Visa Inc. CI A (V): Price and Financial Metrics

V Price/Volume Stats

| Current price | $286.85 | 52-week high | $293.07 |

| Prev. close | $290.62 | 52-week low | $228.03 |

| Day low | $286.33 | Volume | 6,313,100 |

| Day high | $290.44 | Avg. volume | 7,113,824 |

| 50-day MA | $277.12 | Dividend yield | 0.72% |

| 200-day MA | $274.21 | Market Cap | 524.63B |

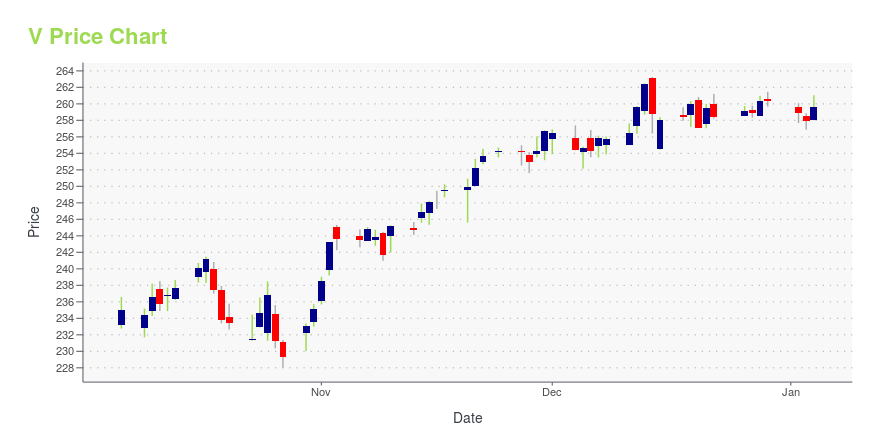

V Stock Price Chart Interactive Chart >

Visa Inc. CI A (V) Company Bio

Visa Inc. stylized as VISA) is an American multinational financial services corporation headquartered in Foster City, California, United States. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies. (Source:Wikipedia)

V Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

V Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching V

Want to do more research on Visa Inc's stock and its price? Try the links below:Visa Inc (V) Stock Price | Nasdaq

Visa Inc (V) Stock Quote, History and News - Yahoo Finance

Visa Inc (V) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...