- Multi-year highs in soybeans, corn, and wheat

- Higher gasoline supports rising ethanol prices

- ADM will benefit from higher agricultural commodity prices

- BG is a play on the agricultural sector and Brazil

- ADM and BG pay investors while they wait for capital appreciation- Both stocks are inflation plays

Bill Gates, Microsoft’s (MSFT) founder and one of the world’s wealthiest people, is the largest private farmland owner in the United States. The investment is looking pretty smart these days as agricultural commodity prices are at over six-year highs.

The ABCDs of agricultural companies are the leading agribusinesses. Cargill and Louis Dreyfus are privately held firms. Archer Daniels Midland (ADM - Get Rating) and Bunge Limited (BG - Get Rating) trade on the stock market. Rising soybean, corn, and wheat prices make ADM and BG growth stocks as we head into the 2021 crop year starting with the planting season this month.

ADM is trading near its all-time high, and BG shares have been moving steadily higher over the past months. Meanwhile, both companies have room to move higher if the bull market in agricultural commodities continues.

Multi-year highs in soybeans, corn, and wheat

As we head into the 2021 crop year in the US and northern hemisphere, oilseed and grain prices remain near multi-year highs.

Source: CQG

Source: CQG

The monthly chart shows that while nearby soybean futures pulled back from over the $14.55 level, at $14.3325 at the end of last week, the price was at the highest level since 2014. Before late 2020, beans had not been in the teens in over six years.

Source: CQG

Source: CQG

At the $5.8675 level, nearby corn futures are at the highest price since July 2013. Corn recently traded to a peak at $6.0150 per bushel and was not far from that level on April 16.

Source: CQG

Source: CQG

Before October 2020, CBOT soft red winter wheat futures had not traded above the $6 per bushel level since July 2015. In January, the nearby contract reached a high of $6.93, the highest since May 2014, and was at the $6.53 level last Friday.

In mid-April 2021, the oilseed and grain futures markets are now in the planting season at the start of the crop year. The weather over the coming weeks and months is the most significant factor for prices as it will determine the size of this year’s crops. Each year the worldwide population rises. With more mouths to feed, production must keep pace with the ever-rising demand for the agricultural products that are primary ingredients in foods.

Higher gasoline supports rising ethanol prices

In the US, corn is the primary ingredient in ethanol, a biofuel. The ethanol mandate requires a blend of gasoline and biofuel. Higher corn prices are pushing ethanol higher, and so are rising gasoline prices.

Source: CQG

Source: CQG

The weekly chart highlights the ascent of gasoline prices from a low of 37.6 cents in March 2020 to a high of $2.17 per gallon wholesale in mid-March 2021. At just below the $2.04 level, a bullish trend in gasoline reflects the rising demand for the fuel and ethanol. Source: CQG

Ethanol prices rose from 79.9 cents last March to a high of $2.01 per gallon wholesale as of the end of last week.

In Brazil, sugarcane is the primary ingredient in ethanol production.

Source: CQG

Source: CQG

The chart shows that nearby sugar futures prices rose from 9.05 cents in April 2020 to a high of 18.94 cents in late February. At the 16.64 cents per pound level at the end of last week, the sweet commodity and ingredient in Brazilian ethanol production was closer to the high than the low over the past year. At nearly 19 cents, sugar rose to its highest price since March 2017. At $2.01, ethanol was at its most expensive level since late 2014.

Companies that process agricultural commodities and offer a wide range of services to the sector are experiencing a bumper year as prices move higher.

ADM will benefit from higher agricultural commodity prices

ADM procures, transports, stores, processes, and merchandises agricultural commodities, products, and ingredients in the US and worldwide. ADM has been in business since 1902. Aside from its substantial business line in the agricultural sector, it also provides futures commission merchant and insurance services to market participants. Higher grain, oilseed, and biofuel prices are bullish for ADM’s profits.

