Apparel retailer Burlington Stores, Inc. (BURL - Get Rating) posted robust results for the fiscal third quarter (ended October 28) yesterday, which led to a 20.7% intraday increase in its stock price. Its total revenue increased 12.2% year-over-year to $2.29 billion. Its adjusted net income and adjusted EPS came in at $63.83 million and $0.98, up 127.8% and 127.9% from the prior-year quarter, respectively.

However, amid broader weakness in recent retail earnings, the company seems to have taken a cautious stance regarding its outlook. For fiscal 2023, the company expects its total sales to increase by approximately 11% and comparable store sales by about 3%, more or less aligned with its last quarter’s outlook.

Given this backdrop, let’s look at the trends of BURL’s key financial metrics to understand why it could be wise to watch and wait for a better entry point in the stock.

Analyzing Burlington Stores, Inc.’s Financial Growth and Fluctuations from 2021 to 2023

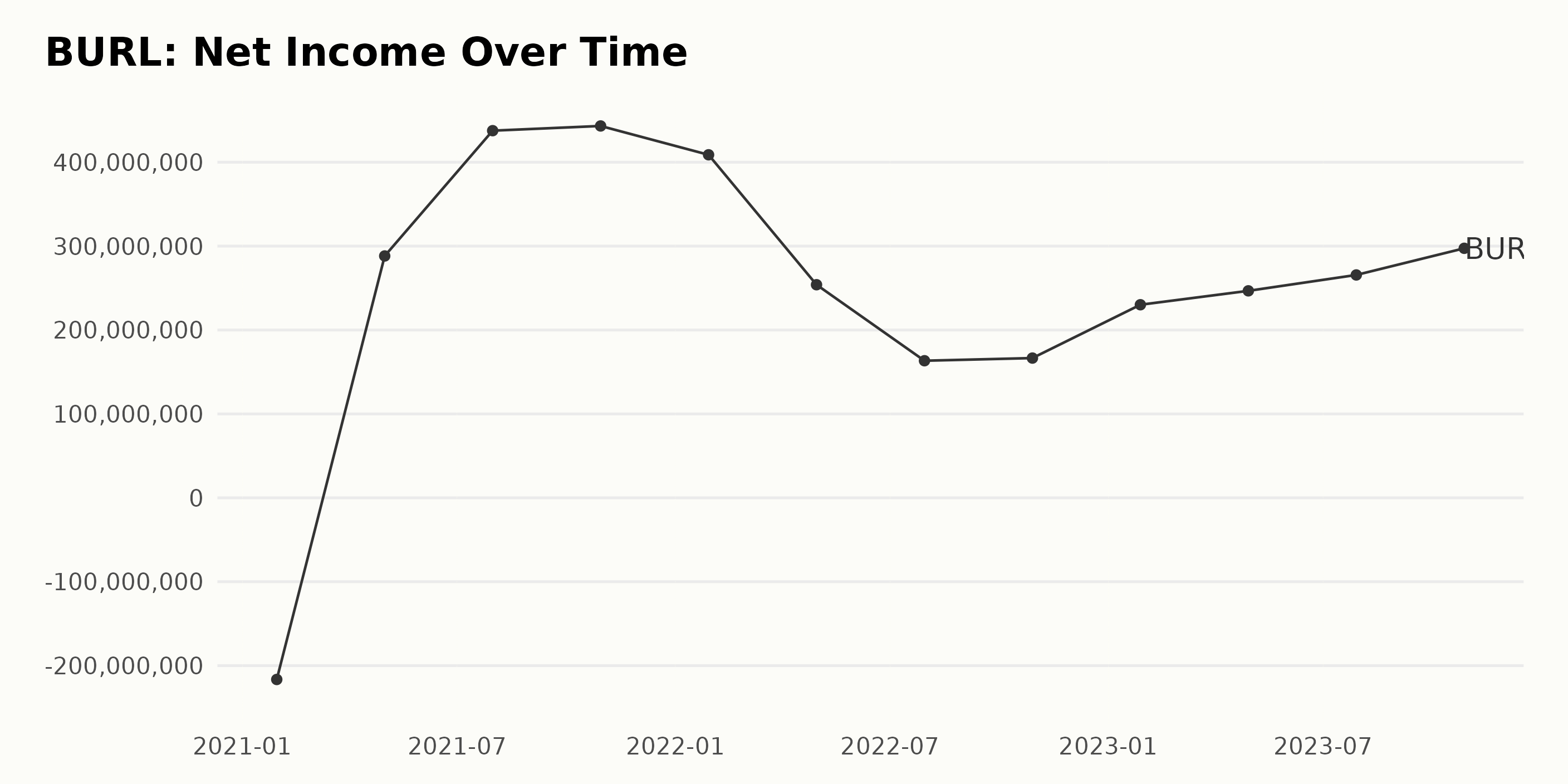

The trend of BURL’s trailing-12-month net income shows a general upward movement from 2021 to 2023, despite some fluctuations. Here are the key points:

- The BURL’s net income began at -$216.50 million on January 30, 2021, indicating a significant loss.

- It saw a substantial uplift, reaching $288.26 million by May 1, 2021.

- Thereafter, it continued to grow with few fluctuations till October 30, 2021, when it peaked at $443.20 million.

- A slight dip was observed on January 29, 2022, posting $408.84 million, but then declined further, albeit mildly, to $166.56 million as of October 29, 2022.

- However, the net income rebounded steadily from there, culminating at $297.39 million on October 28, 2023.

In summary, over the course of this data series, BURL experienced an overall growth in net income from its first reported loss of $216.50 million in 2021 to a profit of $297.39 million in 2023. This represents an impressive growth rate. However, they experienced a period of significant downturn in 2022, where their net income dropped close to the levels seen in early 2021 before embarking on a recovery.

Emphasizing the most recent years, 2022 and 2023, the trend has been volatile yet progressively improving. The company closed the series on a high note, indicating healthy financial performance with a reasonable growth rate.

