- Europe continues to experience pandemic problems

- Crude oil hits a wall of selling on March 18

- BP is a leading European energy producer with upside potential

- TOT has room to move higher

- Crude oil will continue to power the world for the foreseeable future- BP and TOT are attractive on dips

After rallying from late October through early March, energy stocks got a little overheated with the price of the energy commodity and corrected. The crude oil futures market hit a high on March 8 when nearby NYMEX crude oil hit $67.98, its highest level since October 2018. Brent futures peaked at $71.36, 63 cents lower than the January 2020 high. Meanwhile, energy-related stocks, which have lagged the stock and oil markets since 2018, rose to a peak on March 11. The S&P 500 Energy Sector SPDR reached $54.37, the highest level since immediately before the COVID-19 pandemic created carnage in crude oil, stocks, and markets across all asset classes.

After falling to a low of $22.88 in mid-March 2020, the XLE, which holds shares in many of the leading U.S. energy and crude oil-related companies, made a comeback, achieving higher lows and higher highs on March 11, 2021, when it returned to the pre-pandemic level and ran out of upside steam. Only time will tell if higher lows and higher highs are on the horizon.

Meanwhile, European oil companies have followed the same path over the past year. And we think British Petroleum (BP - Get Rating) and the French oil company, Total SA (TOT - Get Rating), could be worth serious consideration on the most recent dip in the energy sector. Both companies’ shares could have lots of room for appreciation over the coming months once the correction ends.

Europe continues to experience pandemic problems

The global pandemic had a devasting impact on the crude oil market in 2020. On April 20, nearby NYMEX crude oil futures fell below zero for the first time since trading began in the early 1980s. NYMEX WTI crude oil is landlocked. Because there was nowhere left to store crude oil in a glut, owners of expiring nearby futures contracts had to sell at any price, pushing the futures below negative $40 per barrel. Brent futures fell to $16, the lowest price of this century. Brent, which is a seaborne crude oil, had tanker availability for storage, sparing it the same fate as the WTI crude oil.

Prices fell last year at this time as demand evaporated. This year, the prospects for crude oil demand have completed a one-hundred-and-eighty-degree turn. Vaccines that are slowly creating herd immunity to the virus have created a light at the end of a long and dark tunnel.

The U.S. is well on its way to vaccinating its population. Three vaccines have already been injected into the arms of more than 89.5 million people, or more than one-quarter of the population. In Europe, the process is taking a lot longer. However, over the coming weeks and months, more people worldwide will receive protection from COVID-19, lifting the fears around the virus and easing social distancing and other coronavirus-related restrictions.

The crude oil price has come a long way since April 2020. However, in early March, it rose to a level where it ran out of upside steam.

Crude oil hits a wall of selling on March 18

OPEC+’s decision to keep production quotas steady and an attack by Iranian-backed rebels on Saudi petroleum infrastructure pushed NYMEX futures to their most recent high of $67.98 on March 8. Brent futures reached a peak at $71.36 per barrel on the same day.

Source: CQG

The chart shows that crude oil ran out of buying at the March 8 high.

After trading between $63.10 $66.44 until March 15, the nearby NYMEX contract took an elevator ride lower on March 18 and March 23 as the price fell to $57.25 on the nearby contract. Meanwhile, the total number of open long and short positions in the crude oil futures arena declined with the price. Lower open interest when the price is falling is not typically a technical validation of an emerging bearish trend in a futures market.

Crude oil-related stocks peaked after the oil futures price. The S&P 500 Energy Sector SPDR (XLE) hit its high on March 11.

Source: Barchart

As the chart illustrates, the XLE peaked at $54.37 on March 11 and fell to a low of $47.26 on March 23, a decline of over 13%, as the price action in crude oil weighed on the companies that produce, refine, and provide services for the energy commodity.

Two European crude oil-producing companies have outperformed the XLE since the energy commodity’s price turned lower. BP and TOT are the UK and French oil companies that could have lots of upside potential if the oil price finds a bottom and resumes its upward price action.