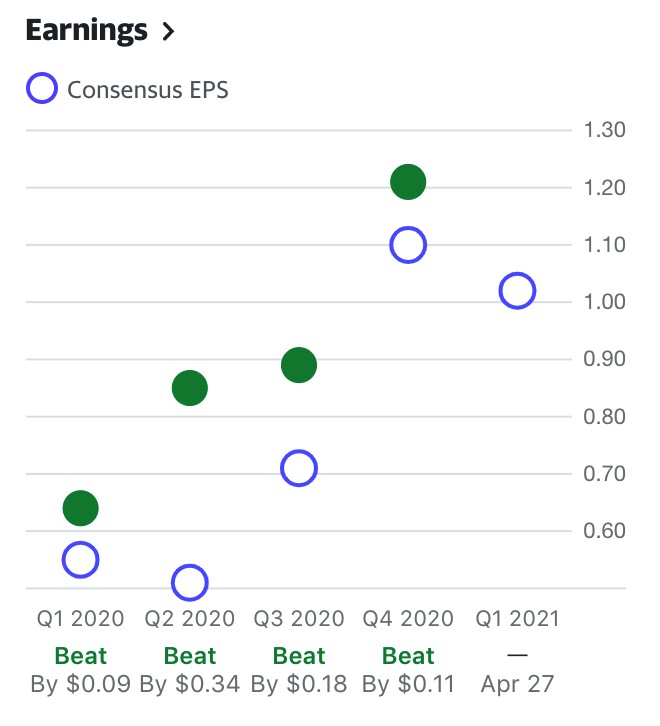

Source: Yahoo Finance

Source: Yahoo Finance

ADM earned profits over the past four consecutive quarters, consistently beating analysts’ estimates. The company will report Q1 EPS on April 27, with average forecasts of $1.04 per share.

Source: Barchart

Source: Barchart

At $59.45 per share at the end of last week, ADM was just below the recent all-time peak of $59.58. the stock more than doubled from its March 2020 $28.92 low. ADM has a $32.8 billion market cap. An average of over 2.40 million ADM shares changes hands each day.

BG is a play on the agricultural sector and Brazil

BG is another leading agricultural business worldwide. BG has been around since 1818, with its headquarters now in St. Louis, Missouri. Bunge has a substantial footprint in Brazil, where the company processes sugarcane into ethanol. Brazil is a leading biofuel producer and consumer.

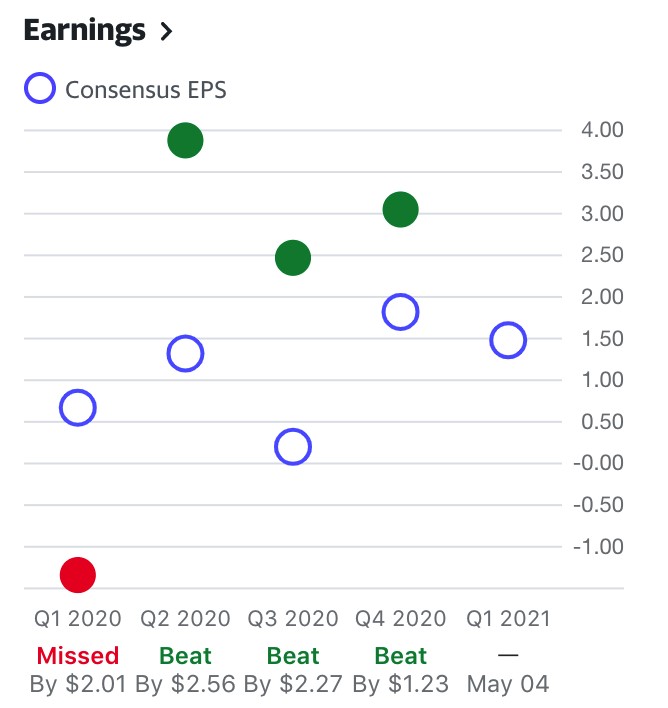

Source: Yahoo Finance

Source: Yahoo Finance

The chart highlights BG beat analysts’ EPS forecasts over the past three consecutive quarters where it posted a profit. BG missed estimates and reported a loss in Q1 2020. The average EPS estimate for Q1 2021 is $1.48. BG will release its earnings on May 4.

Source: Barchart

Source: Barchart

The chart shows that BG shares more than doubled from the March 2020 $29 low and were at the $83.62 level at the end of last week. The most recent high of $83.72 was closing in on the 2017 $83.75 peak. Above the 2017 high, the upside targets are at $92.17, the 2014 peak and $135 per share, the record 2008 high for BG shares.

BG’s market cap stands at $11.34 billion at the $83.62 per share level and trades an average of 990,855 shares each day. Since BG has exposure in Brazil, the weak Brazilian real has weighed on the shares. BG shares peaked in 2008 when the exchange rate between the Brazilian real and US dollar was at a high. A rebound in the Brazilian currency would likely support BG shares.

ADM and BG pay investors while they wait for capital appreciation- Both stocks are inflation plays

A bull market in agricultural commodity prices supports rising earnings for ADM and BG. The trend is always your best friend in markets. In the agricultural sector, the path of least resistance of prices remains higher as we head into the 2021 crop year.

ADM and BG are companies that pay shareholders attractive dividends while they wait for capital appreciation. At $83.62 per share, BG pays $2.00, translating to a 2.4% dividend yield. At $59.45, ADM’s yield is 2.49% with its $1.48 dividend. ADM and BG are agricultural companies that should experience rising earnings and share prices in an inflationary environment. The companies that feed the world remain growth stocks in April 2021.

Want More Great Investing Ideas?

ADM shares were trading at $59.53 per share on Monday morning, up $0.08 (+0.13%). Year-to-date, ADM has gained 18.92%, versus a 11.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ADM | Get Rating | Get Rating | Get Rating |

| BG | Get Rating | Get Rating | Get Rating |