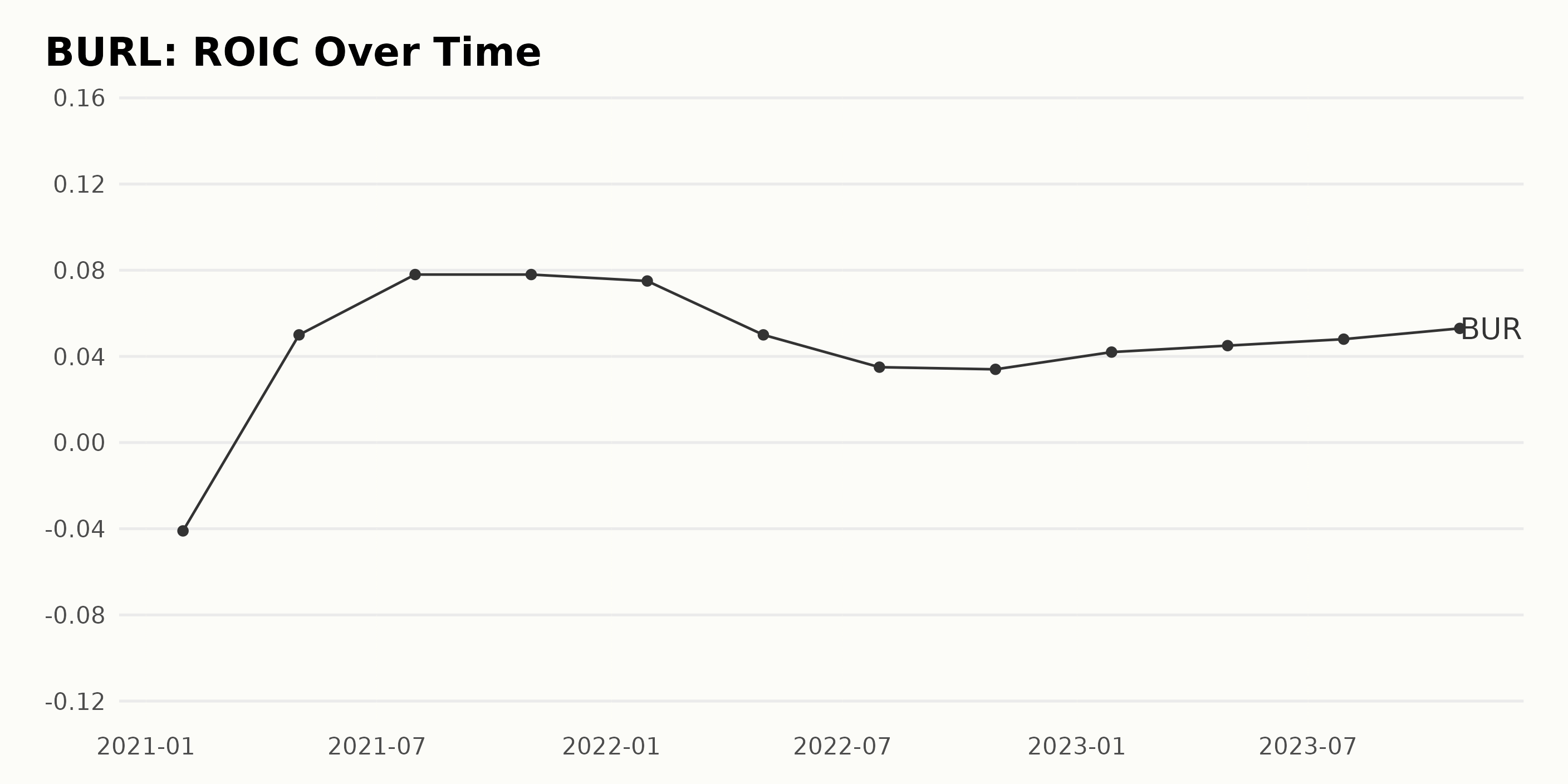

The data series outlines the Return On Invested Capital (ROIC) values of BURL from January 2021 to October 2023. The following represents a scrutinized breakdown:

- In January 2021, the ROIC was significantly negative at -0.04.

- A considerable positive shift was seen by May 2021 when the ROIC rose to 0.05.

- By July 2021, the ROIC had improved further and maintained at 0.078 until October 2021.

- In January 2022, there was a minor decrease to 0.075, which till April 2022 decreased further to 0.05.

- The second half of 2022 witnessed a continued decline of ROIC to 0.035 in July and 0.034 in October.

- Starting in 2023, there was a steady rise again, with 0.042 in January, 0.045 in April, 0.048 in July, and 0.053 in October.

The most recent data from October 2023 shows an improvement from the weak figures in 2022. Notably, a positive trend is taking shape from the start of 2023, coming from a low point in late 2022, indicating recovery.

Comparing the initial figure (January 2021 at -0.04) to the last one (October 2023 at 0.053), the growth rate calculates to a substantial increase of approximately 232%, signifying a major turnaround from the initial negative returns. Trends show fluctuations with a significant rebound recently, indicating a potentially promising future for BURL’s ROIC.

