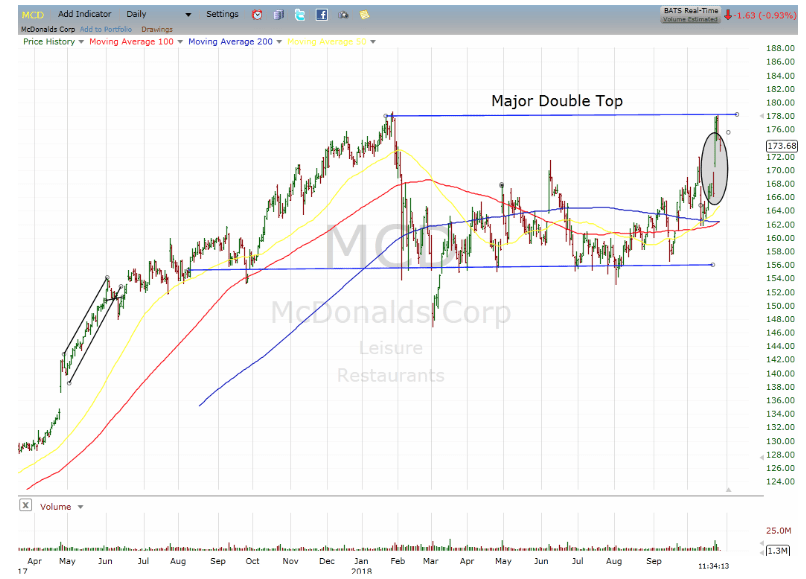

Over the past few weeks — even as the broader market has a meltdown — McDonald’s (MCD) has been hot, hitting a new 52-high, following last week’s solid earnings report. But, there may be trouble cooking behind the counter.

You can see shares of MCD were rising through most of October, despite overall market weakness and then surged to new highs following its October 23 earnings report.

But from a technical standpoint, the chart has now made a major double top — as it failed to take out the high above the $180 level.

Source: FreeStockChart.com

But what caused bigger and longer-term problems are growing tensions between MCD corporation management, which ultimately answers to shareholders, and the franchisees who own and operate the individual restaurants. They are responsible for their own bottom line profitability.

In 2015 when Steve Easterbrook took the helm and President and CEO of MCD, he initiated many transformational plans. One of which was to “refranchise” the stores.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!