The growth of mobile payments is well documented and the choice of platforms for both users and investors is large. But, there’s a pair of Brazilian-based companies that present a largely untapped market.

Overall mobile payments, in which everything from credit cards firms like Visa (V), to pure digital wallets like Apple (AAPL) Pay, to merchant-oriented platforms like Square (SQ), have been growing by some 30% per year and are expected to maintain that rate over the next decade.

But, some areas are growing faster than others. Emerging economies have been growing at nearly double the rate of developed thanks to several key factors; emerging economies have a large unbanked population, as banking services are either not available or unaffordable, and in many regions the adoption or reliance of smartphones is a fundamental necessity for communication and transactions.

Mobile payments fulfill the demand for cheaper, faster, and convenient services, traditional payment service providers, such as banks and credit card companies, are facing major challenges. Traditionally, to accept credit cards, businesses needed the assistance of banks or landline telephone. Mobile payment systems have done away with this requirement, making them ideal for mobile market vendors. Furthermore, unlike banks’ credit cards, mobile payment does not have to ensure a fixed volume of transactions to qualify for an account, making it ideal for small businesses.

My belief is that Brazil presents the greatest opportunity in this sector. The fact that current growth rate of mobile payments are below many markets such as China and India should be viewed as a positive. It’s now just entering the acceleration or ‘curve in the hockey stick’ phase of adoption and penetration.

Brazil is a geographically vast country, of continental proportions, composed of more than 5,500 cities and 200 million people to date. Its populations skews young with an average age of just 34.

According to Neoway, there are currently approximately 9 million small and medium businesses (SMBs) in Brazil that are trying to grow their businesses in the context of a high-cost banking environment and the infrastructure challenges that such a vast geography imposes.

Overall, Brazil less penetrated and has greater growth upside than more mature economies. According to the World Bank and ABECS, electronic payments volume represented 28.4% of total household consumption in Brazil in 2016. This penetration percentage is lower than comparable measures of 46.0% and 68.6%, respectively in the United States and the United Kingdom.

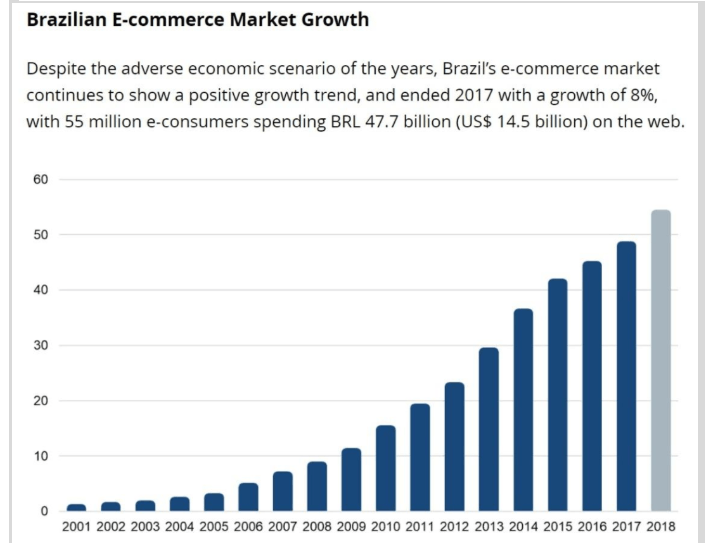

The growth rate for e-commerce is a relatively slow 8% — peer to peer payments are growing by some 18% annually. But this just highlights the opportunity.

Two companies positioned to benefit from the expected growth in mobile payments are StoneCo (STNE) and PagSeguro (PAGS)

StoneCo is a leading provider of financial technology solutions that empower merchants and integrated partners to conduct electronic commerce seamlessly across in-store, online, and mobile channels in Brazil.

Its platform allows its clients who use StoneCo’s technology to get paid quickly and easily. They also provide digital product enhancements such as split-payment processing, multi-payment processing, recurring payments for subscriptions, and one-click buy functionality for its clients.

Its focus is on merchants who have larger businesses and it has a large support staff of sales and customer service personnel in order to provide a customer-oriented business model.

By contrast, PagSeguro is focused in on the micro business and the consumer side of the equation. Its platform day to day financial needs, including receiving and spending funds.

Both companies had initial public offerings within the past year—Stone can boast Warren Buffet’s Berkshire as a recent investor—and carry very lofty valuation. But I think they both will prove to be good long term investments.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!