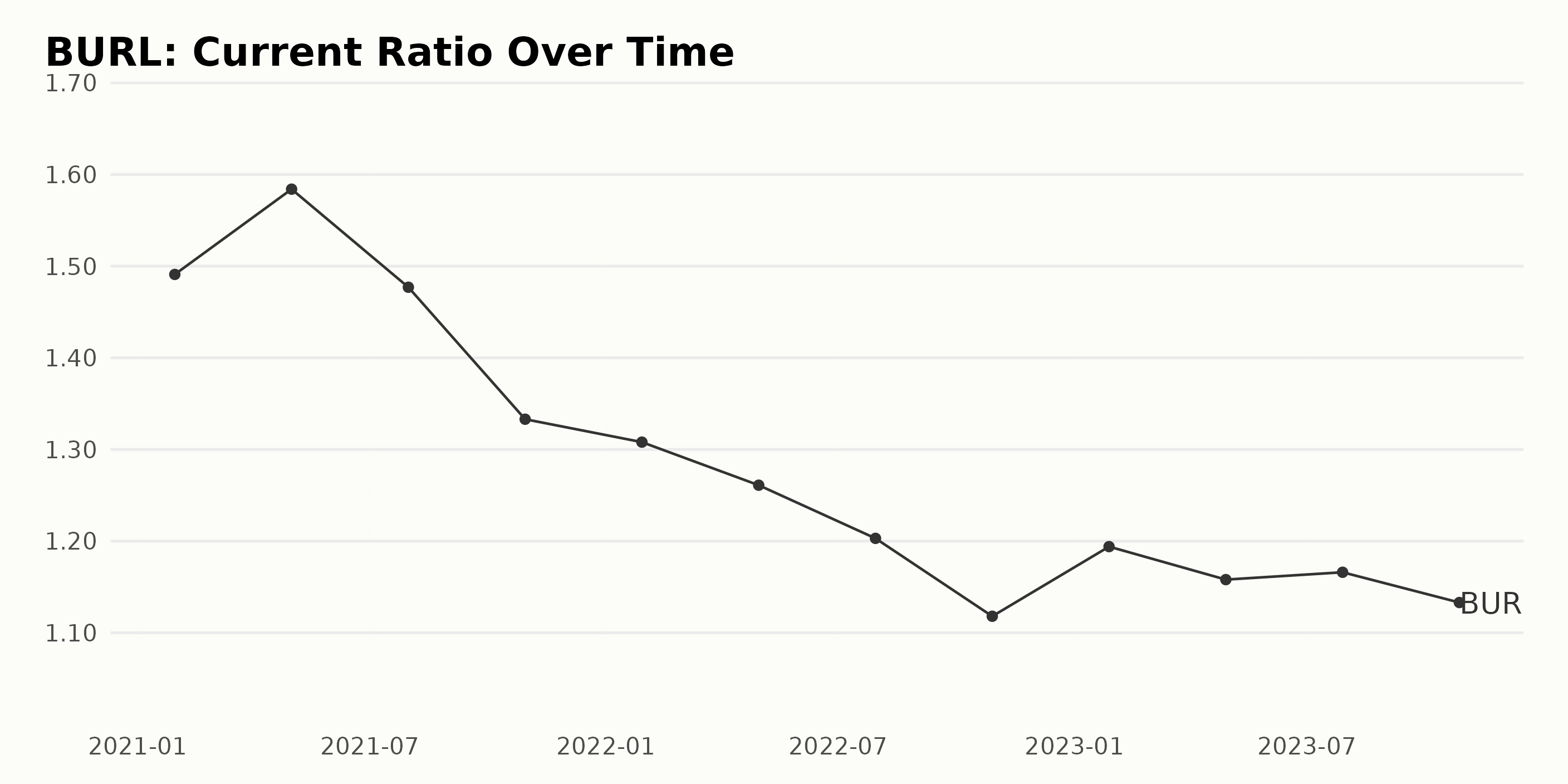

From 2021 to 2023, the current ratio of BURL demonstrated notable fluctuations according to the data provided.

- January 30, 2021: The current ratio started at 1.49.

- May 1, 2021: It rose to 1.58.

- July 31, 2021: A slight decrease was observed with a value of 1.47.

- October 30, 2021: Further decreased to 1.33.

- January 29, 2022: Maintained almost the same trend with a value of 1.31.

- April 30, 2022: Decreased slightly to 1.26.

- July 30, 2022: Fell further to 1.20.

- October 29, 2022: Dipped to 1.12, marking the lowest in the specified period.

- January 28, 2023: Rebounded to 1.19.

- April 29, 2023: Experienced a slight drop to 1.16.

- July 29, 2023: Held relatively steady at 1.16.

- October 28, 2023: Fell slightly to 1.13 as the last recorded value in the series.

Across the timeframe provided, a trend of a general decline in the current ratio can be observed from 1.49 in January 2021 to 1.13 in October 2023 despite several small recoveries.

Based on the first and last values in the series, the current ratio of BURL has seen a decrease of approximately 24%. This suggests that the company’s ability to pay short-term liabilities with short-term assets has decreased over this period.

The analyst price target for BURL has displayed fluctuations over the timespan presented, with more recent data revealing a general downward trend since November 2022, before which there have also been noticeable oscillations.

