a position.

Here, Mike Wolfinger drills down into Option Equivalent Positions

One of the interesting features about options is that there is a relationship between calls, puts, and the underlying stock. And because of that relationship, some option positions are equivalent – meaning identical profit/loss profiles – to others.

Why is that important? You will discover that some option combinations – called spreads – are easier, or less costly to trade than others. Even with today’s low commissions, why spend more than you must?

The basic equation that describes an underlying and its options is: Owning one call option and selling one put option (with the same strike price and expiration date) is the equivalent to owning 100 shares of stock.

S = C – P; where S = stock; C = call; P = put

If you want simple proof that the above equation is true, consider a position that is long one call and short one put. When expiration arrives, if the call option is in the money, you exercise the call and own 100 shares. If the put option is in the money, you are assigned an exercise notice and buy 100 shares of stock. In either case, you own stock.

Beware, if the stock is at the money when expiration arrives, you are in a quandary. You don’t know if the put owner is going to exercise and therefore, you don’t know whether to exercise the call. If you want to maintain the long stock position, the simplest way out is to buy the put, paying $0.05, or less, and exercise the call.

Example of equivalent positions

There is one equivalent position that you, the options rookie, should know because these are strategies you are likely to adopt.

As shown above, writing a covered call is equivalent to selling a naked put. This is not a big deal to anyone who is an experienced options trader. But to a newcomer to the world of options, this can be a real eye-opener.

The more you trade options, you will become more aware of other equivalent positions. You may even decide to play with the equation yourself and discover others.

If you are new to the world of options, today’s discussion may appear to be a bit confusing. But, if you go slowly and re-read the linked posts, you’ll understand the discussion.

If you’ve been trading options for a while and never bothered to learn about equivalent positions, this post contains information that can make your trading more efficient.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!