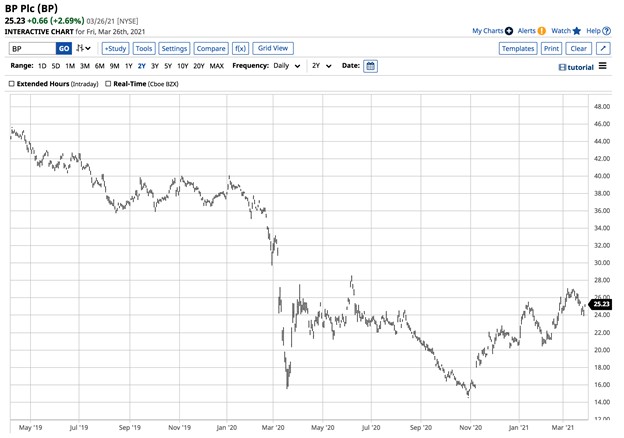

BP is a leading European energy producer with upside potential

British Petroleum PLC (BP) is one of the world’s leading energy companies. The company operates through three segments: Upstream, Downstream, and Rosneft. The Upstream segment extracts oil and gas from the earth worldwide. It operates all the infrastructure necessary to produce fossil fuels. The Downstream segment refines, manufactures, transports, supplies, and trades energy commodities. The Rosneft segment explores and produces hydrocarbons and owns and operates 13 refineries in Russia and 3,000 retail service stations in Russia and worldwide.

At $25.23 per share, BP has just above an $85.28 billion market cap. The company trades an average of over 13.7 million shares each day. BP pays shareholders a $1.24 dividend, translating to a 4.9% yield on the shares.

As U.S. energy policy slowly ushers in a greener path, OPEC and Russia’s role is rising. BP’s joint venture with Rosneft will allow the company to benefit from increased Russian influence and control of the global oil market.

Source: Barchart

After falling to a low of $14.74 in October 2020, BP shares recovered to a high of $27.10 on March 5.

Selling in the oil market sent the shares 6.9% lower to $25.23 at the end of last week as BP marginally outperformed the XLE, which holds a portfolio of U.S. oil-related companies. BP reported a profit in three of the past four quarters, with the only loss coming in Q2 2020 as the pandemic devastated the oil patch. A survey of 12 analysts on Yahoo Finance found an average price target of $29.23 per share for BP, with forecasts ranging from $20.80 to $38.

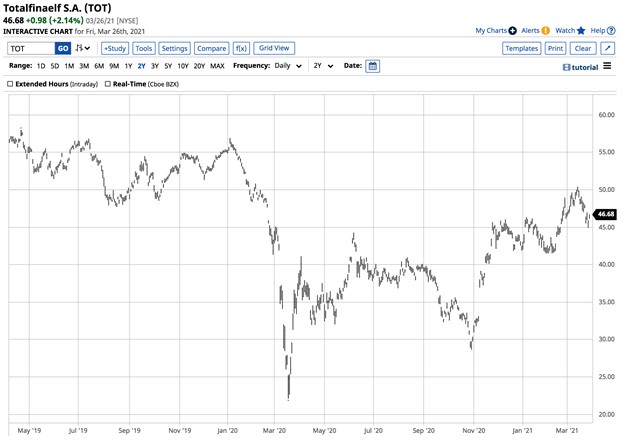

TOT has room to move higher

Total SE (TOT) is the French oil integrated oil and gas company with worldwide interests. TOT operates in four segments, Exploration and Production, Integrated Gas, Renewables and Power, Refining and Chemicals, and Marketing and Services.

At $46.68 per share, TOT’s market cap is just below the $123.84 billion level. Nearly 2.375 million shares changed hands on average each day. TOT pays shareholders a $2.27 dividend. The stock yields 4.86%.

Source: Barchart

TOT shares fell to a low of $22.13 in March 2020 and a higher low of $28.65 in late October. Since then, TOT rallied to a high of $50.41 on March 12. At the $46.68 level at the end of last week, the stock was 7.40% below its most recent high. TOT kept pace with BP and the XLE over the past weeks.

Meanwhile, TOT has reported profits over the past four consecutive quarters. A survey of eight analysts on Yahoo Finance found an average price target of $54.38, with forecasts ranging from $48 to $62 per share. TOT was trading below the low end of the range at the end of last week.

Crude oil will continue to power the world for the foreseeable future––BP and TOT are attractive on dips

The U.S. energy policy shift will not cause a significant short-term decline in demand for petroleum and gas. BP and TOT are leading European producers who stand to profit at oil prices over the $50 per barrel level.

BP and TOT offer shareholders attractive dividends and upside potential for capital growth.

I would be a buyer of BP and TOT on a scaled-down basis during the current period of price weakness in the crude oil market and correction in oil and gas-related stocks. The pace of vaccinations in Europe should increase over the coming weeks and months. Energy demand in 2021 will be far greater than in 2020. BP and TOT offer value after the latest selloffs. While lower prices are possible, they would create even more compelling value for investors. The dividends result in a bonus for those waiting for capital appreciation.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Why Are Stocks Struggling with 4,000?

BP shares were unchanged in after-hours trading Monday. Year-to-date, BP has gained 24.34%, versus a 6.20% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BP | Get Rating | Get Rating | Get Rating |

| TOT | Get Rating | Get Rating | Get Rating |