- Starting at a price target of $362.5 on November 12, 2021, BURL experienced some early minor fluctuations, reaching a peak of $364 in November 2021.

- Thereafter, the price target entered a period of stability, maintaining the level of $350 from early December 2021 to mid-February 2022.

- Beyond mid-February 2022, BURL underwent a significant drop, bottoming at $190 in late September 2022, with several intermittent declines and plateaus seen.

- However, subsequent periods observed another surge, peaking at $227.6 by late February 2023, which continued up until it achieved the highest value of $247.5 in April 2023.

- Following this peak, the trend reverted to a steady decline from May 2023, where it fell to $213 by July 2023, before a slight recovery to $219.7 in August 2023.

- The remainder of 2023 after August saw a consistent drop culminating in a value of $190 as of November 22, 2023.

BURL’s analyst price target has decreased from the first recorded value to the last, indicating an overall negative growth rate.

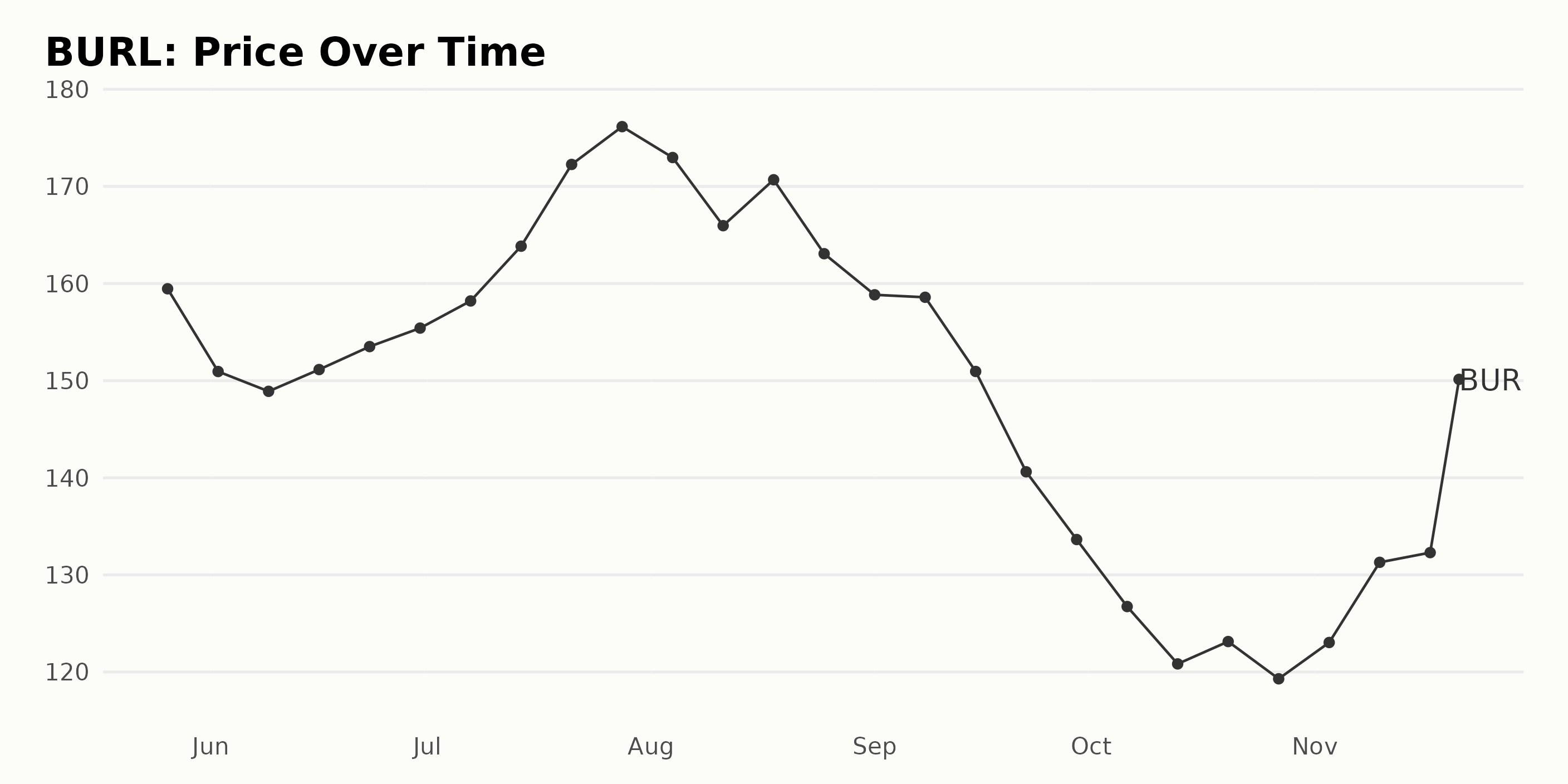

Analyzing The Roller-Coaster Trend in Burlington Stores, Inc. Share Prices, May-November 2023

Analyzing the data, here’s the trend and growth rate for BURL share price ranging from May 26, 2023, to November 21, 2023:

- Starting at $159.46 on May 26, 2023, the BURL shares initially had a decelerating trend, witnessing a fall to reach a value of $148.90 by June 9, 2023.

- From there, the shares began an accelerating upward trend, culminating in a peak price of $176.15 by July 28, 2023.

- Subsequently, it experienced a pronounced decelerating trend, reaching a low point of $119.30 by October 27, 2023.

- However, BURL rebounded again in November 2023, with the share price climbing sharply to $165.06 by November 21, 2023.

This data indicates a volatile period for BURL’s shares over these months with several peaks and troughs. Here is a chart of BURL’s price over the past 180 days.

Exploring Burlington Stores, Inc.’s Consistent Growth, Quality, and Increased Momentum

The POWR Ratings grade of BURL, a stock in the Fashion & Luxury category, appears to fluctuate over time. As per the data provided:

- Although BURL had a consistent grade of C (Neutral) for a considerable time period, the last recorded POWR grade in November 2023 is also a C (Neutral).

- The POWR grade upgraded to B (Buy) in late August 2023 and then oscillated between B (Buy) and C (Neutral) up until mid-November of the same year.

- The highest rank BURL reached in its category was #17. This happened in late October 2023 when BURL had a POWR grade of B (Buy).

- However, the last given rank in the category for BURL, as of November 22, 2023, was #29, falling under the C (Neutral) POWR grade.

In summary:

- Latest POWR Grade: C (Neutral).

- Latest Ranking in Category (Fashion & Luxury): #29 out of 62.

It’s important to note that despite some fluctuations in BURL’s POWR grade and ranking within its category, it remains well-positioned within the top half of stocks in the competitive Fashion & Luxury sector.

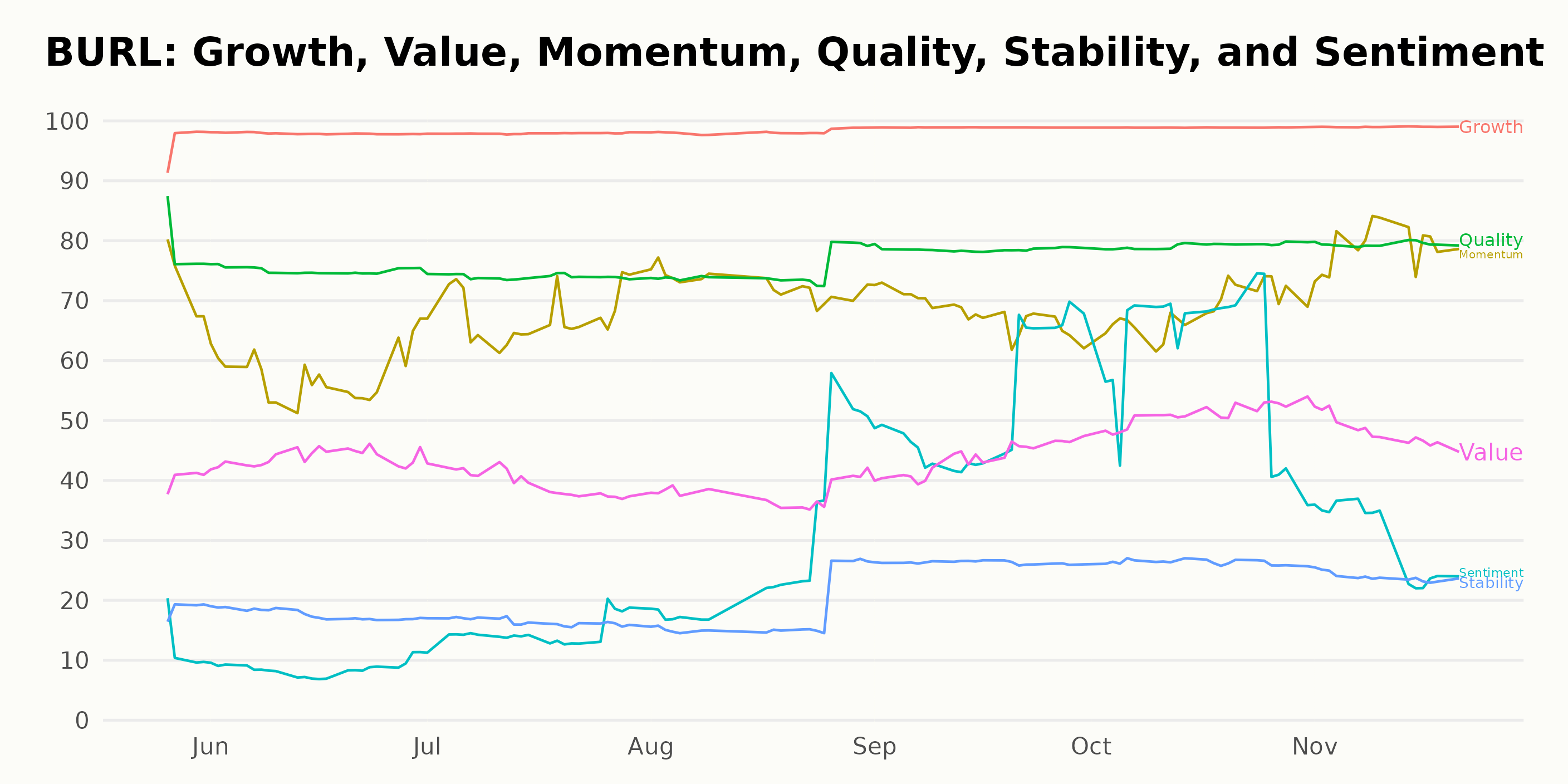

Here are the three most noteworthy dimensions for BURL according to the POWR Ratings:

Growth: Starting from a high rating of 96 in May 2023, the Growth rating for BURL has shown a consistent upward trend over the months, peaking at 99 in September, October, and November 2023. This indicates that the company has demonstrated strong Growth.

Quality: The ratings for Quality have fluctuated slightly but have generally remained stable. Starting at 79 in May 2023, a minor decline was seen between June and August 2023, leading to the same points in September, October, and November at 79. Therefore, it seems we can say that the Quality of the company has maintained fairly high stability.

Momentum: Noticeably, the Momentum dimension shows a clear trend, with ratings progressively gaining from 73 in May 2023 to 79 in November 2023. There is evidence to show that despite minor fluctuations, BURL has been able to maintain high ratings on these three dimensions, putting them in a favorable light.

How does Burlington Stores, Inc. (BURL) Stack Up Against its Peers?

Other stocks in the Fashion & Luxury sector that may be worth considering are Weyco Group, Inc. (WEYS - Get Rating), J.Jill, Inc. (JILL - Get Rating), and The TJX Companies, Inc. (TJX - Get Rating) – they have better POWR Ratings. Click here to explore more Fashion & Luxury stocks.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

BURL shares were trading at $171.70 per share on Wednesday morning, up $6.64 (+4.02%). Year-to-date, BURL has declined -15.32%, versus a 20.34% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BURL | Get Rating | Get Rating | Get Rating |

| WEYS | Get Rating | Get Rating | Get Rating |

| JILL | Get Rating | Get Rating | Get Rating |

| TJX | Get Rating | Get Rating | Get Rating |